When Goldman Sachs went public in 1999, it was a drastically different company. Its first letter to shareholders was concise, the shortest of any since. The tone was optimistic, a display of confidence from a firm facing favorable conditions in global markets. At the end, it thanked shareholders, clients, and employees.

A lot has changed since then. Goldman Sachs more than doubled its staff and revenue over the past two decades. By the early 2000s, it found itself in the midst of a worldwide economic slowdown and went on to navigate the lasting impact of the 2008 financial crisis. As market conditions changed, so did the company’s priorities.

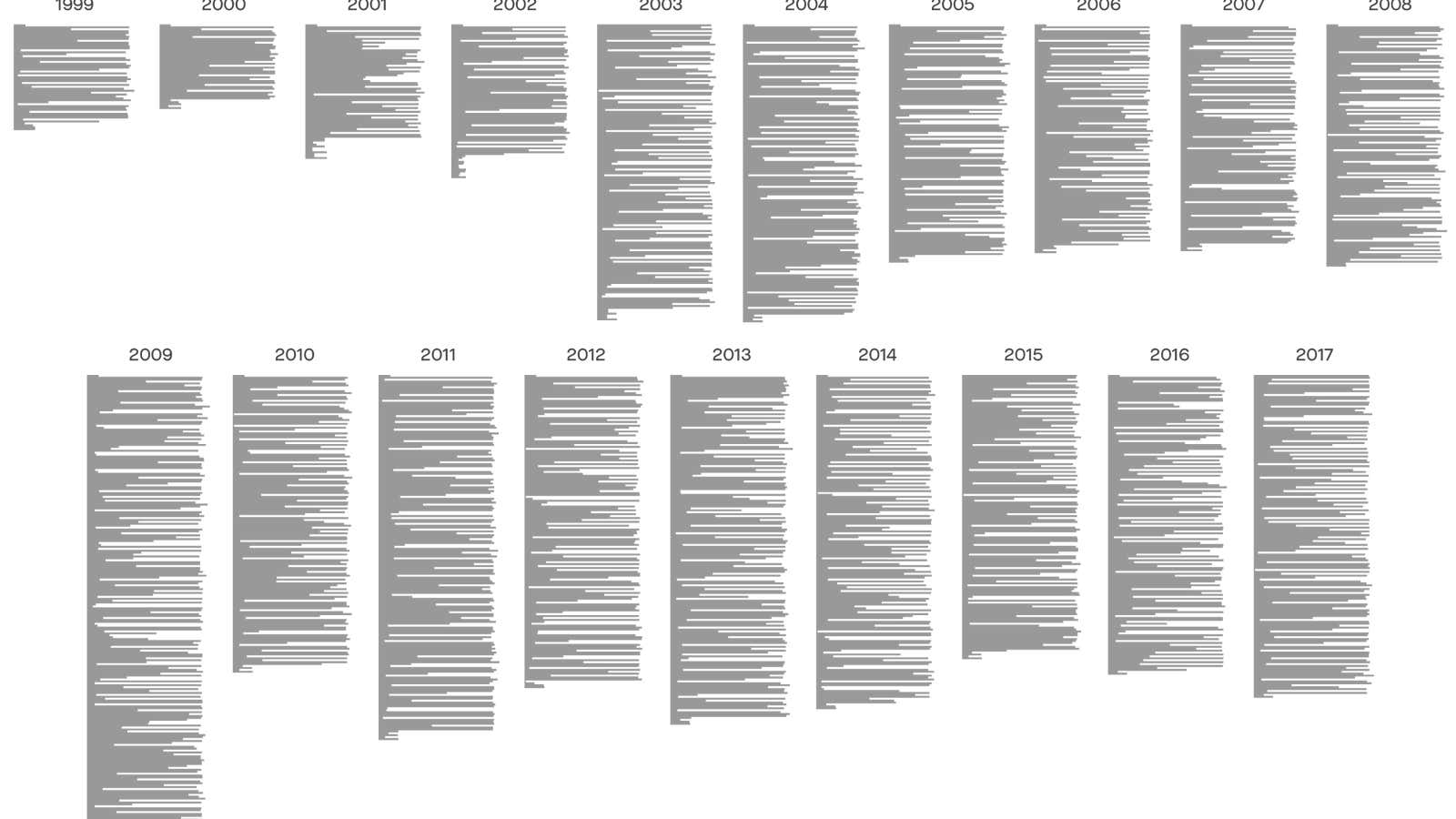

The company’s letters to shareholders reflect these shifting priorities. In some years, the letter reassured investors of the business’s strength in its core operations; in others, it talked about the impact of regulations and cautioned shareholders of risks. Below are some of the revealing words and phrases in each year’s letter1. That is to say, the words and phrases that were not only common each year, but those that were common in that year’s letter but less common in the rest.