One chart Starbucks would really like you to see

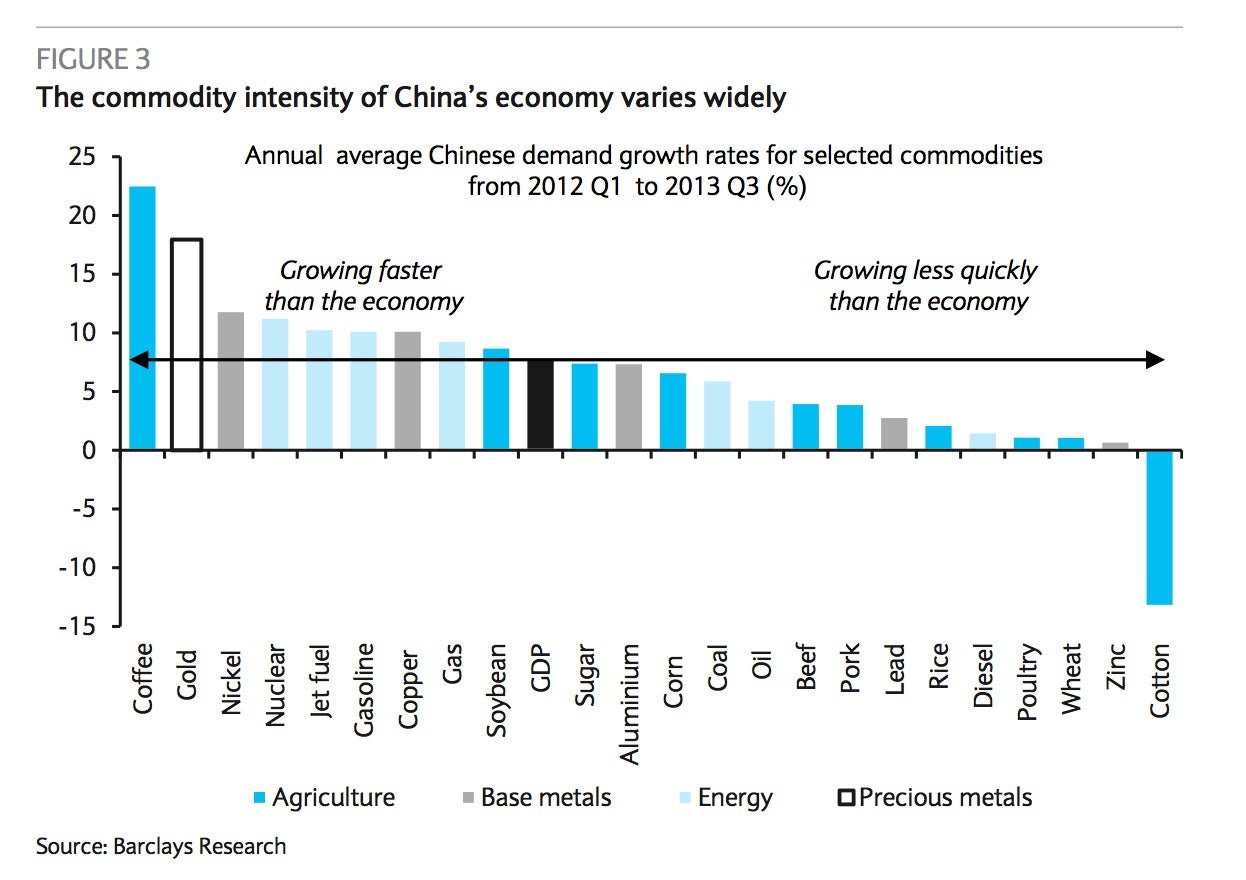

For a long time now, global demand for commodities has been almost inextricably linked to Chinese industrial growth. Of course, now we’re told that China is slowly trying to rebalance its economy away from the industrial investment that drove its growth toward more domestic consumption. That’s an important shift, with big implications for commodity producers.

For a long time now, global demand for commodities has been almost inextricably linked to Chinese industrial growth. Of course, now we’re told that China is slowly trying to rebalance its economy away from the industrial investment that drove its growth toward more domestic consumption. That’s an important shift, with big implications for commodity producers.

But not all commodities are suffering. While Chinese demand for a lot of basic foodstuffs and industrial commodities is growing more slowly than the Chinese economy overall, demand for others is surging. For instance, take a look at coffee.

Apparently, the coffee business is doing quite well in China, thanks very much. Starbucks’s China/Asia Pacific business is posting pretty giant revenue growth. (It was 27% in the fiscal year that just ended in the fall.) Last month Starbucks CFO Troy Alstead touted an “acceleration of new store development” in China/Asia Pacific, calling growth there “very accretive, high profit, high return on capital new store development.” Starbucks’s profit margins in the Asia/Pacific region hover around 35%.

“We have seen firsthand that Starbucks is increasingly becoming a daily ritual for local Chinese,” John Culver, president of Starbucks Coffee China told analysts on the company’s last post-earnings conference call. Normally, we’d disregard that statement as typical corporate puffery. But demand is clearly on the up and up.