US Airways boasts record earnings, doesn’t see that as an obstacle to merger

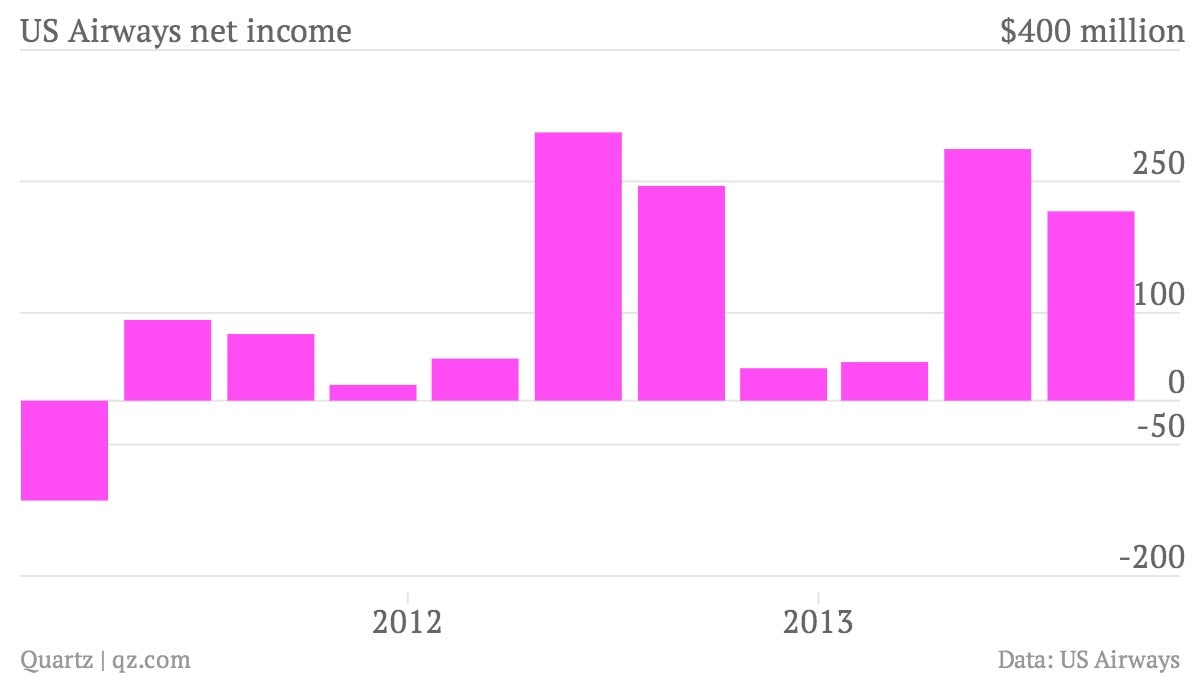

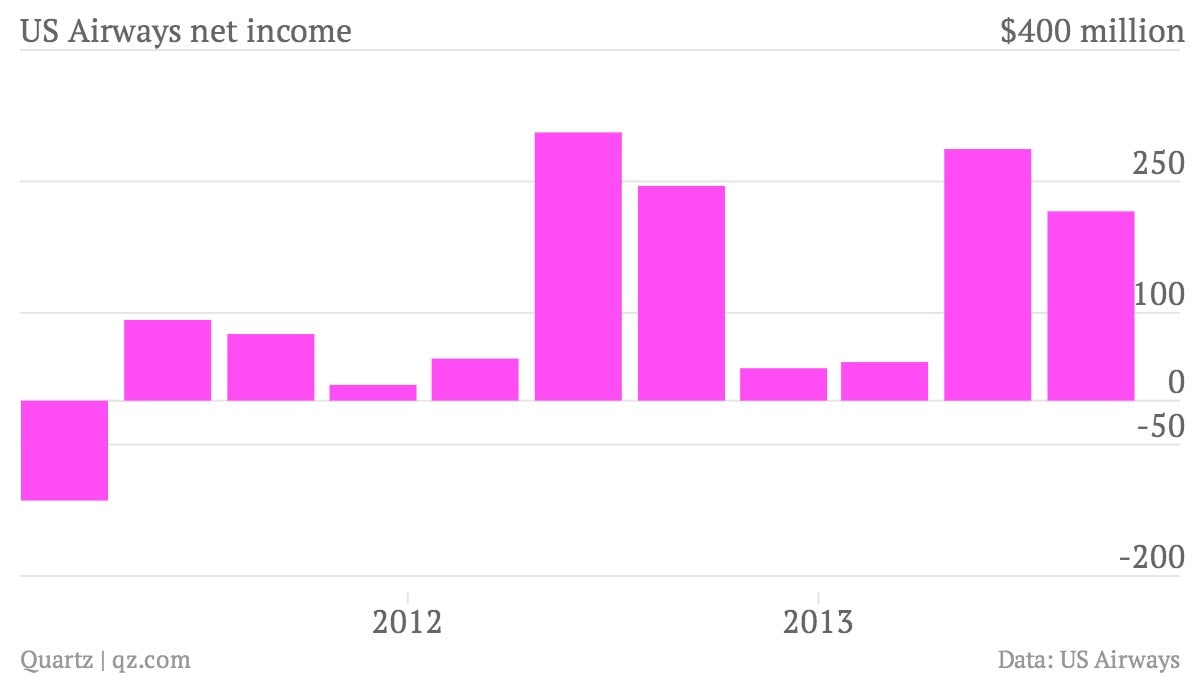

The numbers: America’s fifth-largest airline by yearly passengers reported a record pretax profit of $367 million, and a healthy net income (profit after taxes) of $216 million. With earnings of $1.16 per share, the company beat analyst expectations by $0.04. Total revenue per available seat miles, a measure of airline capacity, increased 4.9% to $0.16.

The numbers: America’s fifth-largest airline by yearly passengers reported a record pretax profit of $367 million, and a healthy net income (profit after taxes) of $216 million. With earnings of $1.16 per share, the company beat analyst expectations by $0.04. Total revenue per available seat miles, a measure of airline capacity, increased 4.9% to $0.16.

The takeaway: While the company was happy with its financial results, it didn’t want to talk about the biggest issue on its docket: it’s delayed merger with American Airlines, which has attracted the anti-trust interest of the US government. But US Airways’s good returns, alongside another profitable quarter from American, may undermine arguments that the deal is necessary to ensure the survival of both companies by pulling American from bankruptcy and allowing US Airways to compete with larger rivals. ”Strong companies merge all the time,” US Airways CEO Doug Parker told analysts. “The fact that we are currently making profits today doesn’t change that in any way whatsoever.” The end of November will be big for the company: On November 25th, it will begin defending its merger in an anti-trust trial, and December 1—the Sunday after the Thanksgiving holiday—is traditionally its biggest revenue date of the year.

What’s interesting: The company noticed a dip in revenues caused by the government shutdown—or “the government histrionics,” as one executive called it. Government travel, which was 3% of the company’s overall revenue in 2012, fell by 57% in the first two weeks of October. That gets at one of the big issues in its anti-trust trial: US Airways currently controls 55% of the runway slots at Reagan National Airport, the closest hub to the US capital. If it combines with American, it will control 67%, which the US Department of Justice (and US Airways’ competitors) fear will lead to price gouging or other anti-competitive practices.