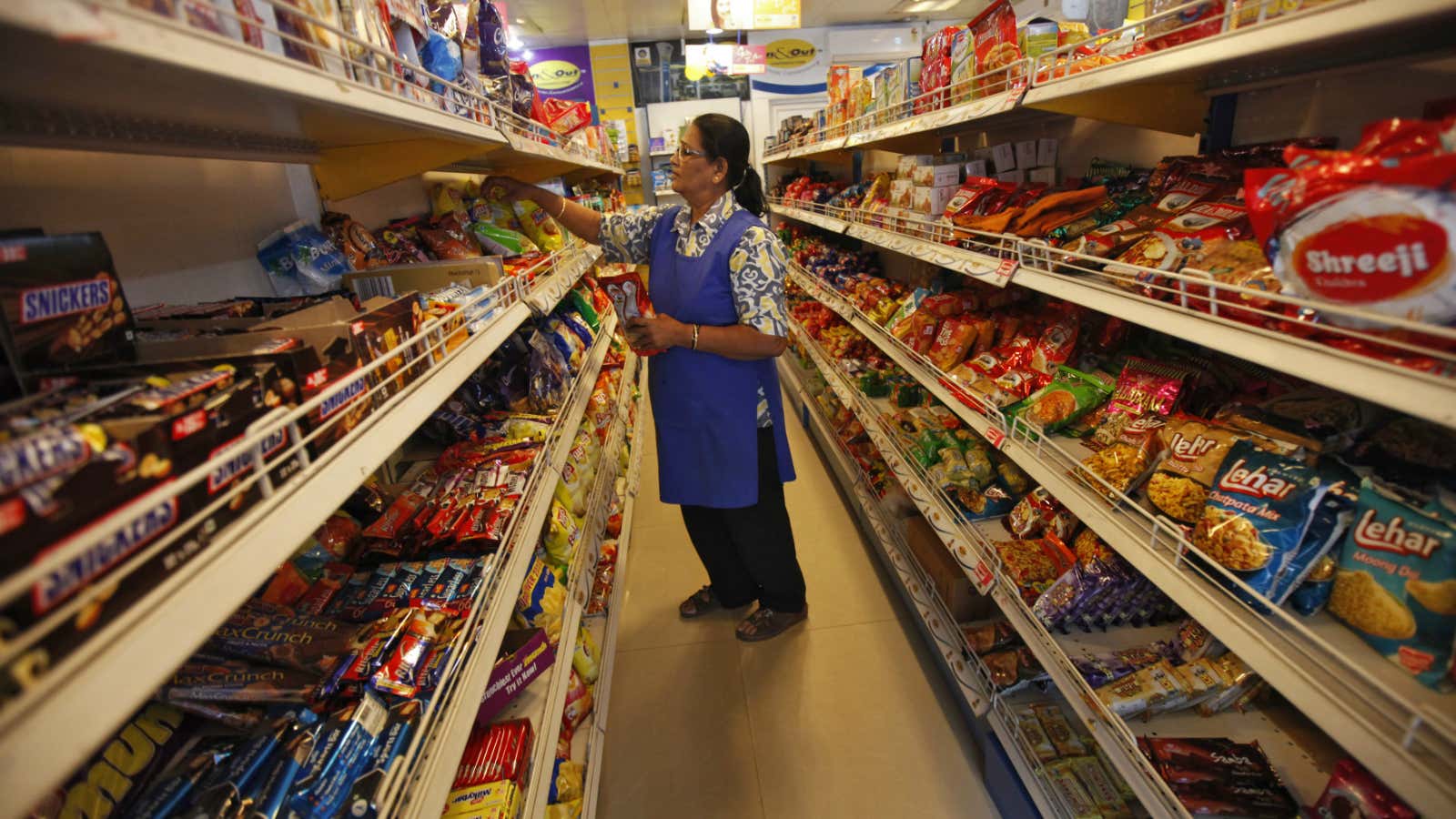

India is a snacking market unlike any other.

