Wall Street isn’t boosting bitcoin

Wall Street is steadily making it easier for a wider range of investors to buy and sell bitcoin. It’s a development that should, in theory, boost prices—if a torrent of institutional money is poised to rush into crypto, then the buildout of professional-grade infrastructure should be a boon for things like bitcoin, ether, and other offshoots. But so far that’s not the case:

Wall Street is steadily making it easier for a wider range of investors to buy and sell bitcoin. It’s a development that should, in theory, boost prices—if a torrent of institutional money is poised to rush into crypto, then the buildout of professional-grade infrastructure should be a boon for things like bitcoin, ether, and other offshoots. But so far that’s not the case:

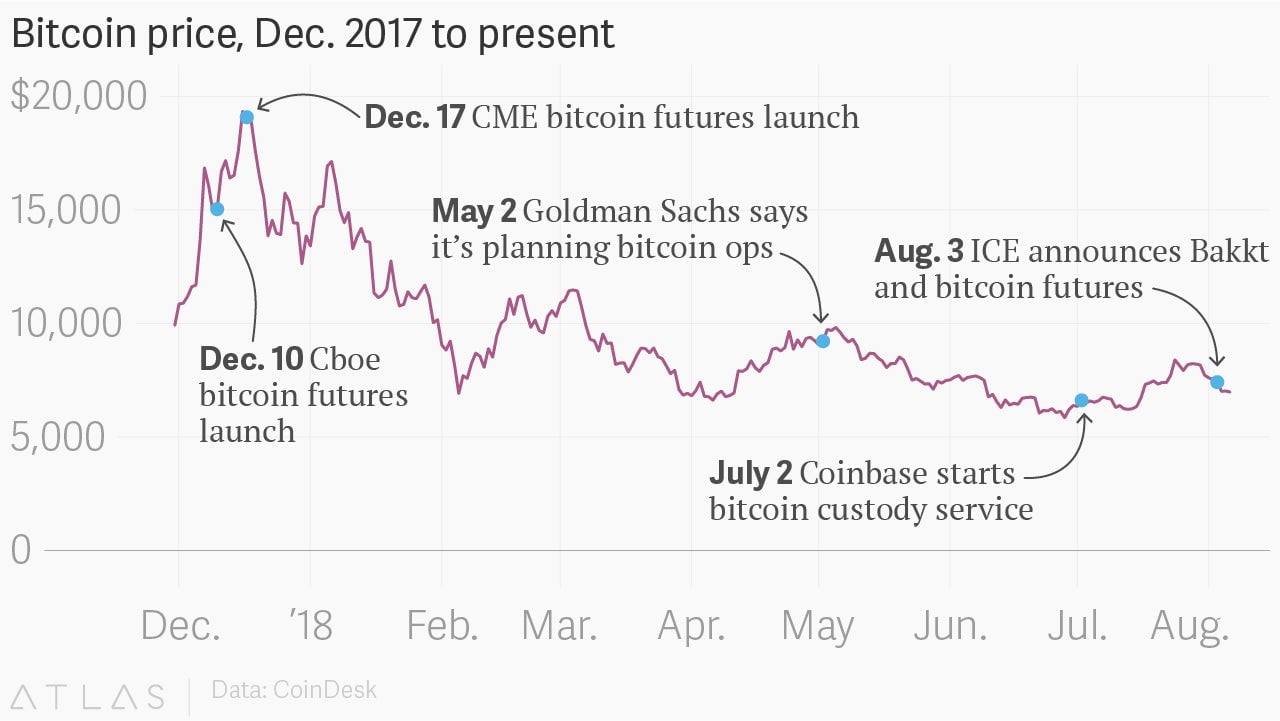

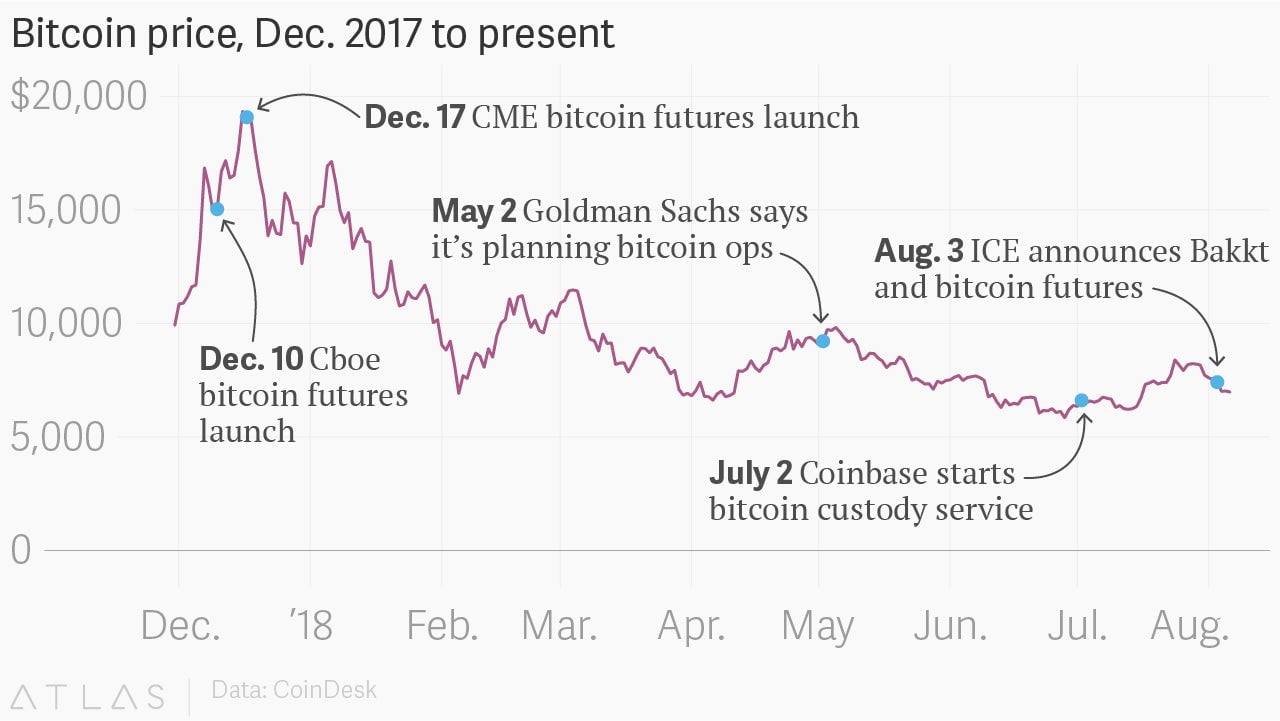

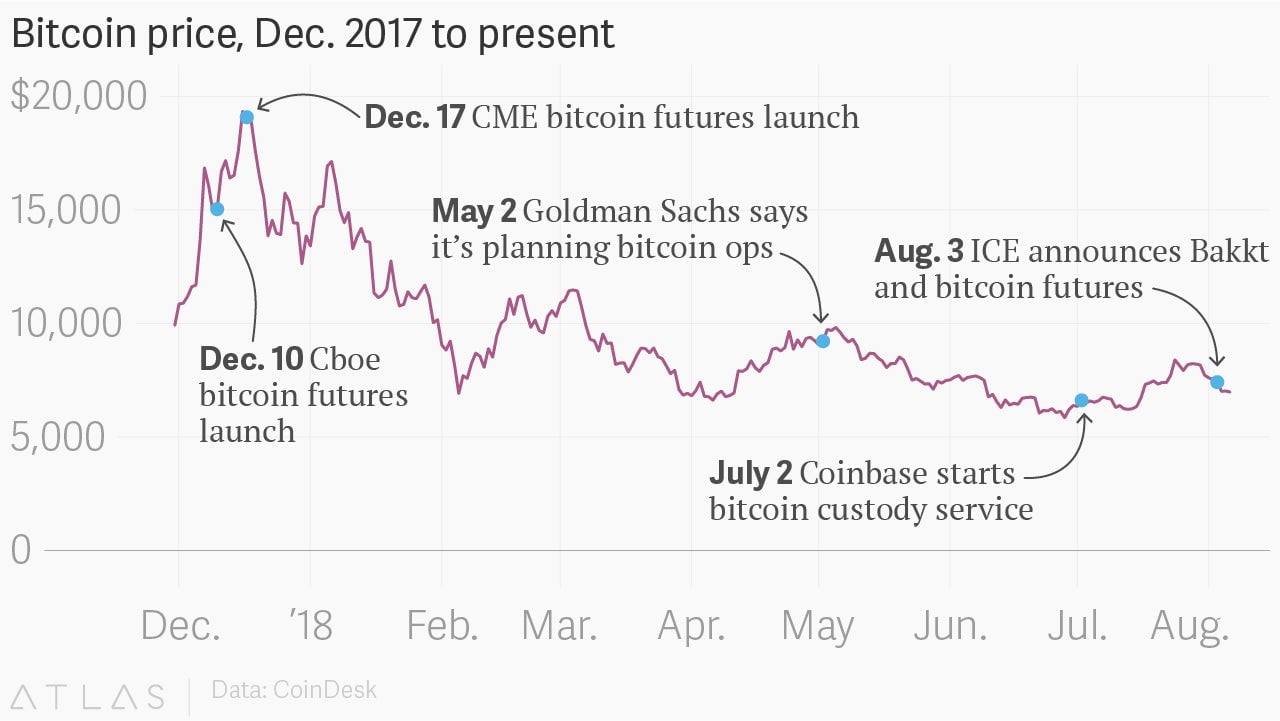

Bitcoin has fallen more than 50% since Dec. 10, when Cboe Global Markets launched its futures contract, which allows traders to hedge or speculate on the digital asset’s price in the future. CME Group started its own bitcoin derivative seven days later. While crypto trading has been