These charts show why the Fed must keep creating new money out of thin air

In the Full Employment and Balanced Growth Act of 1978, the US Congress gave the Federal Reserve two jobs, a dual mandate. The mighty central bank is supposed to 1) maximize employment and 2) keep prices stable. (Price stability essentially has come to mean ensuring a stable but relatively low level of inflation.)

In the Full Employment and Balanced Growth Act of 1978, the US Congress gave the Federal Reserve two jobs, a dual mandate. The mighty central bank is supposed to 1) maximize employment and 2) keep prices stable. (Price stability essentially has come to mean ensuring a stable but relatively low level of inflation.)

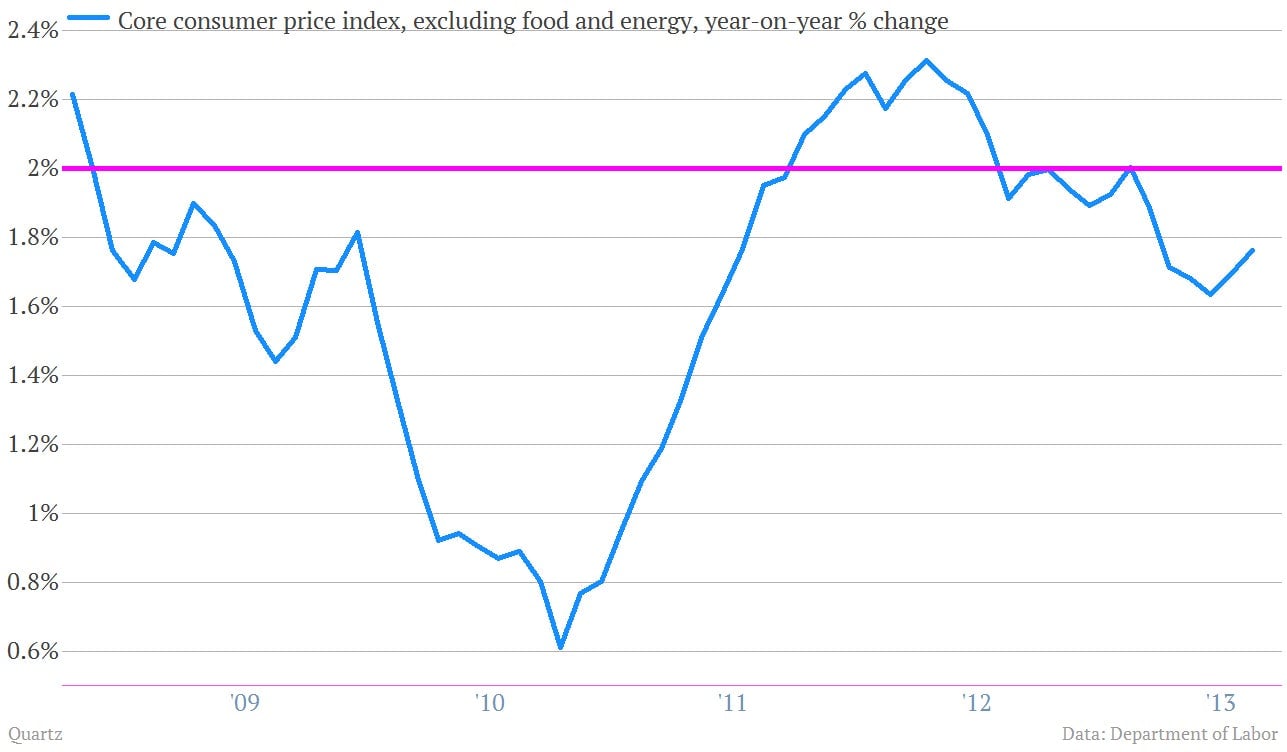

And there’s a lot more to be done on both of those fronts. For example, just-released price data for September showed that inflation continues to remain below the Fed’s target of around 2%.

And while it’s moving in the right direction, US unemployment remains unacceptably high. The jobless rate was 7.2% in September, much higher than history shows the US economy is capable of.

But what can the Fed do?

