S&P cuts Spain’s rating, yet again

Not a huge shocker here, although the market has been bracing for a cut from rival credit rating firm Moody’s. Instead, S&P lowered the axe on the Kingdom of Spain. To quote from their note:

Not a huge shocker here, although the market has been bracing for a cut from rival credit rating firm Moody’s. Instead, S&P lowered the axe on the Kingdom of Spain. To quote from their note:

- The deepening economic recession is limiting the Spanish government’s policy options.

- Rising unemployment and spending constraints are likely to intensify social discontent and contribute to friction between Spain’s central and regional governments.

- Doubts over some eurozone governments’ commitment to mutualizing the costs of Spain’s bank recapitalization are, in our view, a destabilizing factor for the country’s credit outlook.

- We are therefore lowering our long- and short-term sovereign credit ratings on Spain to ‘BBB-/A-3’ from ‘BBB+/A-2’.

- The negative outlook on the long-term rating reflects our view of the significant risks to Spain’s economic growth and budgetary performance, and the lack of a clear direction in eurozone policy.

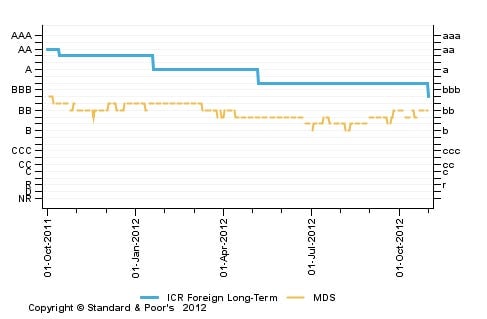

This is just the latest move lower in Spain’s S&P ratings. Here’s a look at the trend over the last year or so.