How Trump and the Brexiteers froze the world’s IPO market

For a demonstration of how political upheaval ripples through the financial system, look no further than the market for initial public offerings (IPOs). Stock offerings dried up almost completely last month in the US and Europe, and things weren’t much better in the rest of the world, as well.

For a demonstration of how political upheaval ripples through the financial system, look no further than the market for initial public offerings (IPOs). Stock offerings dried up almost completely last month in the US and Europe, and things weren’t much better in the rest of the world, as well.

The US and Europe managed just two IPOs—New York’s New Fortress Energy and Austria’s Marinomed Biotech—last month, according to Refinitiv. The global total, 46, was also the lowest in two years.

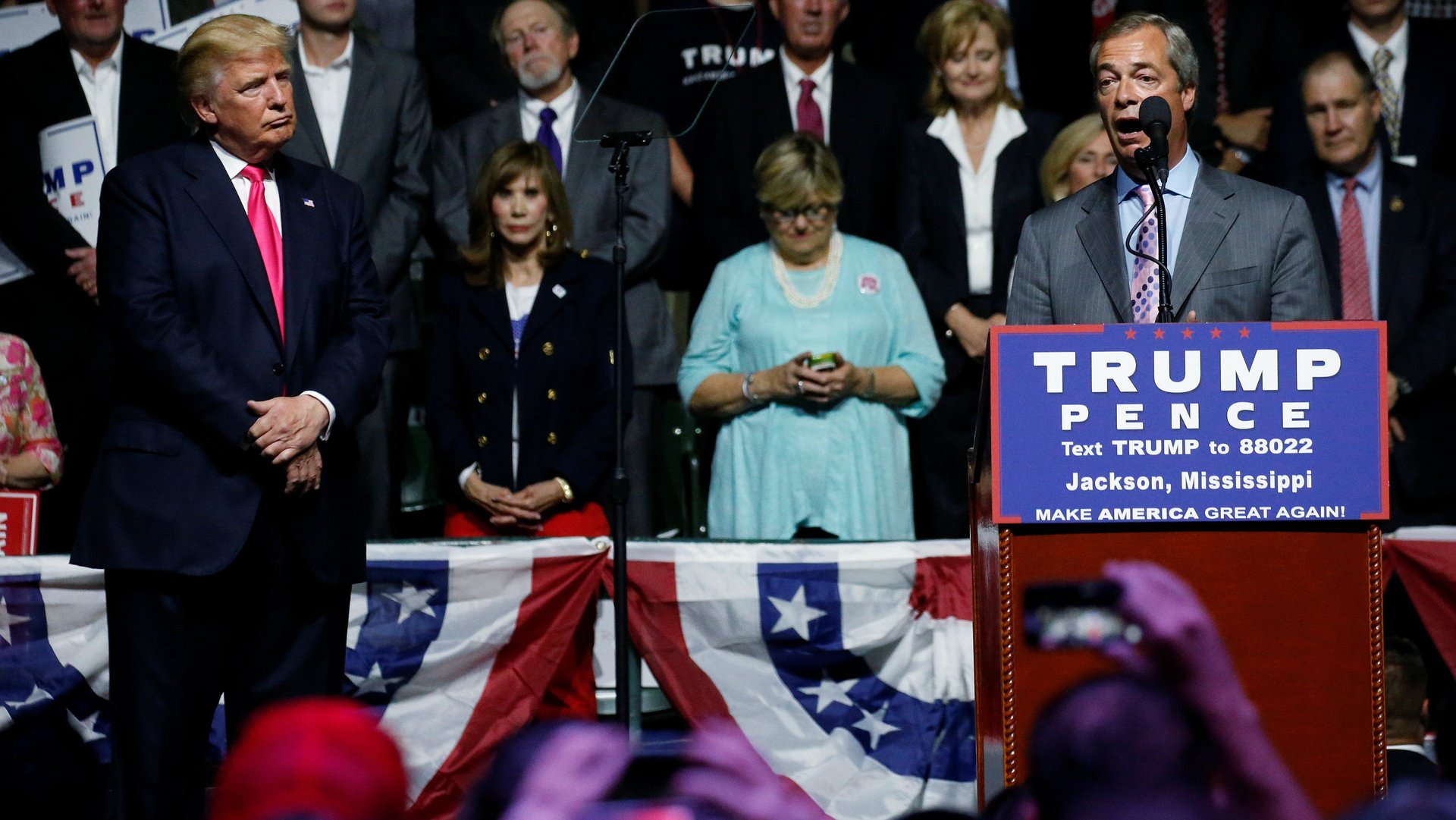

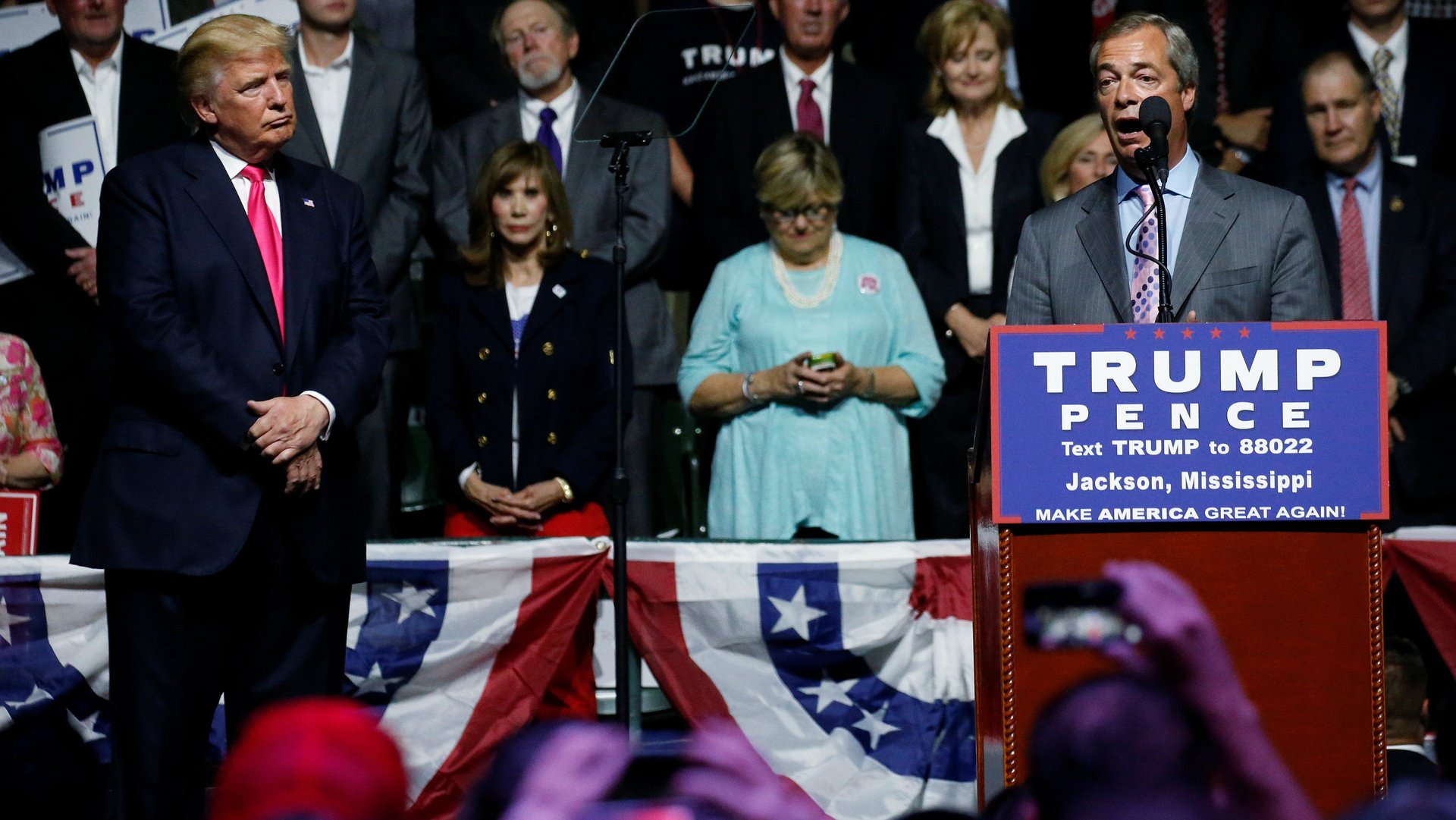

In the US, the partial government shutdown, which Donald Trump said he was willing to own in order to get funding for his border wall, explains the seizure. The Securities and Exchange Commission operated with barebones staffing during the closure and was unable to approve IPOs.

In Europe, the UK is slated to leave the EU in March, but the British government can’t agree on how to go about it. Prime minister Theresa May’s Brexit agreement with the EU, which was two years in the making, was resoundingly defeated in a vote in the British parliament last month. Failure to hammer out an orderly exit would rupture trade and commerce within the bloc, sending economic shockwaves throughout Europe.

Meanwhile, Trump’s trade war with China has squeezed its economy, and has likewise smothered its stock market (paywall). A deadline of March 1 has been set for negotiators to agree on ways to restructure the trade relationship between the world’s largest economies; if no agreement is reached, the US will ratchet up tariffs on Chinese goods even higher.

Some of the factors weighing on the global IPO market are most likely transitory. Assuming the US government and its agencies stay open, domestic IPOs will eventually get back on track. But how exactly the UK’s departure from the European bloc will proceed is anyone’s guess. Likewise, it’s impossible to predict the results of the US’s deliberations with China, which will have a wide-ranging impact on businesses across the world.