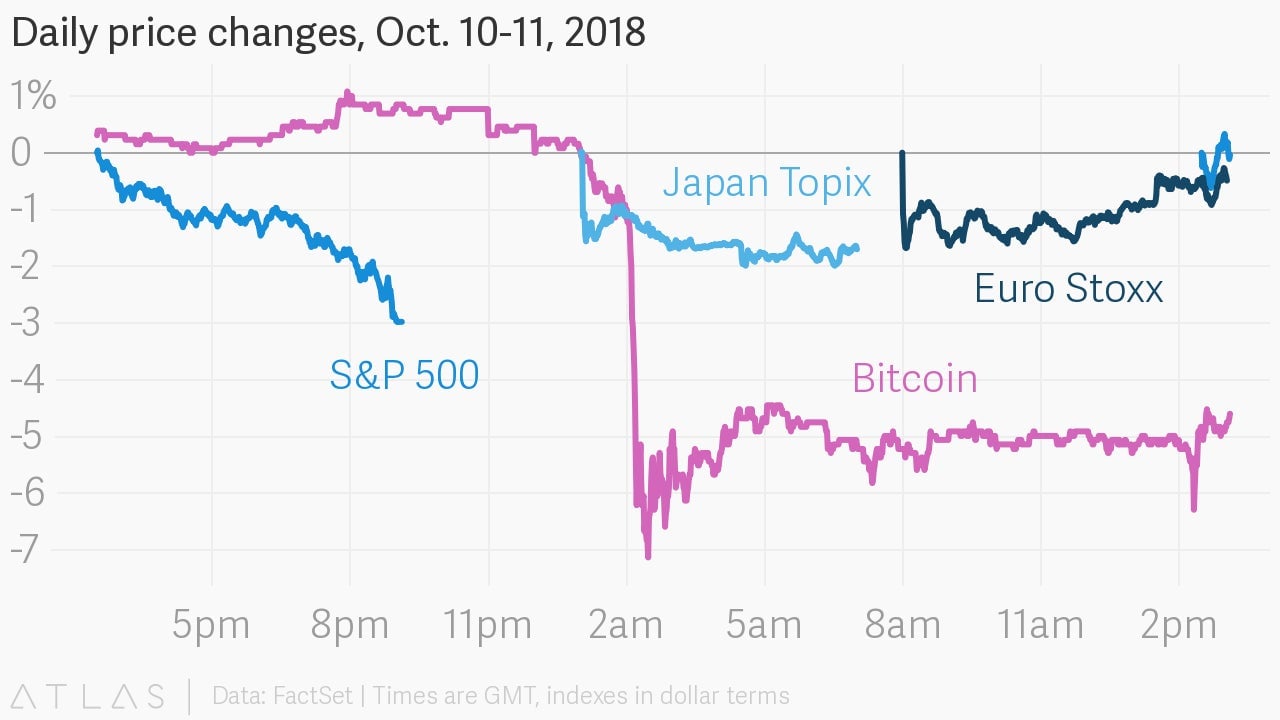

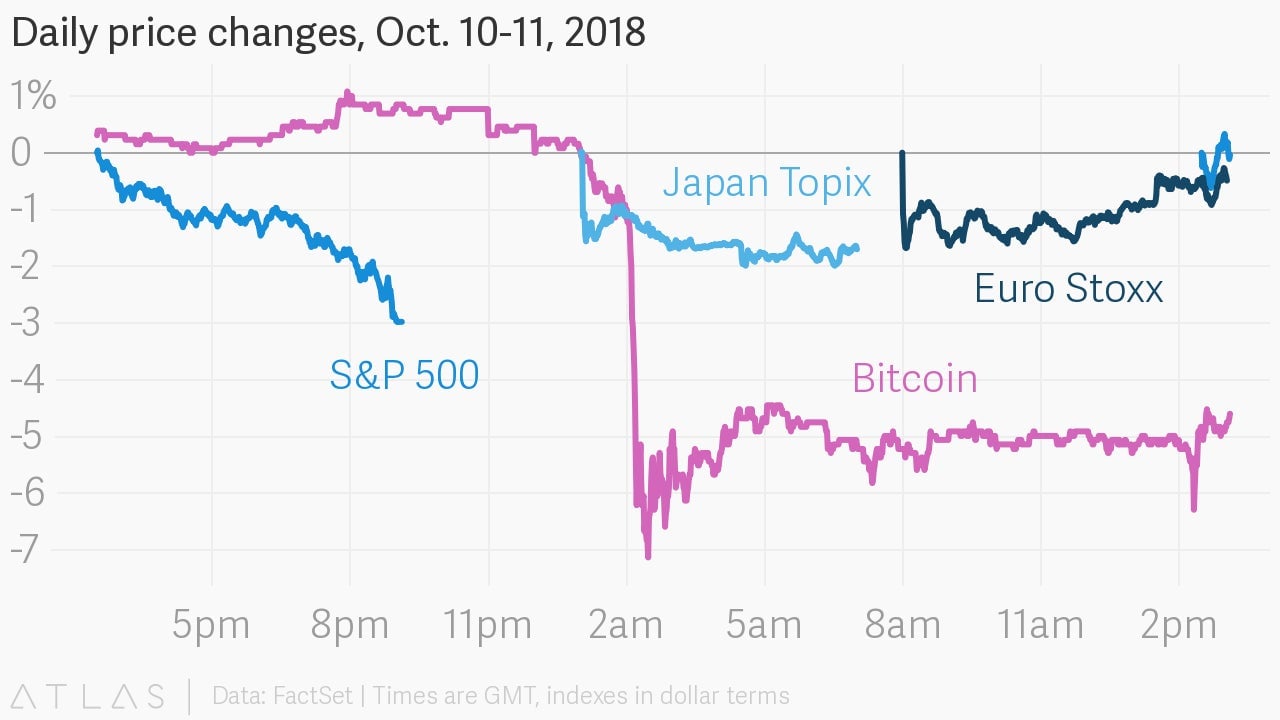

Stocks have been hit hard, but crypto has been hit even harder

Global stock markets have been whipsawed as concerns grow over a trade war between the US and China, and as central bankers raise interest rates and withdraw the stimulus that’s helped push equity prices higher. Bitcoin and its crypto cousins have also plunged amid the malaise, declining even more than major equity markets from Tokyo to New York.

Global stock markets have been whipsawed as concerns grow over a trade war between the US and China, and as central bankers raise interest rates and withdraw the stimulus that’s helped push equity prices higher. Bitcoin and its crypto cousins have also plunged amid the malaise, declining even more than major equity markets from Tokyo to New York.

The US Federal Reserve has led global central banks when it comes to tightening monetary policy after years of unprecedented stimulus. The US economy has been growing steadily, and signs of inflation are creeping in, prompting the Fed to boost borrowing costs last week, with more hikes expected in the coming quarters. Donald Trump, quick to boast about rising markets, appeared to pin blame for the declines on the Fed. “I think the Fed is making a mistake. It’s so tight, I think the Fed has gone crazy,” he said. (He also described the rate-setting institution as “going loco,” for good measure.)

The reasons for cryptocurrencies’ sharp decline are less clear. One explanation is that investors’ risk aversion is creeping into especially crypto assets. According to analysts, there are also signs that bitcoin’s price has fallen below the cost of electricity needed to create it through mining—the intense computations required to win newly created bitcoins. At the time of writing, bitcoin was down by more than 4% over the past 24 hours, while ether and XRP had shed just over 10% each over the same period.

Stock markets in the US and Europe, meanwhile, showed signs of rebounding in early New York trading. Traders are nervous that Trump will brand China a currency manipulator next week, according to Kit Juckes, global fixed-income strategist at Societe Generale. The US has been seemingly impervious to signs that the global economy is starting to slow, and it “has long been assumed by market participants that when global market malaise finally transfers to the US, the Fed will pay attention,” Juckes wrote in an email. The broader markets are wagering that the US Fed “will soften its tone” if the selloff continues, he said.

Want to stay up to date with everything going on in the crypto world? Sign up for the Quartz Private Key Newsletter and get a free 2 week trial!