Germany’s economy is actually giving the world what it wants

The structure of Germany’s economy has been a political football since the onset of the eurozone crisis. Keynesian-minded economy watchers think Germany needs to spend more and save less, focusing less on exports and more on imports to support broader European growth. For their part, German economic officials seem unswayed. But that may be changing.

The structure of Germany’s economy has been a political football since the onset of the eurozone crisis. Keynesian-minded economy watchers think Germany needs to spend more and save less, focusing less on exports and more on imports to support broader European growth. For their part, German economic officials seem unswayed. But that may be changing.

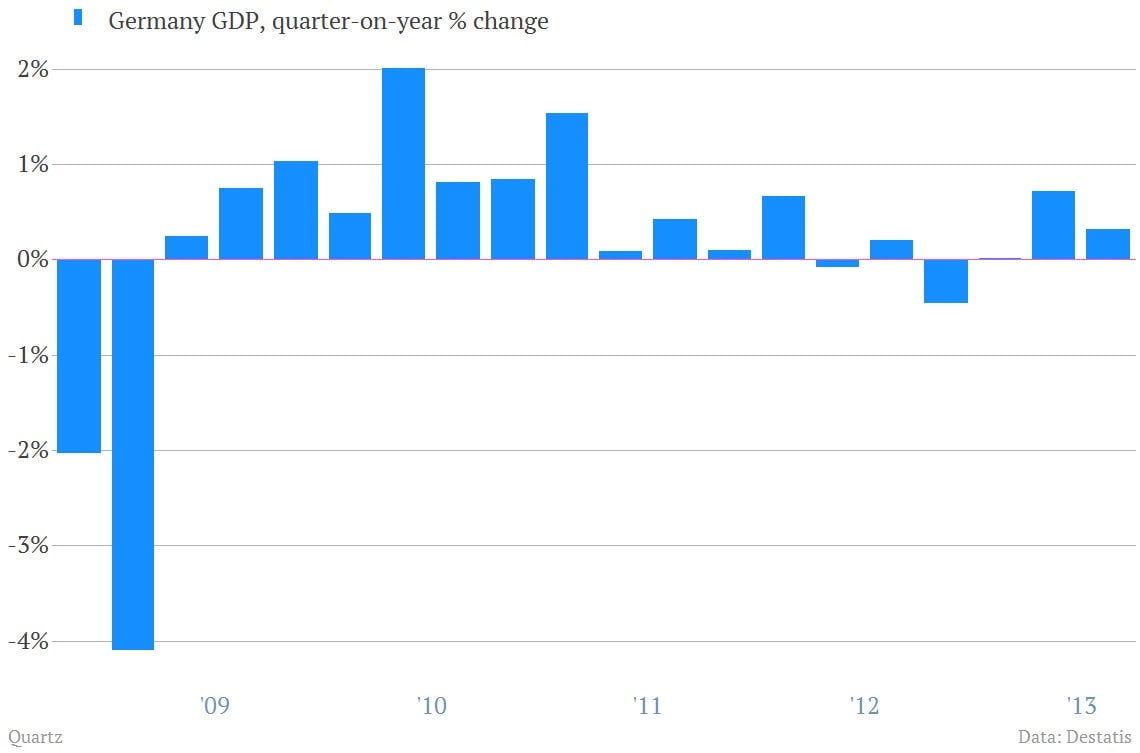

A fresh look at Germany’s economy in the third quarter—released today—offers some interesting details about the country’s recent growth drivers, which happen to be just what the Keynesians have been asking for: domestic spending and capital investment. Check it out.

Third-quarter GDP increased 0.3% over the second quarter. And it’s up 1.1% since the same quarter last year.

