Family Dollar is losing the dash to sell US consumers the cheap goods they’re craving

The numbers: Not great. Although fourth-quarter profit at US discount store Family Dollar was $102.2 million, up 26% from the same period last year, its revenue of $2.5 billion was slightly lower than the $2.56 billion forecast by Forbes’ analysts. Family Dollar shares are down in early trading.

The numbers: Not great. Although fourth-quarter profit at US discount store Family Dollar was $102.2 million, up 26% from the same period last year, its revenue of $2.5 billion was slightly lower than the $2.56 billion forecast by Forbes’ analysts. Family Dollar shares are down in early trading.

The takeaway: The number Family Dollar was really hoping to flaunt came in flat. Same-store sales growth at the discount store was expected to come in at 2%, but instead remained unchanged. Family Dollar conceded in its earnings release that both the average amount of customers’ transactions and customer traffic at its stores were unchanged for the month. “The environment was more challenging than expected,” CEO Howard Levine said in a statement. Family Dollar is taking a cautious approach to its future, citing economic uncertainty, shrinking margins and tepid traffic expectations for new and old stores.

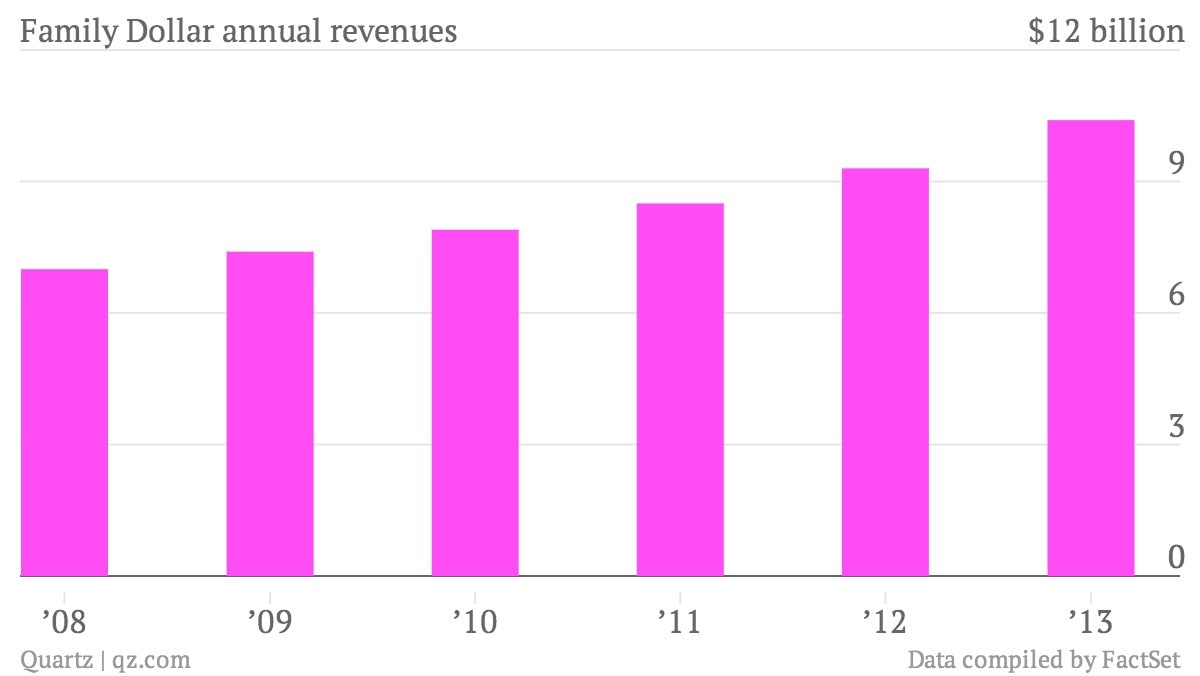

What’s interesting: A step-back look at Family Dollar’s performance post-2008, however, tells a pretty revealing truth: the Great Recession has been rather good to the discount store. The company has seen an average 14% year-over-year growth in revenue over the last four quarters, and a roughly 50% spike in annual revenues over the past 5 years.

The problem, however, is that it hasn’t been doing nearly as good a job as its most able competitor, Dollar General Corp. Unlike Family Dollar, Dollar General is not only managing to woo more and more people into its stores; it’s also getting them to spend more money while there. Dollar General reported a 5.1% increase in same-store sales last quarter on better store traffic and average transaction size, and predicts that same-store sales will rise by as much as 5% in 2013.

Dollar General has also done a lot better than Family Dollar at controlling its margins on consumer goods, the sort of everyday purchases and necessities customers have been buying amidst the economic slowdown. With both companies continuing to erect hundreds of stores across the US—Family Dollar opened over 500 new stores in 2013, and plans to open another 500-plus in 2014—it will be interesting to watch how each fares in the race to feed US consumers’ growing appetite for cheap goods while squeezing out what margins they can.