After all, its traditional policy tool—lowering interest rates to help fuel the economy—is pretty much useless, since the Fed’s key policy rate has been parked at zero since the crisis hit. That leaves the so-called unconventional policies that the Fed has undertaken under chairman Ben Bernanke. Those programs include buying US Treasury bonds and packages of government-guaranteed mortgage bonds, which is another way of continuing to press interest rates down.

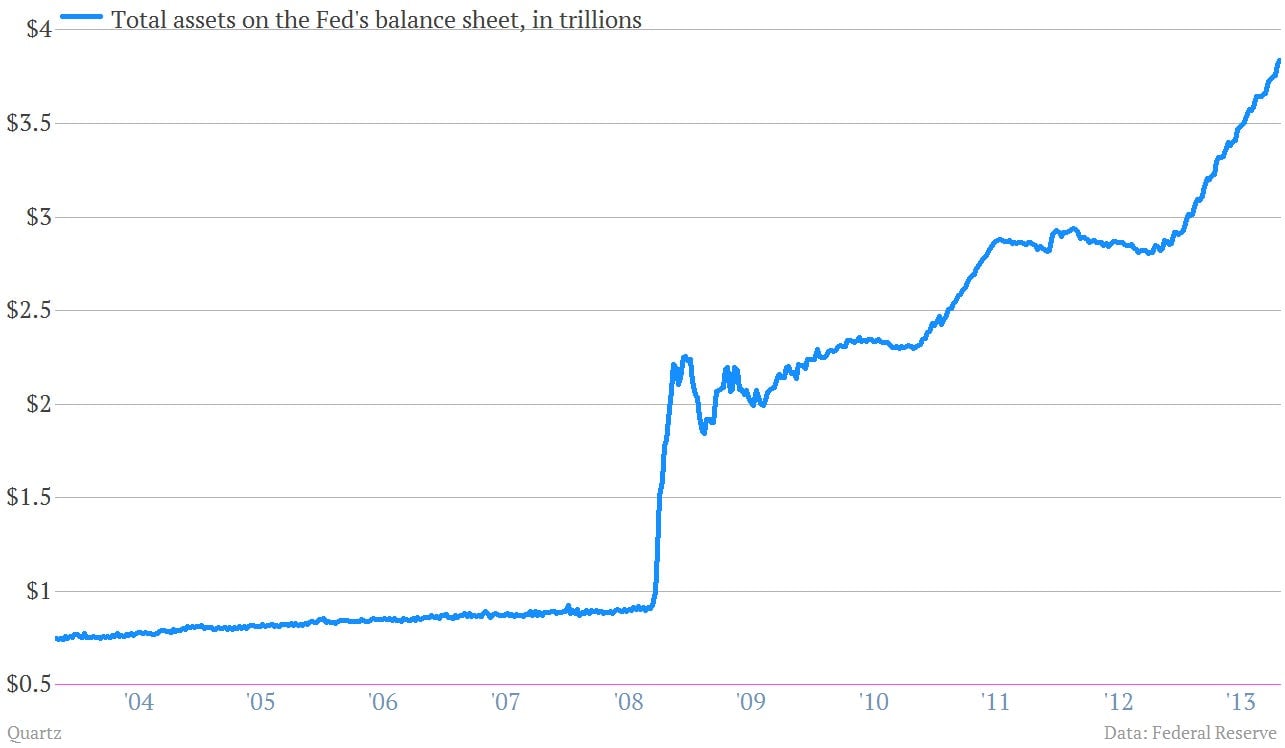

Those purchases—which are done, by the way, with money that the Fed creates from thin air—have greatly expanded the size of the Fed’s balance sheet. (Tracking the balance sheet is one way to keep an eye on how much in unconventional activity the Fed is doing to try to spur on the economy.)

Some Fed critics have argued that the central banks efforts have been ineffective at helping the economy. (After all, the unemployment rate is still above 7%.) But most economists would acknowledge that interest rate sensitive areas of the US economy, such as automotive sales and home prices, have rebounded nicely following the financial crisis. And the damage done to the economy during that period was so deep that it just takes a lot of work to get out of the hole.

That’s why when the Fed makes its monetary policy statement today around 2 p.m. EST, hardly anybody expects a big change to its effort to keep the economy moving forward.