The slow decline of the once-venerable hedge fund

Hedge funds don’t close that often, let alone two large ones in the space of a week.

Hedge funds don’t close that often, let alone two large ones in the space of a week.

Criterion Capital Management of San Francisco, which manages about $2 billion in assets, this week told its investors (paywall) it is shutting down after 16 years as it failed to hit its targets. That follows the much larger Boston-based hedge fund Highfields Capital Management, which manages $12.1 billion and was formed in 1998 by a former stock-picker for Harvard’s endowment, which is currently $37 billion.

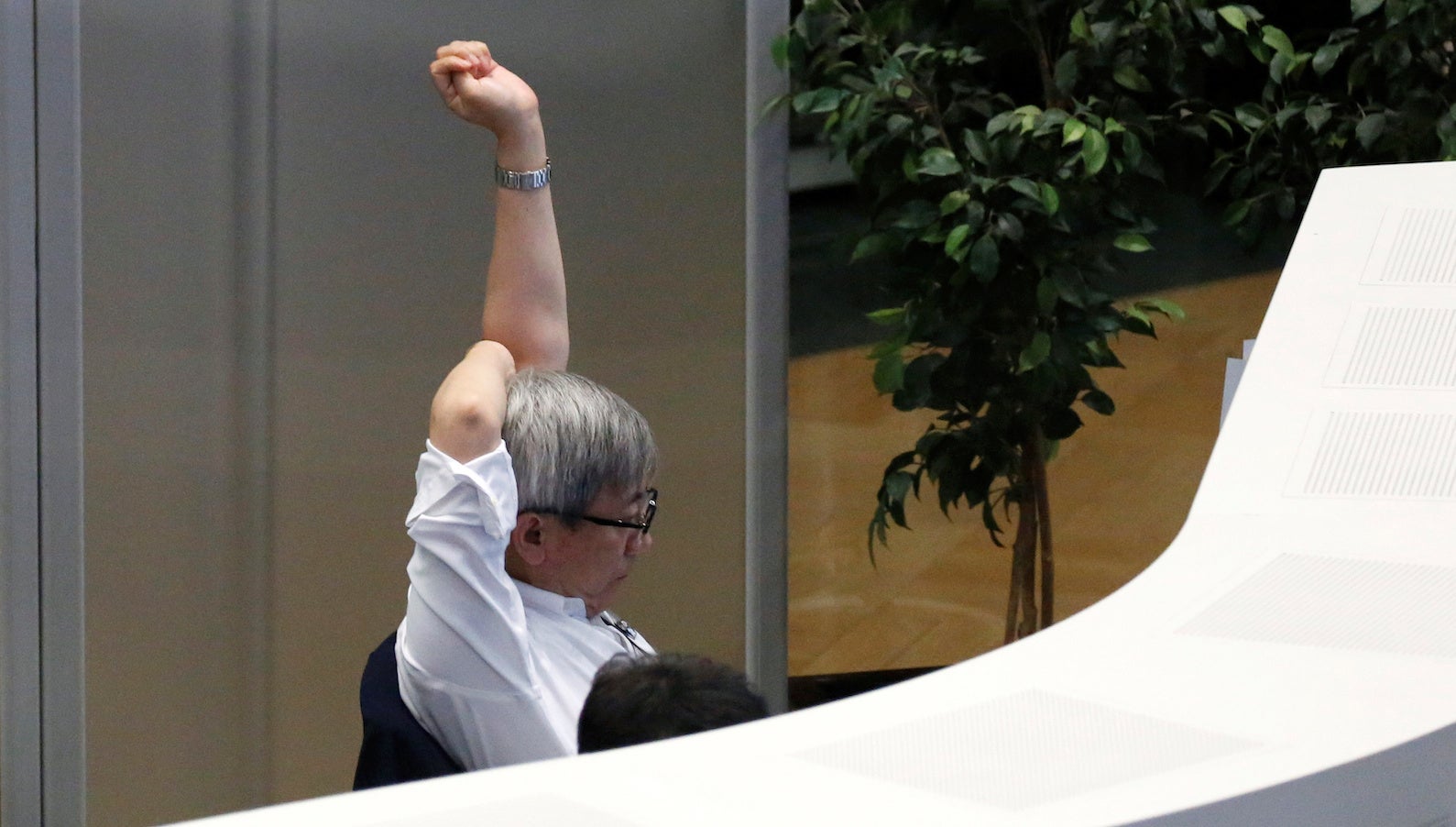

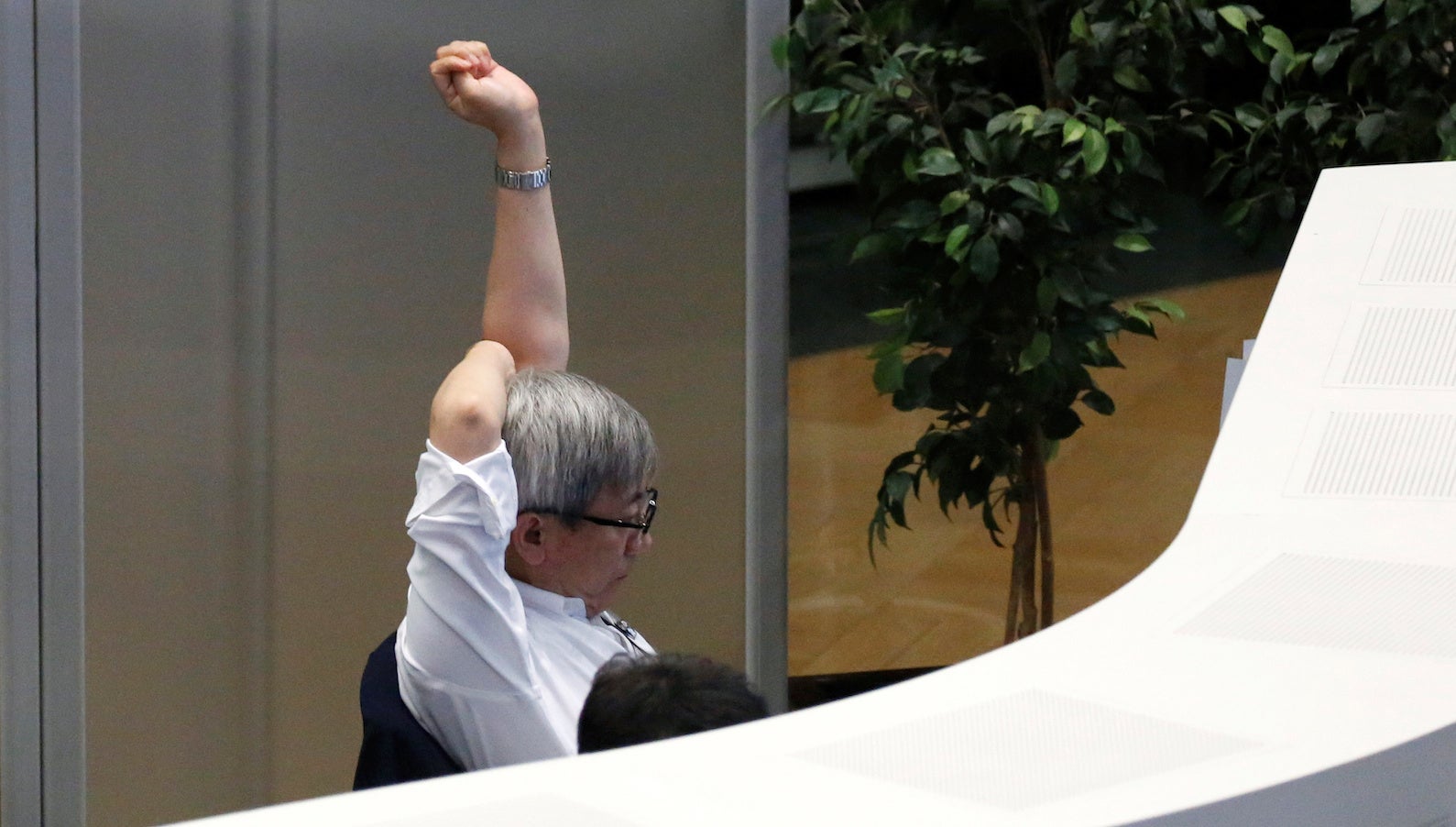

Hedge funds place bets on declines in financial markets as well as “long” bets on appreciation, allowing them theoretically to weather storms as markets rise and fall. But the bull market in US stocks, now the longest ever, has been hard on the hedgies, which typically charge 2% of total asset value as a management fee and an additional 20% of any profits earned. That is hard to justify to investors when they would have been better off putting their money into Apple.

