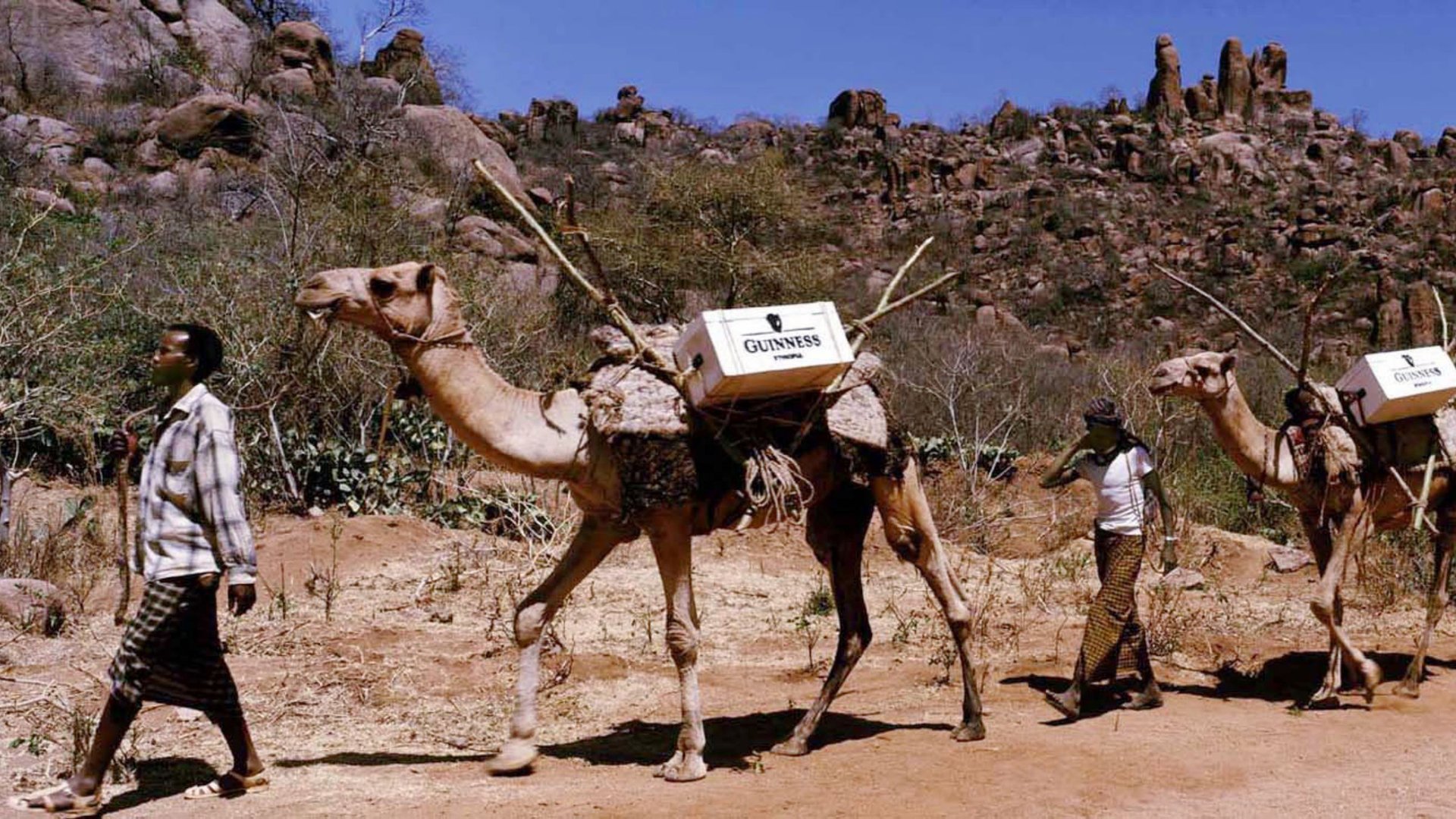

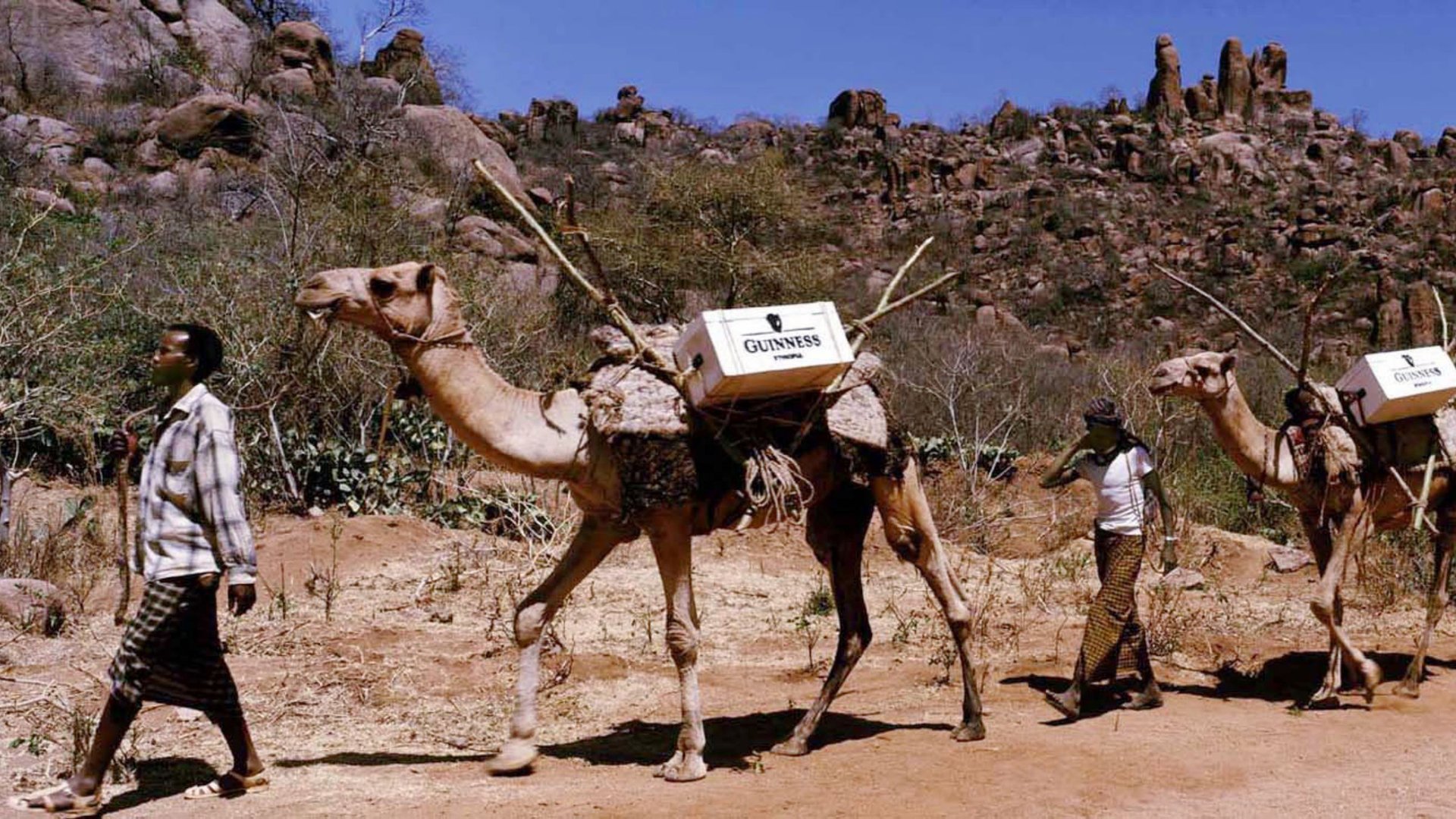

Guinness makes up nearly half the beer sold in Africa and Diageo reckons it can sell even more

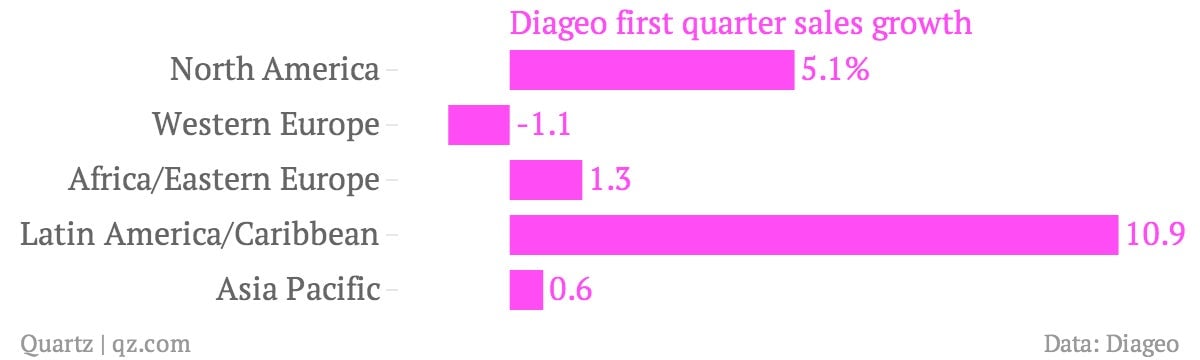

The numbers: The world’s largest spirits company reported a 3% spike in net sales growth for the quarter ending Sept. 30. Volumes—the number of units sold—were up 0.6% from the same three-month period last year.

The numbers: The world’s largest spirits company reported a 3% spike in net sales growth for the quarter ending Sept. 30. Volumes—the number of units sold—were up 0.6% from the same three-month period last year.

The takeaway: A tale of two hemispheres. Austerity measures in western Europe and government crackdowns on gift-giving in China are hurting Diageo’s sales growth on the eastern side of the Atlantic. “Government policies in China have led to a substantial fall in net sales in Diageo’s Chinese white spirit subsidiary,” the company said in a statement. Strong sales growth in both the North America and the Latin America/Caribbean regions, however, are helping counterbalance the company’s flailing performance elsewhere.

But the strong sales in Latin America are being offset by devaluing currencies in the region, pinching the company’s US dollar profits. “Colombia was weaker, and currency weakness led to destocking in the distributor channel in West Latin America and the Caribbean,” the company said.

What’s interesting: Diageo is counting on Guinness to drive growth in Africa. Africa currently buys more of Diageo’s beer than any other, and Guinness, in particular, has proved wildly popular; it currently accounts for roughly 45% of the company’s beer sales on the continent. The company, however, is banking on its ability to speed up what have already been extremely strong sales in the continent—sales have grown by roughly 13% per year since 2007—by rebranding and relaunching its popular Irish stout. The campaign is set to be the largest ever launched by the company in Africa.