Expensive energy imports are a big snag for Abenomics

Japan’s exports are booming thanks to a weakened yen. But—in a central challenge to the government’s ongoing efforts to both boost its economy and manage its giant debt—the country’s trade deficit is rising because energy is costlier to import in yen terms.

Japan’s exports are booming thanks to a weakened yen. But—in a central challenge to the government’s ongoing efforts to both boost its economy and manage its giant debt—the country’s trade deficit is rising because energy is costlier to import in yen terms.

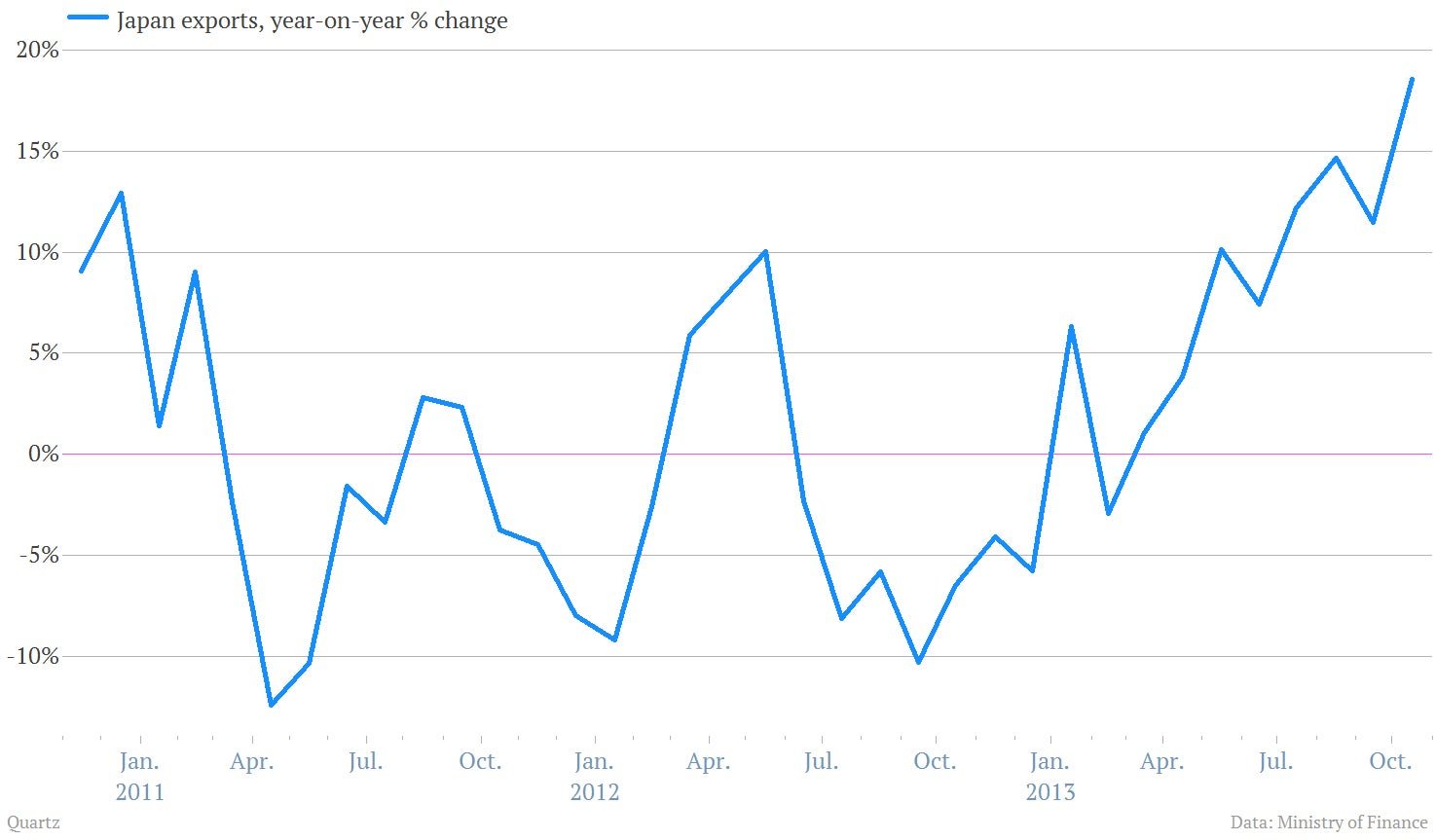

Japanese exports rose nearly 19% in October from a year earlier, according to just-released data. That’s the eighth straight year-on-year increase.

But imports are growing at an even faster clip. They rose at more than 26% over the prior year, thanks to the surging costs of importing energy. (The weak yen makes imports more expensive for Japan.) Since the Fukushima disaster led Japan to shut down its nuclear energy production, the country’s reliance on imported gas and oil has surged.

