PepsiCo’s numbers: A bit flat.

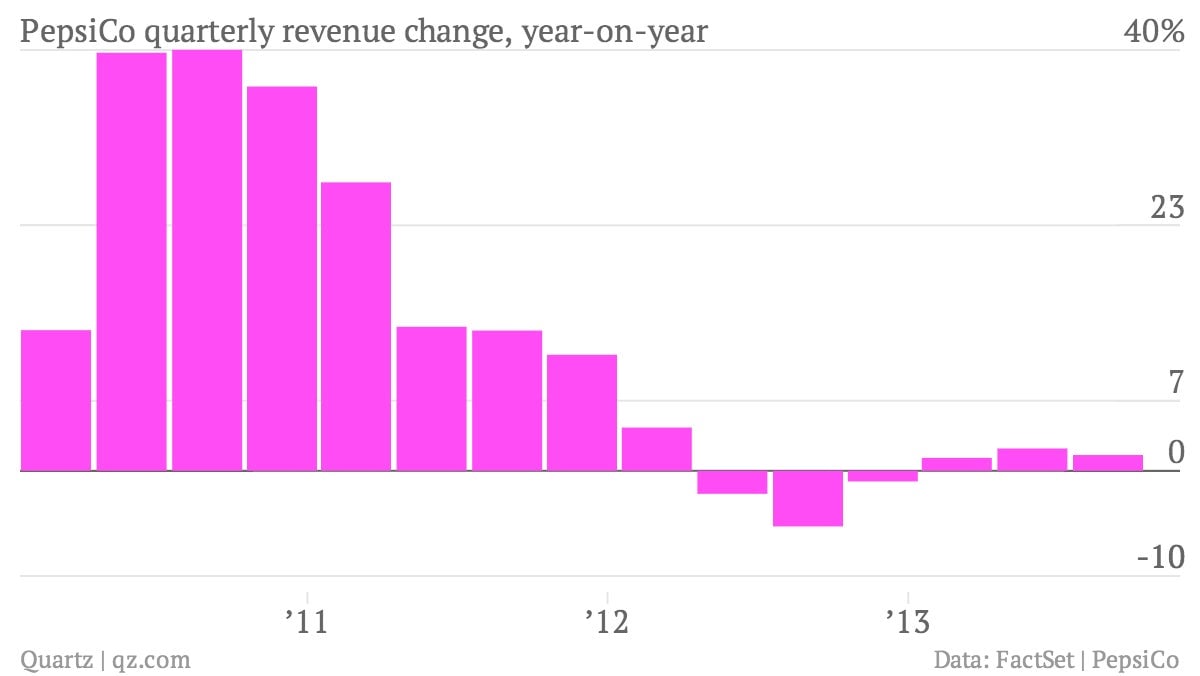

The numbers: They were ok. Profits rose 0.5% to $1.91 billion. Sales rose 1.5%. The Frito-Lay snacks business was the star of the quarter. Frito-Lay helped drive PepsiCo Americas food sales in North America up 7%. Latin America food sales rose 14%, of which 3% was organic volume growth. The rest was price increases. Shares were up slightly in premarket trading.

The numbers: They were ok. Profits rose 0.5% to $1.91 billion. Sales rose 1.5%. The Frito-Lay snacks business was the star of the quarter. Frito-Lay helped drive PepsiCo Americas food sales in North America up 7%. Latin America food sales rose 14%, of which 3% was organic volume growth. The rest was price increases. Shares were up slightly in premarket trading.

The takeaway: The North America drinks business is still a dog. Beverage revenue for PepsiCo’s Americas declined by 1.5% while volume fell by 4%. The lack of fizz in the beverages business provides more fuel for activist investor Nelson Peltz, who is pushing for changes at Pepsi. Over the summer Peltz publicly declared that Pepsi should get rid of its lagging drinks business.

What’s interesting: The soda business continues to be flat. Carbonated soft drink volumes declined in the “mid-single digits” in North America. Pepsi prefers to spotlight the “liquid refreshment” business, which encompasses a broader range of drinks in addition to the bubbly stuff. In an conference with analysts back in May, PepsiCo CEO Indra Nooyi batted away a question about the soda pop business by pointing out “60% of the market is non-carbs. And within carbonated soft drinks, colas are a smaller percentage and declining. So I think there is a maniacal focus on colas. It is not the right way to look at a beverage market that is so huge.”