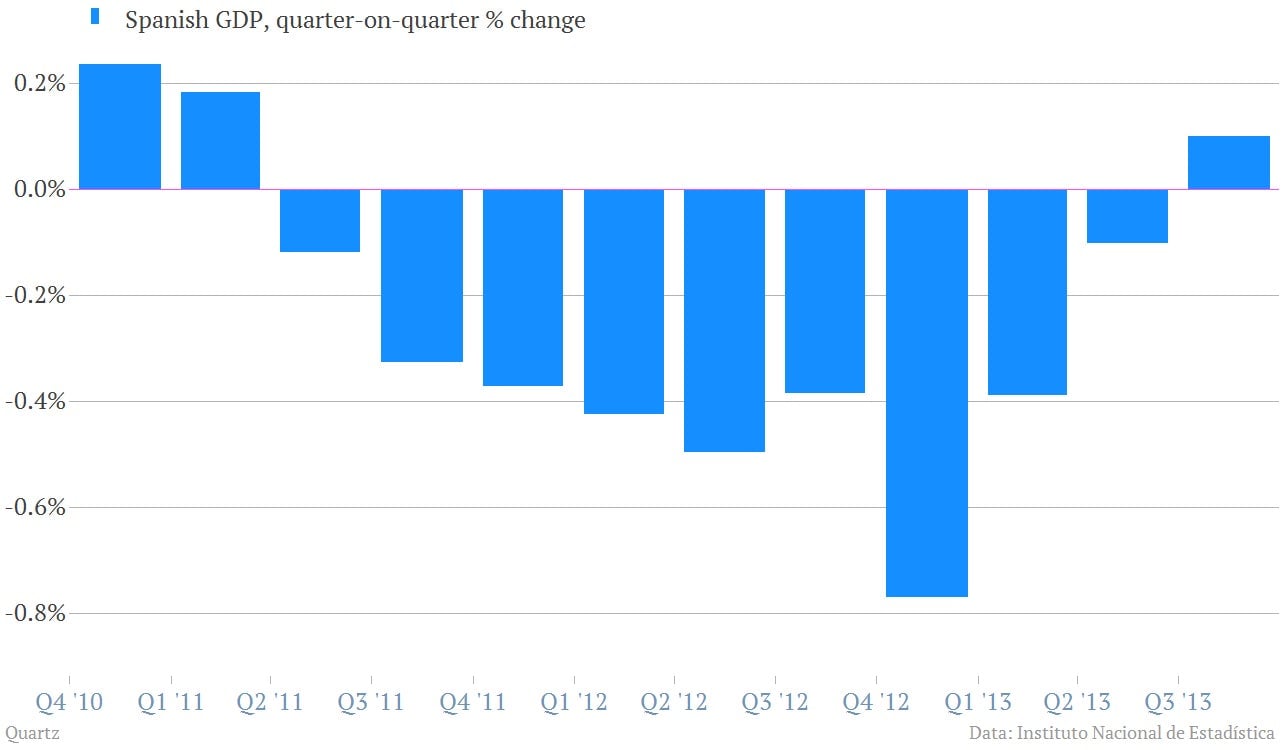

Spain goes from terrible recession to pathetic recovery

Let the slow clap begin.

Let the slow clap begin.