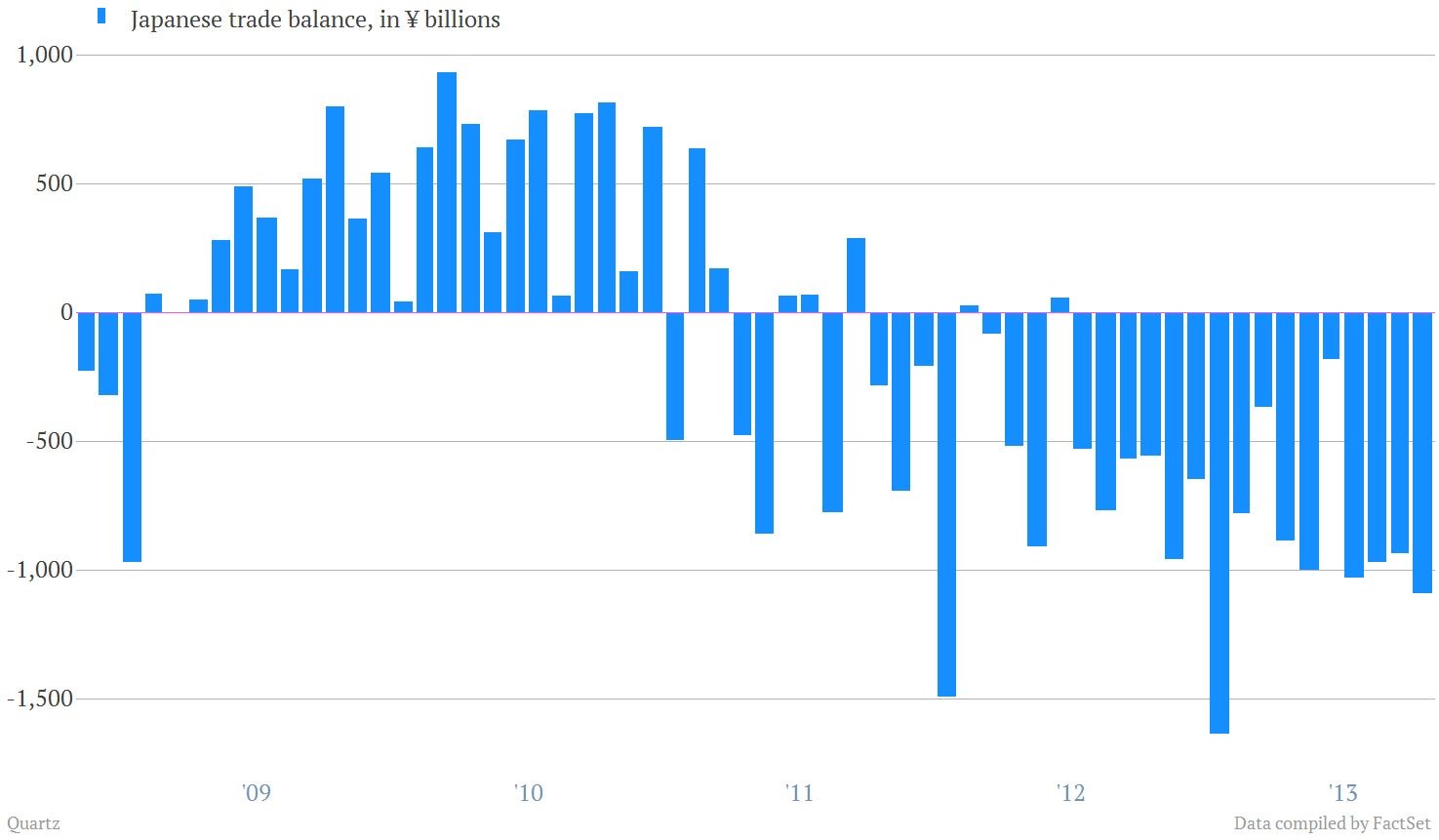

The result? The country’s sixteenth-consecutive trade deficit, at ¥1.09 trillion ($10.9 billion). As long as Japan is running deficits like this, it’s hard to argue that Abenomics—premier Shinzo Abe’s economic policy push aimed at jolting Japan into higher-gear growth—is working as planned.

One of the reasons growth is important is that it will help Japan manage what has become the world’s largest national debt at more than one quadrillion yen. (Yes, a quadrillion—that’s equal to one thousand trillion.) One of the keys to Japan’s ability to manage such enormous debt is that it’s overwhelmingly domestically funded thanks to the large current account surpluses it ran for decades. That essentially meant for decades the country had excess savings that it could channel into its own government bond market.

But Japan’s recent persistent trade deficit—which is helping to push Japan into a current account deficit—effectively means Japan will have to borrow more money from foreigners, a new, riskier chapter for Japan’s giant debt.