Big Dairy wants chocolate milk to be the new post-workout recovery drink

With the American milk business souring, the dairy industry is casting a covetous eye on athletes in need of a restorative post-workout beverage.

With the American milk business souring, the dairy industry is casting a covetous eye on athletes in need of a restorative post-workout beverage.

A campaign has gradually been building to convince exercise fiends to drink chocolate milk instead of protein shakes. Milk producers like Shamrock Farms Co. (paywall) are rushing to mimic the wildly popular protein-shake industry, currently occupied by companies like Muscle Milk. Last year, Shamrock partnered with GNC to launch sales of Rockin’ Refuel, a mixture of the farm’s chocolate milk and protein. Dynamoo, a post-work out “recovery” drink, is now being sold in grocery and health food stores (spoiler: It’s really just re-packaged milk). Fitness sites and academic journals tout the benefits of chocomilk for athletes. Meanwhile, the US national dairy council has turned its famed “Got Milk?” campaigns into “Got Chocolate Milk?” ads, which feature athletes downing the stuff after exercising.

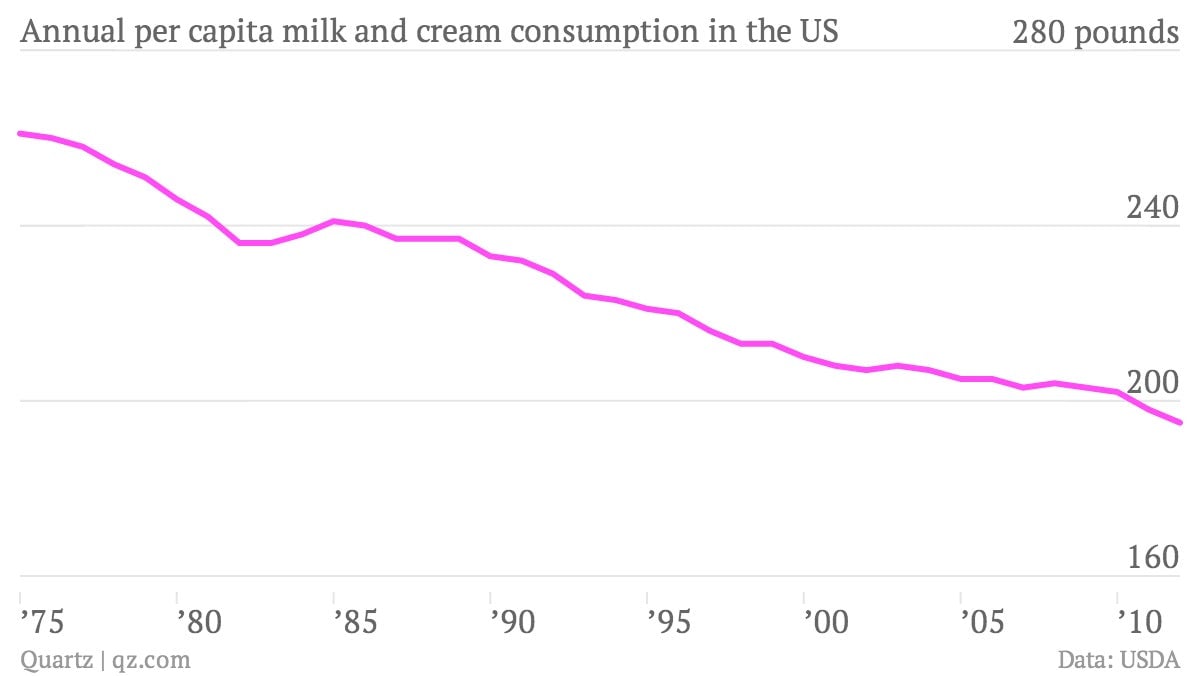

The recasting comes at a particularly rough time for Big Dairy in the US. Milk consumption has been declining fairly steadily for several decades. Americans now drink almost 30% less on average than they did in 1975.

