The markets are starting to look like they seriously think the US might not pay its debt

The markets are starting to get seriously twitchy about Washington’s lack of progress toward ending the US government shutdown or raising the debt ceiling to avoid a default on America’s debts.

The markets are starting to get seriously twitchy about Washington’s lack of progress toward ending the US government shutdown or raising the debt ceiling to avoid a default on America’s debts.

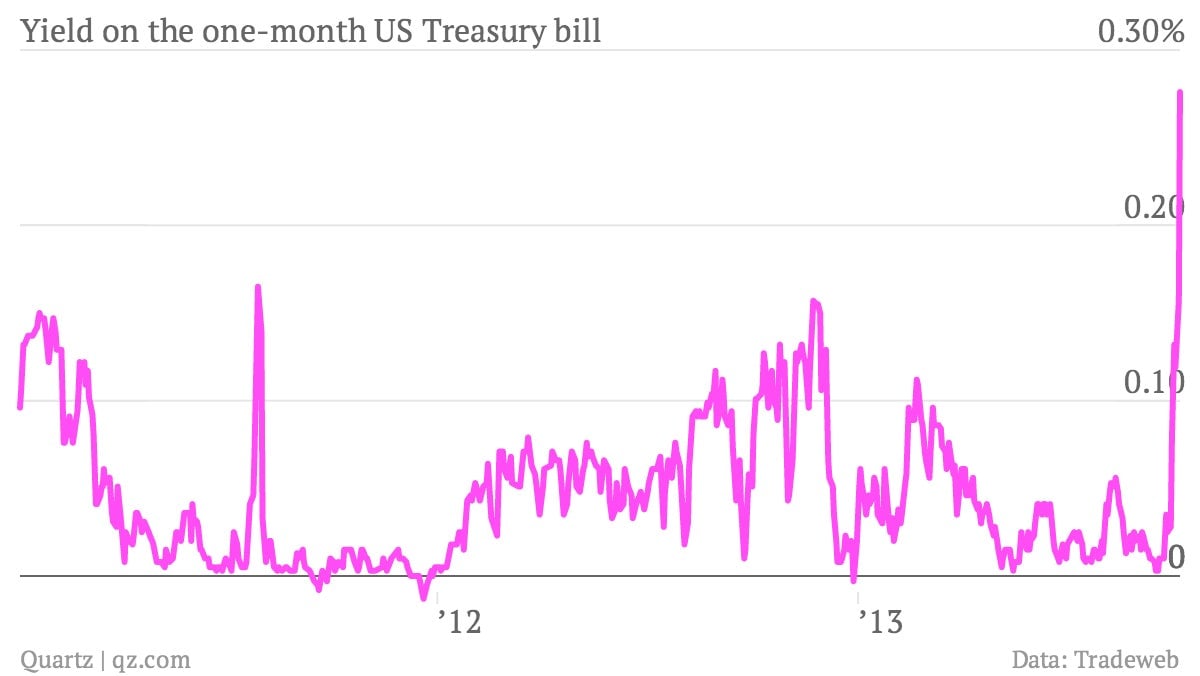

For one thing, the yield on some very-short-term Treasury-bills, normally the safest thing you can possibly own, has been shooting higher. The spike is mostly concentrated around Treasury bills that mature later this month and in early November, just as the US Treasury department will be running low on cash if the debt ceiling isn’t raised.

You can see, in the chart above, that the yield on the one-month bill has now spiked higher than where the benchmark one-month bill was during the worst moments of the debt ceiling debacle back in the summer of 2011.