Not only do the taste profiles change of consumers every couple of hundred kilometers, there are also challenges with distribution and awareness.

There’s also an intensifying competition with over 3,000 branded players, including local firms like Pratap Snacks and Haldiram’s.

In the middle of all this, US food and beverage major PepsiCo India is trying to update its strategies to retain its over 45% share of the $2 billion (approx Rs14,000 crore) Indian salty-snacking market.

Jagrut Kotecha, vice-president for PepsiCo India’s snacking category, says the company has been innovating its flavours, packaging, and communication. For instance, earlier this year, it refreshed Kurkure’s packaging and took steps to reduce sodium-content across its portfolio to keep with consumer’s changing health needs.

In an interview with Quartz, Kotecha said the company has many more such plans for the future. Edited excerpts:

How is the salty snacks segment doing in India?

Salty snacks is a very robust category, growing 10-12% annually. For us, it has been clocking a solid growth for the last 18 to 24 months. And some of our interventions in the last few years are paying up.

What are these interventions?

Starting last year, we did a lot of innovation in marketing and packaging on Kurkure and Lay’s. We got our price-pack architecture and channel distribution right. So now we have started to drive a lot of our Rs5 packs in the rural and semi-urban areas, while in modern trade (supermarkets), we are pushing the Rs35 and Rs60 price packs.

Also, there have been significant changes in Kurkure. For instance, we reformulated our masala in April last year because research showed that Indian consumers have evolved. Also, we realised there was a lot of suspense about Kurkure’s ingredients. Which is why now we focus on the ingredient story. All our new packaging has a lot of visible ingredients display.

What prompted these changes?

Whenever we do such things, it comes either from consumer needs or because of a competitive environment. So those were the two main reasons this time as well. We wanted to do something that helped us stand apart.

Could you tell us about the current trends in the snacking market overall?

Today, consumers have a lot more variety to choose from as against a decade ago. Back then, there were fewer players, the entry barriers were high, the capital expenditure was more, and distribution was a big challenge. But now, these barriers have come down significantly. Nielsen says there are some 3,000 players in the branded salty-snacks segment alone, and we’ve not included unbranded companies in this.

Another thing we always knew, but we would not have thought about it so aggressively is that in India every 100 and 200 kms the taste profile changes. Which is why local players thrive because they give a great tasting, locally-relevant product.

As an MNC, we cannot have a different masala flavour for every market everywhere. But we are also trying to have multiple variants. For instance, we have spicier variants to target the northern and eastern markets and a sweeter version for the south.

What are you doing to address health concerns?

We have reduced 5%-to-25% sodium across popular variants of Lay’s and Kurkure, and further aim to reduce sodium in 75% of our portfolio by 2025. But we cannot compromise on taste. So we are doing it subtly. In the recently launched Kurkure Multigrain, we have reduced sodium by 21%. In the Indian Magic Masala and Spanish Tomato Tango variants of Lay’s, we have reduced by 13%-15%.

With the recent plastic ban in Maharashtra, is PepsiCo India working towards reducing its plastic footprint?

We are doing both reduction and recycling. To reduce the use of plastic, we are making smaller packets for our snacks. For instance, last June, we reduced the Kurkure Rs5 pack size by 6%.

We’re also working on reducing our carton footprint and redesigning our carton packs.

On the recycling front, we have piloted a film-to-fuel project at our Pune plant to convert all plastic film waste from the packaging process, into fuel.

Also, we will potentially be the first F&B company in India that will pilot a 100% compostable packaging in the fourth quarter this year.

Going forward what will drive snacking in India?

The rural markets will gradually grow and people will move from unbranded to branded packs. You will also see a lot more innovation as entry barriers are low. So products will come and go. Lastly, the definition of healthy snacks will change. It will be a lot about seeking out the right ingredients. In the trade-off between calorie and taste, consumers will never compromise on taste.