Square—Twitter founder Jack Dorsey’s other company—is one of the high flyers in the race to reinvent how we pay for things. The San Francisco company’s stock is up 80% in the past year, and that’s even after coming down from highs reached in September.

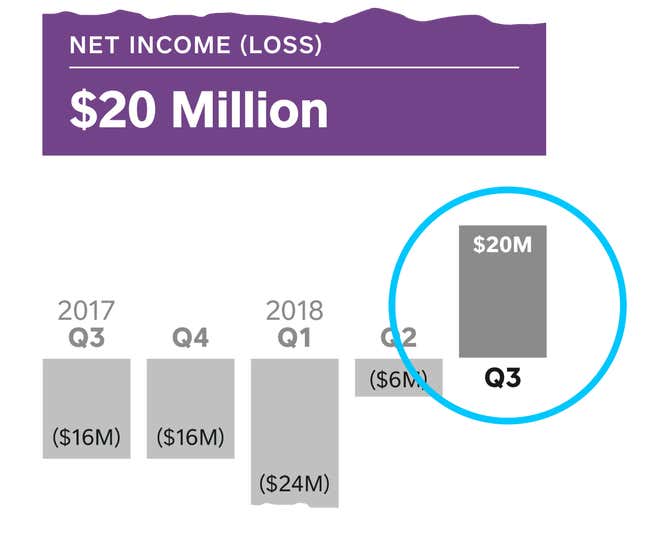

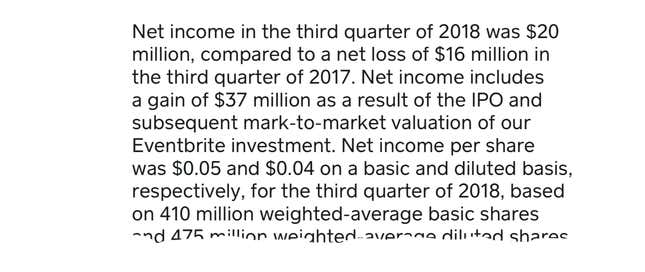

Square’s valuation has soared so much, short sellers are parsing its financial reports for reasons to bet on a decline in its stock price. Square turned a profit in the third quarter, but there’s a big asterisk next to that figure. Read on to see what else we found in the company’s most recent earnings report.

Square’s net income gain would have been a $17 million loss without the sale of Eventbrite.

Morgan Stanley analyst James Faucette said he expected more upside from Square’s gross payment volume (GPV) given buoyant results in the rest of the industry.

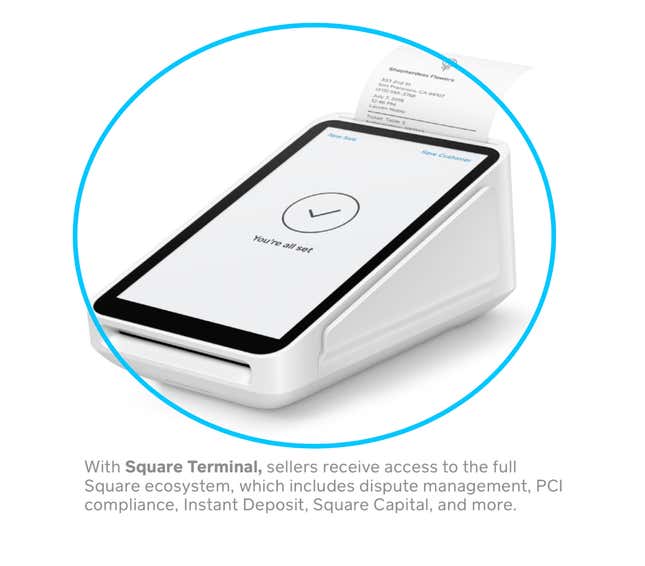

In an interview with Quartz this year, Square CFO Sarah Friar said she’s a big believer that software will eat the world. For now though, Square at times looks like a hardware company (and why not—it works for Apple). Sellers, Dorsey said in the conference call, don’t want to use their personal device (presumably their phones) to accept card payments. He said Square provides the hardware, software, and operating system for its new terminal device.

