Good luck paying for pot by tapping your Fitbit. To the dismay of some in the industry, marijuana is a business that runs almost entirely on cash.

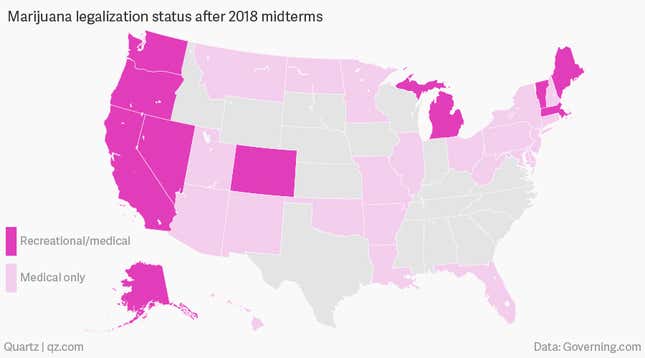

Following the November midterm elections, 10 states in the US have broadly legalized marijuana, and it’s legal for medicinal use in more than a dozen others. But it’s still a “Schedule 1” controlled substance—the same classification as heroin—at the federal level. Banks are reluctant to work with marijuana businesses even in states that have legalized it because they could be charged with money laundering.

This legal twilight means many parts of the multi-billion dollar marijuana industry are still in the financial equivalent of the stone age, even as they spin out of huge sums of cash. In Nevada alone the nascent sector is expected to generate $1 billion in revenue this year. Bitcoin may be preferred on the dark web, but US legal tender is the means of exchange for the burgeoning American marijuana sector.

In California, where marijuana sales are expected to exceed $7 billion in two years, only about 30% of marijuana-related businesses have bank accounts. Some entrepreneurs are in a regular game of cat-and-mouse with their bankers, disclosing as little about their businesses as possible and then scrambling to find a new bank or credit union when they get cut off.

Severed body parts

Dealing in cash creates scores of logistical headaches, like paying taxes, suppliers, and employees in paper currency, as well as the heightened risk of violent robbery. In one horrifying crime, a California owner of a medical-marijuana dispensary was abducted and tortured—kidnappers are accused of cutting off the victim’s penis—to find out where he kept his cash.

Needless to say, these companies spend a lot of money on security. The businesses have come a long way in the past year in making it feel more like a regular retail experience, said John Lynch, head of sales at PAX Labs, which makes marijuana vaporizers. But make no mistake, he says, there’s heavy security in the background.

The high-end marijuana dispensaries blooming in states like Nevada, for example, are a cross between a polished Apple store boutique and a fortress. “There’s usually a burly guy with pants tucked into his boots and a gun on his hip,” said Mark Downey, co-founder of Colorado-based Hoplite Collective, which sells hemp-based wellness products.

After being greeted by armed security, in many cases a buyer will show identification before passing through multiple checkpoints and fortified locked doors, all while monitored by CCTV cameras. “In some neighborhoods, there’s a much more overt demonstration of security,” PAX’s Lynch said. In others places, “it’s like Williams Sonoma.”

The risk of robbery and kidnapping has driven demand for high-security companies like Denver-based Iron Protection Group, which was founded by US Marine Corps veterans. And it appears to be working. Grisly anecdotes aside, the number of robberies and crimes in Denver tied to marijuana industry has “remained stable and made up a very small portion of overall crime,” according to Colorado Division of Criminal Justice Office statistics.

Cash flow problems

Illegal drug lords have also long hoarded cash while trying to find ways to launder it back into the economy. In one better known example in 2006, police discovered more than $200 million worth of cash piled up at a methamphetamine kingpin’s mansion in Mexico City.

And there’s little doubt that some entrepreneurs in the (legal) cannabis gold rush would rather do business in cash to avoid paying taxes, and some were already operating on the black market before state laws began to change.

Others are new to the industry and betting on a longer game of legalization that could parallel the alcohol industry, and that federal law will gradually reflect the posture states have taken. Lynch, at PAX, says the businesses he works with aim to stay within the lanes of regulation. They would prefer the safety and convenience of bank accounts and electronic transactions people typically take for granted.

There are signs that the cash-only days are coming to an end in Colorado, according to Downey of Hoplite, which uses a credit union. He says the company has easier access to banking because it sells CBD products (which don’t get you high) derived from hemp, a cousin of marijuana. Some dispensaries now accept credit and debit cards. But even so, Downey said it’s not unusual for cannabis farmers to keep a cash vault on their premises, and retailers still dispatch highly-stressed couriers with tens of thousands of dollars to carry money between offices.

The hero that is paper money

Running a cash-based business is dangerous and difficult, but it’s certainly possible. The burgeoning legal-pot sector has made a go of it in part with heavy security, almost like the days of the American Wild West. And thanks to anonymous paper money (printed and provided, as it happens, by the federal government’s central bank), US states are able to pass laws that foster an entire industry, even though it’s in defiance of federal rules.

If all money were electronic, flowing through regulated commercial banks, would this industry have even gotten started? It would certainly be more costly and difficult. But William Luther, director of the Sound Money Project at libertarian think tank American Institute for Economic Research, thinks interested parties will always find a way to transact if the gains are great enough.

“Perhaps they’d use cryptocurrencies, gift cards, gold, silver (probably more likely than gold for small transactions), or some kind of a credit system … who knows?” he said in an email. “People come up with peculiar solutions when necessary.”