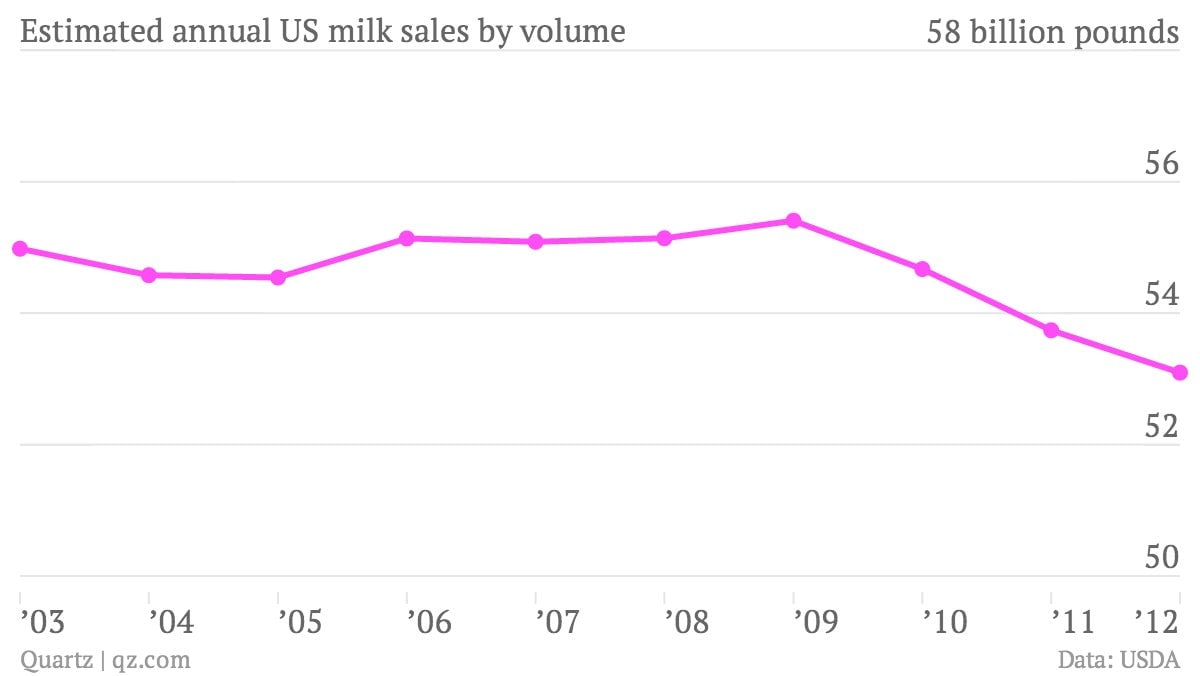

Likewise, total US milk sales have been pretty flat since the turn of the century, and have started to tumble in recent years, even though the US population has grown by some 11% since 2000.

There are a few reasons for milk’s decline:

- Milk is out of style among health nuts. More Americans are ditching fat-heavy dairy for calorie-free beverages like bottled water.

- Milk drinkers are aging. The biggest drinkers of milk, children, account for a smaller percentage of the population than before—because of declining birth dates.

- Milk prices are rising. The price of milk has gone up steadily in response to rising grain prices needed to feed dairy cows. The price of milk jumped nearly 10% last year, and has continued to rise moderately since then.

- Americans are getting their milk nutrients elsewhere. Vitamin D and calcium, which Americans used to rely on dairy to provide, are now selling points for nutritional bars and health juices (Tropicana, for example, sells a vitamin D-rich orange juice).

The answer to the American milk industry’s woes appears to be to appeal to protein buffs and exercise gurus. It’s a clever approach—protein bars and drinks, after all, have become a global sensation; sales are expected to reach £7.8 billion ($13 billion) globally by 2017, reports the BBC, citing Euromonitor. Protein shakes alone are already a half-billion-dollar business in the US, and are slated to grow by roughly 7% annually, according to Euromonitor analyst Chris Schmidt.