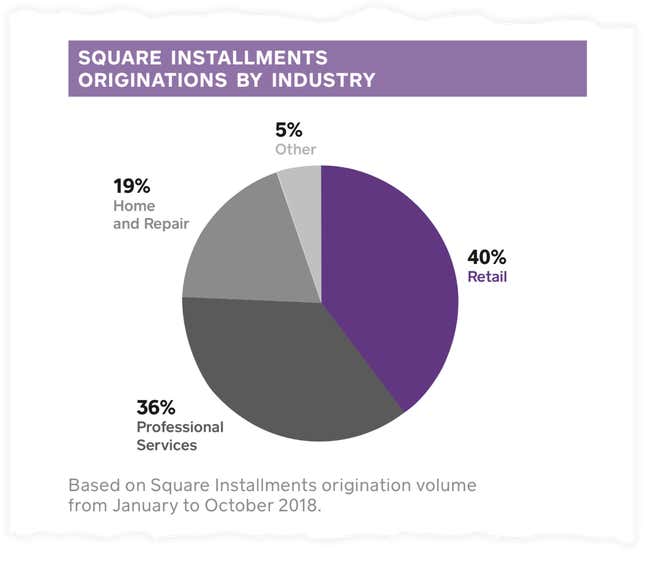

For now, these installments stay on Square’s balance sheet—meaning the company is at risk of loan losses. Morgan Stanley says Square plans to eventually move them off balance sheet, just as it plans to do with its Square Capital loans. A key question is how this lending will hold up when the next economic downturn inevitably arrives, as this book of loans has never been tested during a recession.

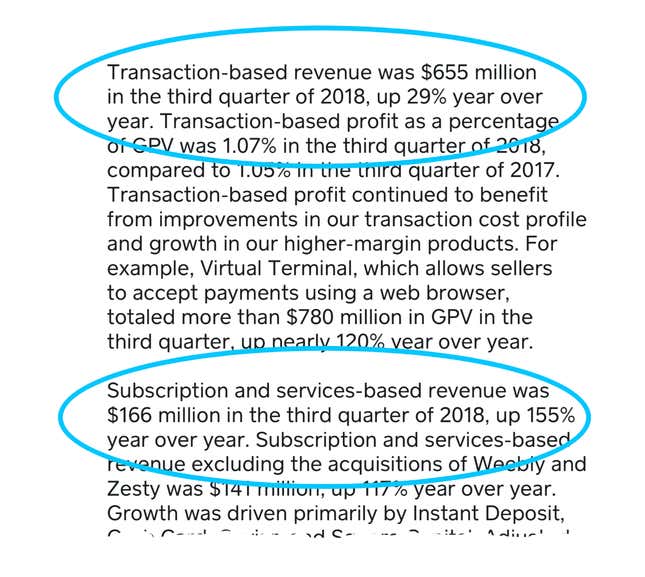

Subscription and service revenue is a “lower quality” source of sales, according to Morgan Stanley. Faucette was less impressed with the transaction revenue metrics.

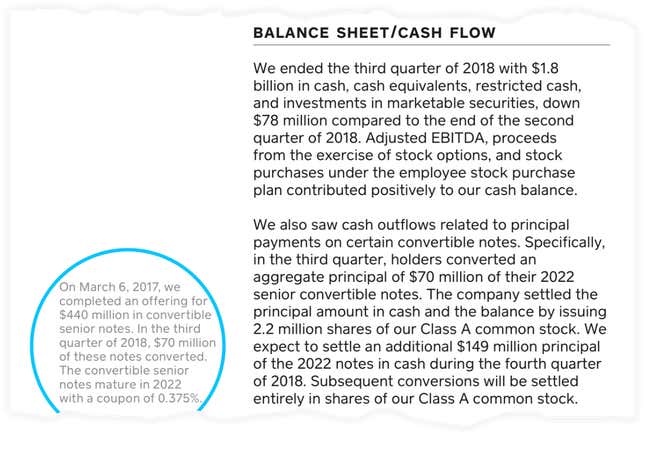

Square has $1.8 billion of cash, and plans to settle some of the debt coming due in 2022. At the current rate of cash burn, Square can likely go a few years without raising money.

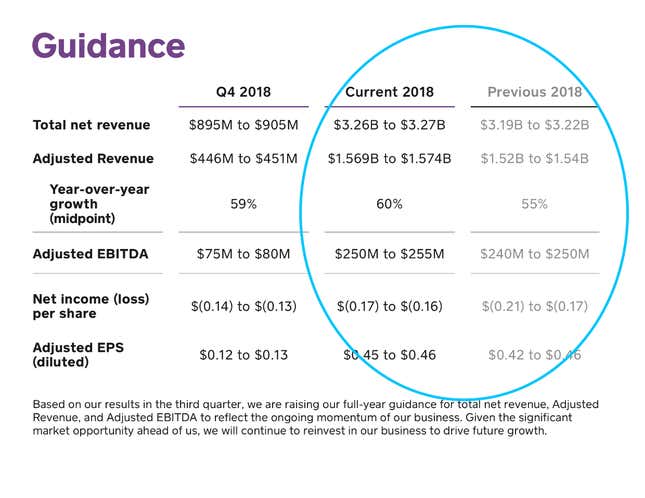

These projections are why Square’s stock price fell the day these figures were released. Traders took note that the payment company reduced its expectations for revenue and earnings.

The biggest news of late is that Friar, seen as a vital sherpa for the company, is leaving to run social media company NextDoor. The question now is who Dorsey, the multi-tasking CEO, will find to fill this key role. Whoever it is will be under no illusion that the top job is up for grabs. Friar’s departure shows that that job is Dorsey’s for the foreseeable future.