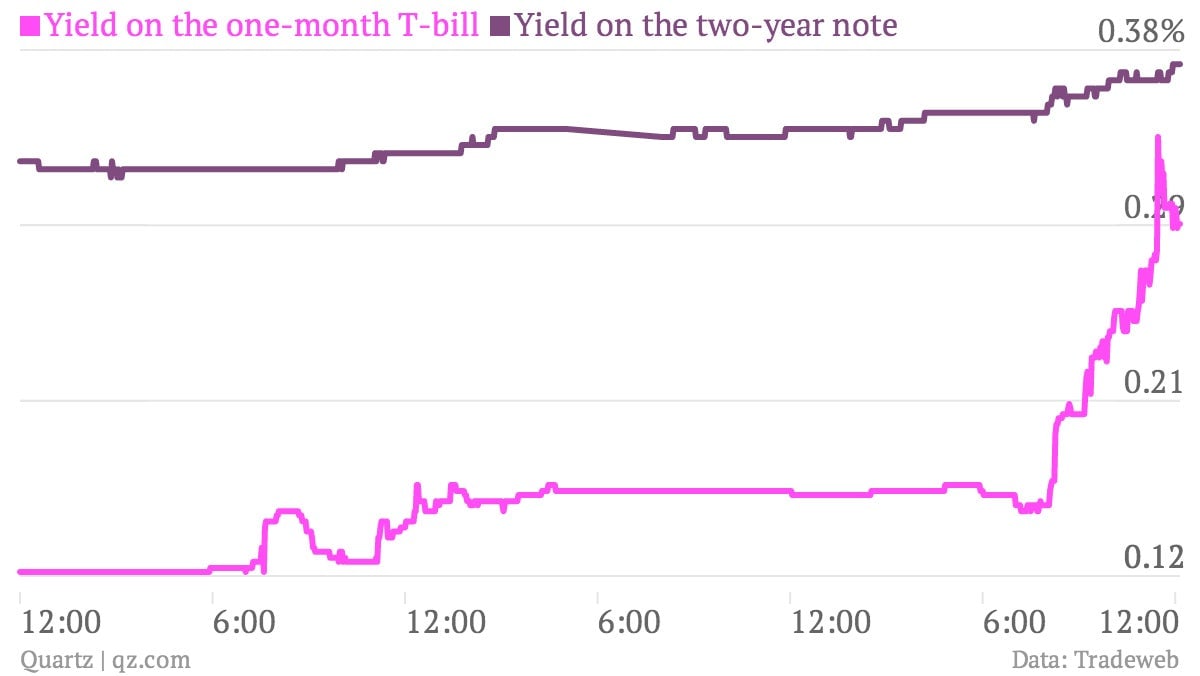

In fact, at its worst moments today, the yield on the one-month bill was about 0.34%, according to data from bond market data provider Tradeweb. Bear in mind the yield on the two-year note is 0.38%. In the world of bonds, you normally get paid higher interest for lending at longer terms. So the fact that the one-month bill pays nearly as much as the two-year note reflects a fundamental disturbance of the force.

The different interest rates investors pay for different terms of lending—a 30-year year bond pays much higher interest than a two-year note—is known as the yield curve. And in the short-term section of the yield curve, the difference between the one-month bill and the two-year note moved sharply lower today, a process known as “flattening.”

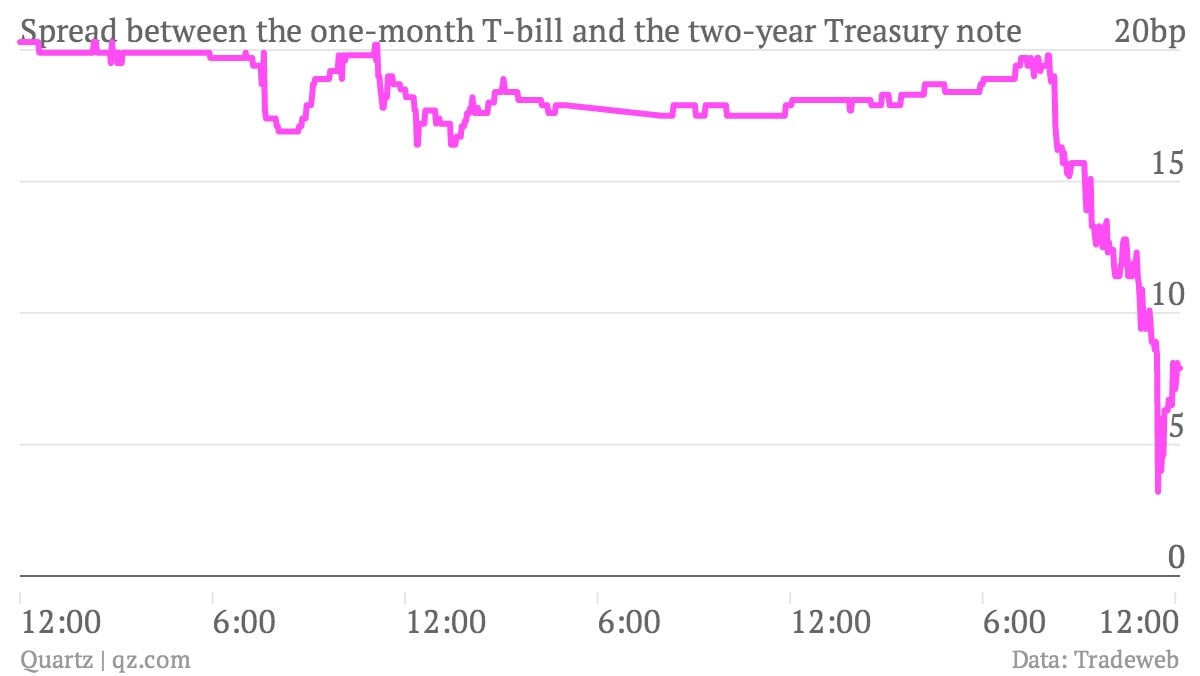

You can see in the chart below that the yield curve flattened from about 0.20 percentage points—or 20 basis points (bp)—to about 0.08 percentage points.

There’s a long history of trying to interpret the contortions of yield curves. Traditionally, a flattening yield curve is seen as a prediction of poor economic growth in the future and perhaps even recession. But when there are questions of creditworthiness, a flattening yield curve can also suggest that investors are prepping themselves for the prospect of some sort of problem with the debtor in question paying up on time. (We saw similar things happen with heavily indebted European countries during the continental debt crisis over the last few years.)

So what’s the upshot? The bond markets are sending a very bad signal about the prospects for any near-term solution to the US debt ceiling fight, and they may even be bracing for a worst-case outcome, such as a default.

It’s important to note that we’re not seeing a similar dynamic further out the yield curve. Yields on US 10-year notes, a traditional benchmark, have fallen since mid-September and remain around 2.65%. That means the markets haven’t lost all confidence in America’s ability to pay its bills. But the fact that there are real signs of investors considering the prospect of default in the market—a poor auction of Treasury bills today seemed to set off the selling—shows that real damage has already been done to the US reputation as a borrower. That’s a shame.