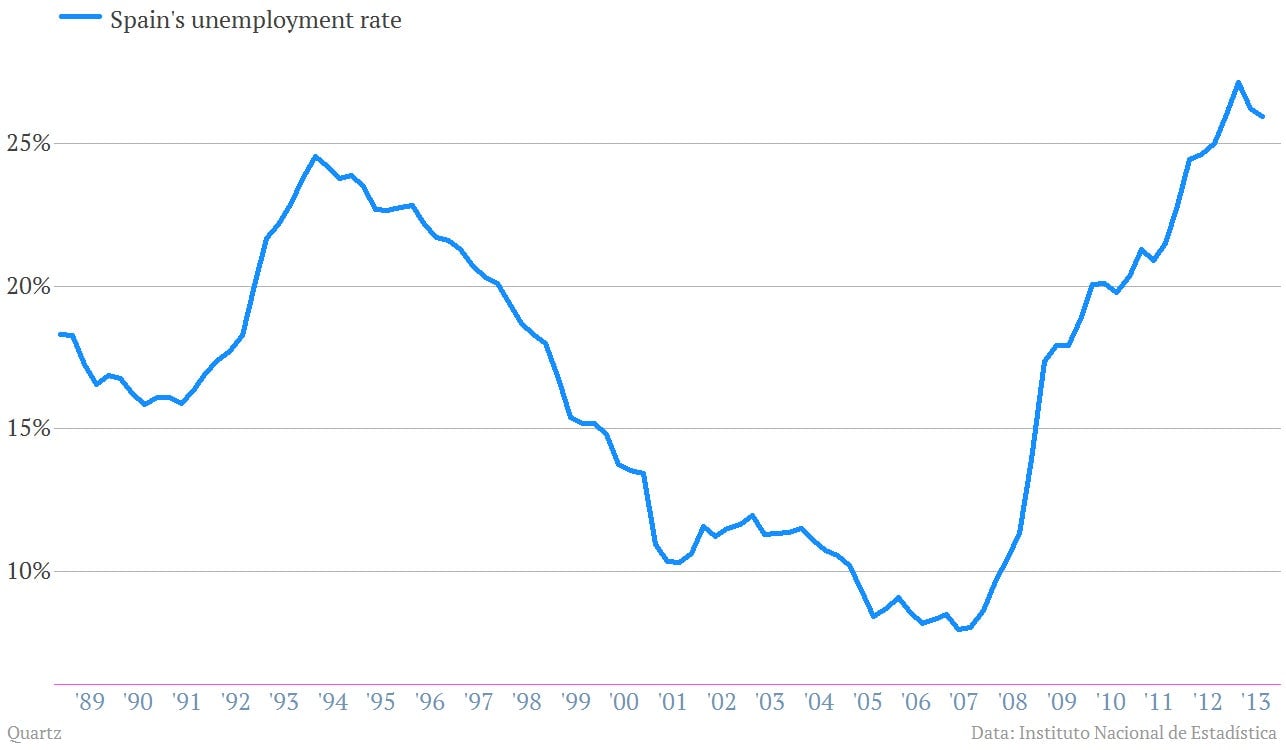

Spain’s economy is growing again after two years of crippling recession that has seen the nation’s unemployment rate climb to 26%.

There have been some early signs of improvement on unemployment, too. The rate is actually down slightly from a peak of more than 27% in March.

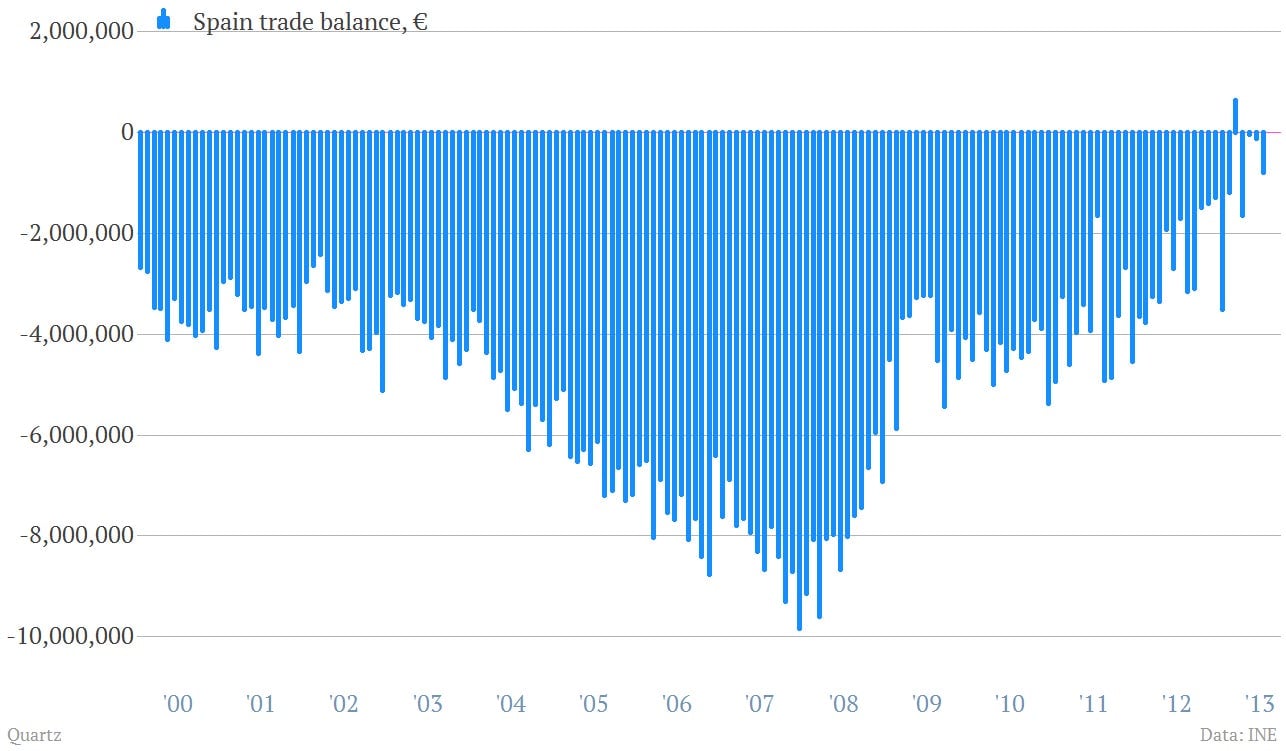

And from a trade perspective, Spain has made great strides to live within its means, as its trade deficit has all but disappeared. (Although that reflects, to some extent, a collapse of imports related to the miserable domestic economy.)