In 2018 so far, for example, Highfields’ funds have lost more than 1%, the Wall Street Journal reported (paywall) after outstanding returns in years past. Equities hedge funds on average returned 2.3% for the year to August, the Journal reported, citing research firm HFR. Meanwhile, the benchmark S&P 500 is up 8.2% this year. Apple stock alone is up 33% so far this year.

“Our 2018 results and those of the last few years have clearly not met either my expectations or yours,” said Highfields founder Jonathon Jacobson. “No one feels worse about our lagging performance than I do.”

In August, Cerrano Capital–a $230-million fund backed by bigshots including billionaire Dan Loeb of Third Point—closed after less than a year after failing to raise its $1-billion target (paywall). Billionaire David Einhorn’s Greenlight Capital has seen its assets shrink by more than half, to $5.5 billion, since 2014 (paywall). Last year, Blue Ridge Capital, Eton Park Capital Management, and Passport Capital’s flagship fund have also all shut down. In private, hedge-fund bros are openly saying not to leave money with them.

Earlier this week, Quartz reported that family offices—which manage the money of the ultrawealthy—were pulling their money out of hedge funds. “If you’re making 20%, I’m quite happy for you to have a lovely big fee,” one CEO of such an office said. “But I know most of the hedge funds haven’t been making 20%.”

So what is Jacobson doing next? He is converting his firm into a family office.