With Yellen in charge, the Federal Reserve might not taper stimulus until March 2014

Investors have been consumed by one question over the last six months. When will the US Federal Reserve will begin to wind down the bond-buying program known as quantitative easing?

Investors have been consumed by one question over the last six months. When will the US Federal Reserve will begin to wind down the bond-buying program known as quantitative easing?

Since the summer, most believed that Fed chairman Ben Bernanke would start pulling the plug in September. Of course, that didn’t happen; the Fed continues to buy $85 billion in mortgage bonds and long-term Treasurys each month to push down interest rates. Now some reports suggest the Fed won’t cut back on its bond buying until early 2014, in light of the ongoing government shutdown and the fact that Fed chairwoman-elect Janet Yellen will take office in January.

Deutsche Bank senior economist Carl Riccadonna thinks the Federal Reserve might not begin to “taper” its bond-buying program until even later, in March 2014. Why? It has to do with economic indicators that are important to Yellen.

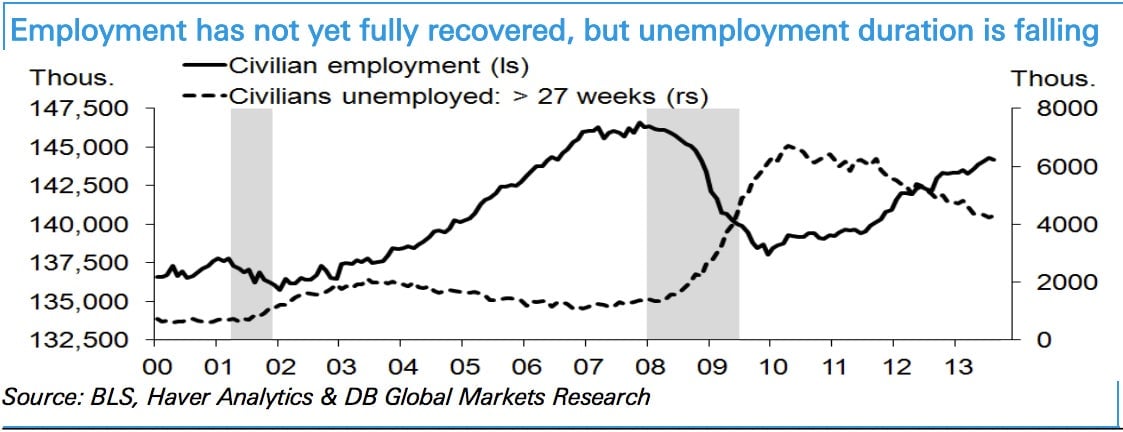

Riccadonna and his team sorted through Yellen’s speeches from the last year and concluded that Yellen is worried about the overall jobless rate—still 7.3% in August. But Yellen also spends a lot of time talking about two other things: long-term unemployment (the number of individuals out of work for more than six months) and the sheer number of workers in the economy.

As you can see from the chart, the number of people out of work for an extended period of time is still roughly double what it was before the financial crisis. And there were still 2.1 million fewer people employed in August than there were in the previous economic cycle.

“Regardless of whether one looks at the unemployment rate, the pace of hiring, the level of employment or the duration of unemployment, all of these metrics remain well outside of the range which the dovish core of the FOMC would deem a substantial improvement in the labor market—the necessary precondition for ending QE,” Riccadonna said. ”Yes, we’re moving in the right direction, but we’re not ready yet,” he added in a phone interview.

Although Deutsche Bank’s team still calls a December taper its baseline scenario, Riccadonna thinks it’s an increasingly less probable scenario. And the likelihood that the Fed will start winding down its stimulus on the earlier side will recede the longer the US government remains shut down.

Then we have the changing of the guard. Bernanke’s last meeting is in January. Yellen’s first meeting as chairwoman will fall on March 18-19. At that point, Riccadonna thinks, she’s likely to make a point of pulling back the program barring serious warning signs in the economy.

So all those concerns you had about how the end of Fed stimulus would send global markets tanking? Fuhgeddaboudit! (At least, for a few months.)