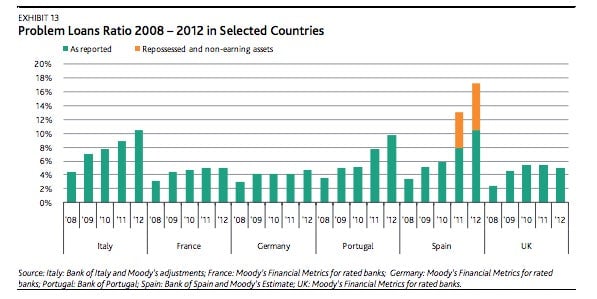

But for the record, Spain hasn’t even really begun to address its problems, which are centered in a rotten banking system, where non-performing loans are piling up.

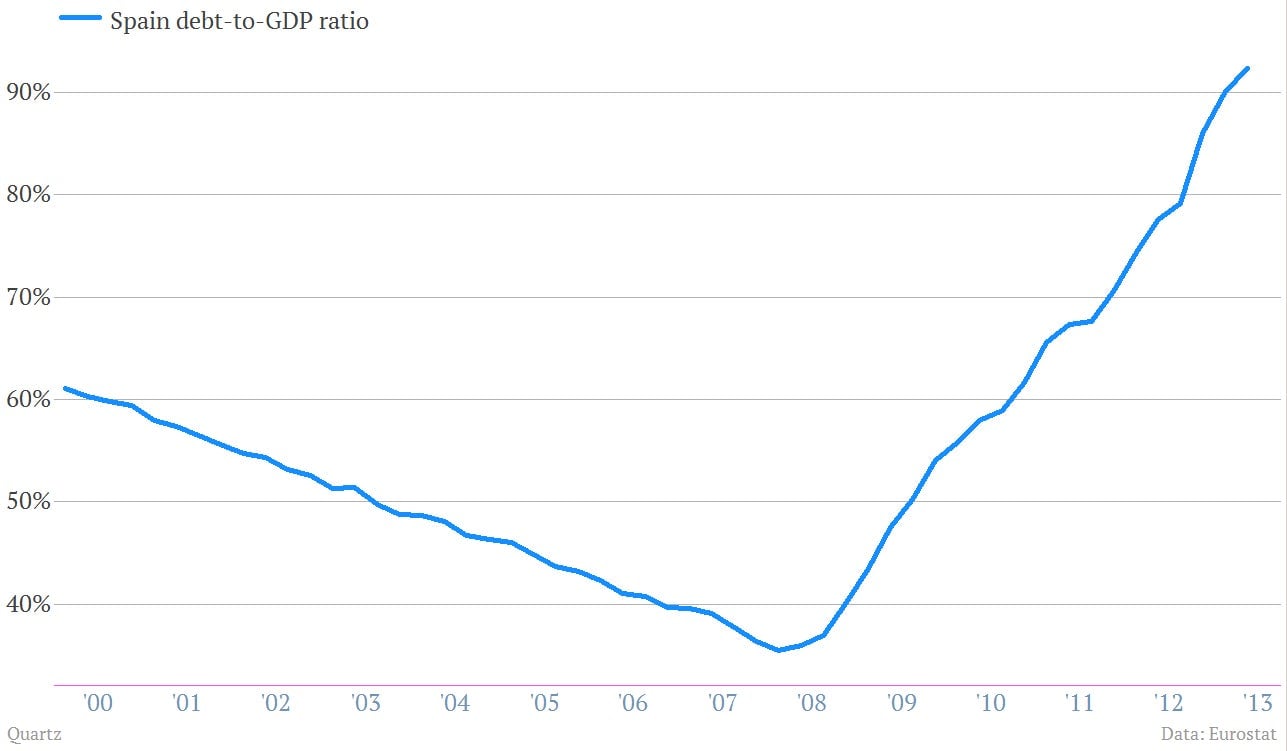

What’s more, it has acquired new problems. Spain’s bust was centered in the private sector—in a giant real estate bubble. But government finances were actually quite manageable and improving before the collapse. But now, its debt-to-GDP ratio has skyrocketed due to the damage the Spanish economy has endured over the last few years.