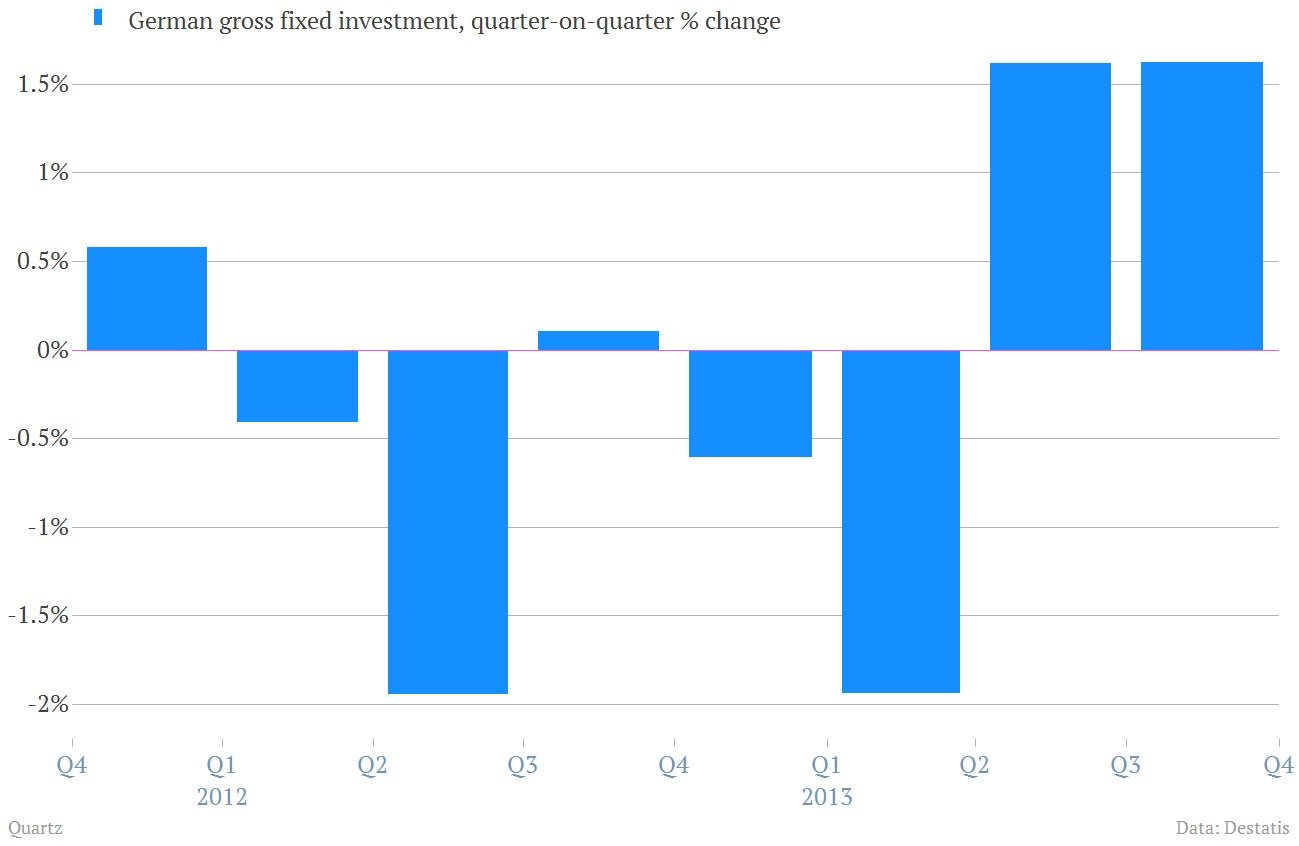

The key contributor to that growth? Investment. Gross fixed capital formation, a broad measure of capital investment, rose 1.6% in Germany in the third quarter, thanks to a rise in construction. Some of that construction uptick might be weather-related. But there was also at 0.5% increase in business and equipment investment. Government spending grew by 0.5%, too. And it was the second straight quarter of strong growth for investment as a whole.