dogged by regulatory uncertainty, futures seem like a promising development because government watchdogs have given them their blessing and institutional investors are deeply familiar with these types of derivatives.

Likewise, Wall Street has shown a willingness to support bitcoin if the institutional demand is there. In May, the New York Times reported that Goldman Sachs will post bids and offers for bitcoin futures, and is looking into ways to trade actual crypto tokens.

Another big concern for institutions—how to protect crypto holdings—may be gradually resolved. Pensions and hedge funds typically rely on specialized custody banks to safeguard their securities. Crypto exchanges, on the other hand, have a worrying propensity to get hacked. With this in mind, last month Coinbase rolled out a custody service, with a mission “to make digital currency investment accessible to every eligible financial institution and hedge fund in the world.”

And last week, Intercontinental Exchange—the owner of the New York Stock Exchange—said it’s starting a company and trading platform for bitcoin called Bakkt. The idea is to bring applications for digital assets together with “regulated, connected infrastructure,” ICE CEO Jeffrey Sprecher said in a statement. Pending regulatory approval, ICE said it intends to start a bitcoin futures contract in November. Starbucks, which has a mobile payment service for its rewards members, is also participating. Bitcoin drifted lower following the announcement.

Mind you, bitcoin is still trading at more than $6,900, double its level a year ago, according to CoinDesk. But even so, the prospect for more institutional involvement doesn’t seem to have buoyed prices lately. They are, after all, well down from the all-time high near $20,000 at the end of 2017.

Kenneth Griffin, the founder of the hedge fund group Citadel, said last month that he doesn’t “have a single portfolio manager who has told me we should buy crypto.” In its mid-year investment research outlook, Goldman’s strategists said they expect further bitcoin declines because it doesn’t fulfill the role of money. By their reckoning, it’s not a medium of exchange, a unit of measurement, or a store of value.

Of course, bitcoin has been pronounced dead in the past—and then soared spectacularly. But for now, the potential for more Wall Street involvement is doing little to stoke a crypto rally.