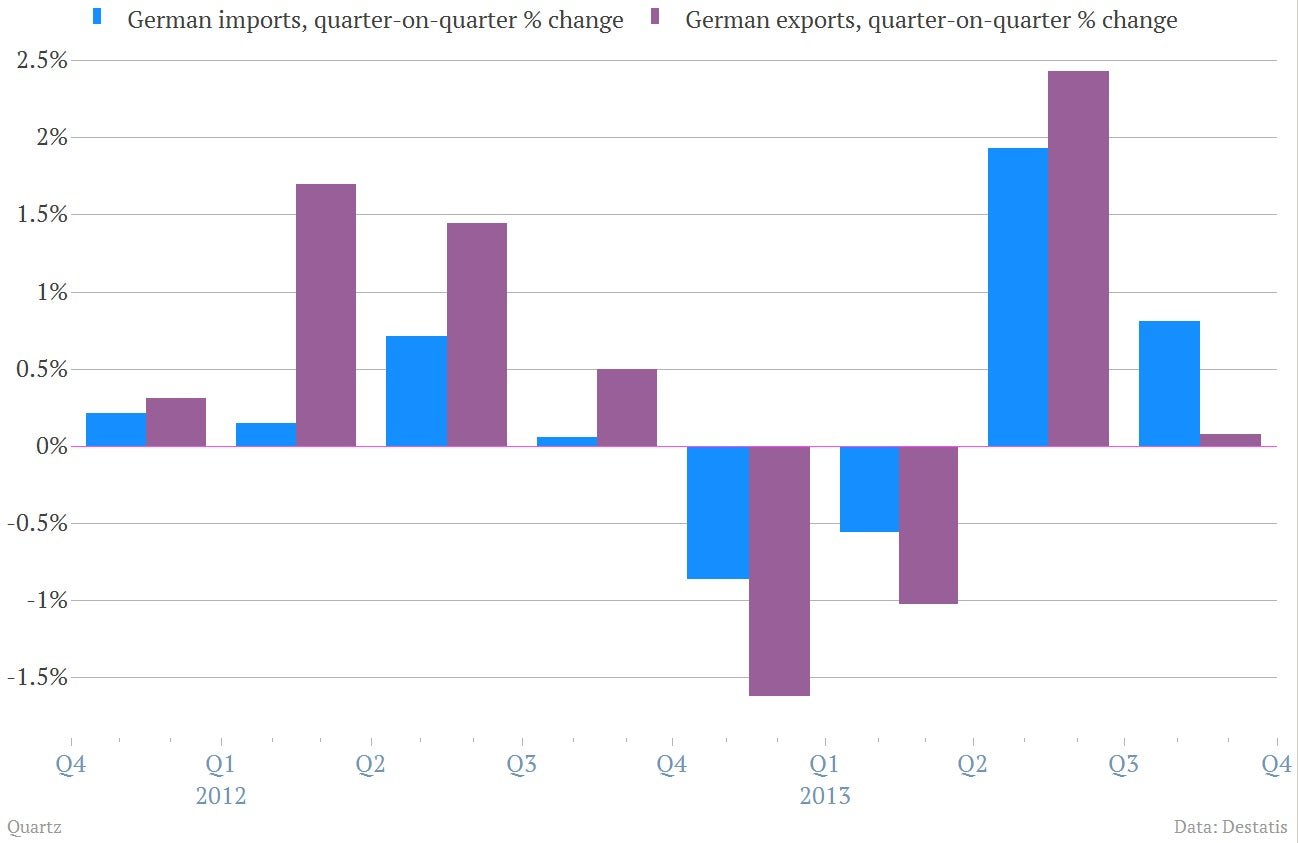

In fact, Germany’s vaunted export engine sputtered during the quarter, growing just 0.1%. Imports grew more: 0.8%.

Germany may be realizing the value of doing a bit more spending. Even though growth slowed from 0.7% to 0.3% between the second and third quarters as Germany spent more, it may have suffered more in the absence of that spending. After all, its economy depends on the health of greater Europe; the continent buys 69% of German exports.

The coming fourth quarter will reveal more about Germany’s intentions. Just don’t expect its policymakers to advertise a change in direction because of political pressures abroad.