The US economy may never be the same after the Great Recession

There’s a notion in the air that, after the Great Recession, the US might not be able to grow as fast as it used to.

There’s a notion in the air that, after the Great Recession, the US might not be able to grow as fast as it used to.

Just listen to former US Treasury Secretary-turned-public intellectual Lawrence Summers, who has been hammering on the notion of “secular stagnation” for several months now. He’s was out with another column on the topic over the weekend (paywall).

Here’s the argument, in a nutshell: For some reason—perhaps related to demographic changes tied to the baby boom generation—the US economy has been losing its gangbuster growth potential for a while, perhaps since the 1980s. The economy has had good runs, but those stretches were enabled only by the emergence of debt-driven bubbles—like the housing market during the pre-crisis period—to keep the economy burbling above its natural tendency.

Summers isn’t the only one sniffing around this notion. Market analysts and economists at some of Wall Street’s biggest, most-influential banks also seem to be coming around to the view that the US and other developed countries may be losing their ability to grow quickly.

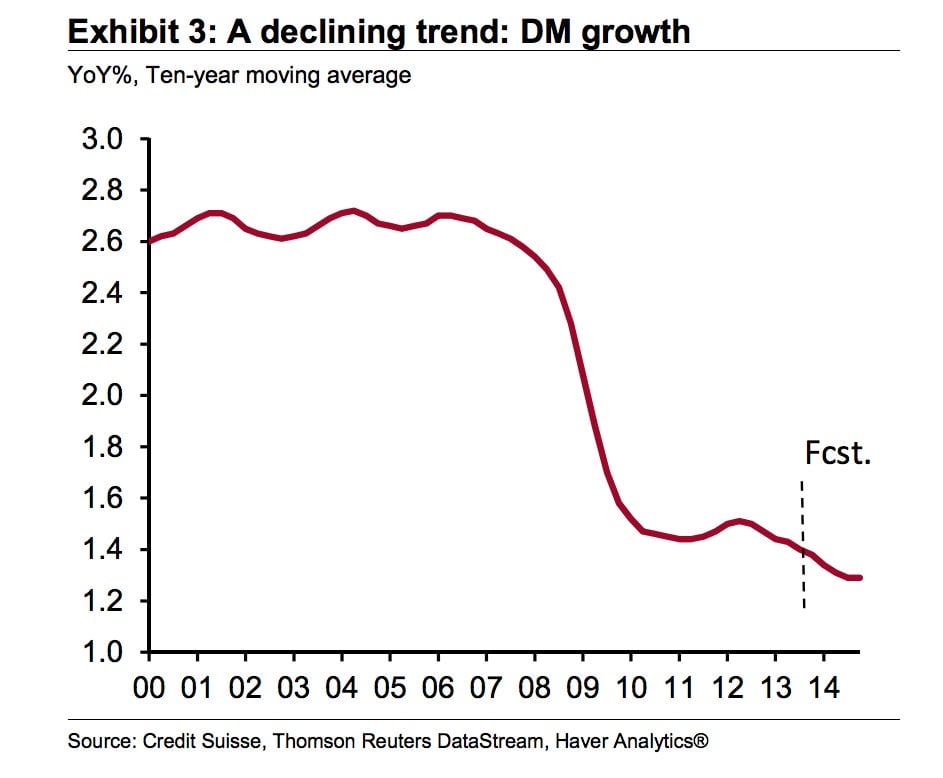

Credit Suisse noted declining growth momentum in a recent report. “Relatively subdued private fixed investment and, in many [developed market] jurisdictions public infrastructure investment, combined with the puzzle of poor labor force participation, and the predictable fact of aging populations come together to put a lid on potential GDP growth,” wrote Credit Suisse economists in a recent research note.

And J.P. Morgan economists estimate that real US potential GDP has fallen to 1.75% a year, down from around 3.5% In the late 1990s. ”If realized this would be the lowest of the post-WWII era,” they wrote.

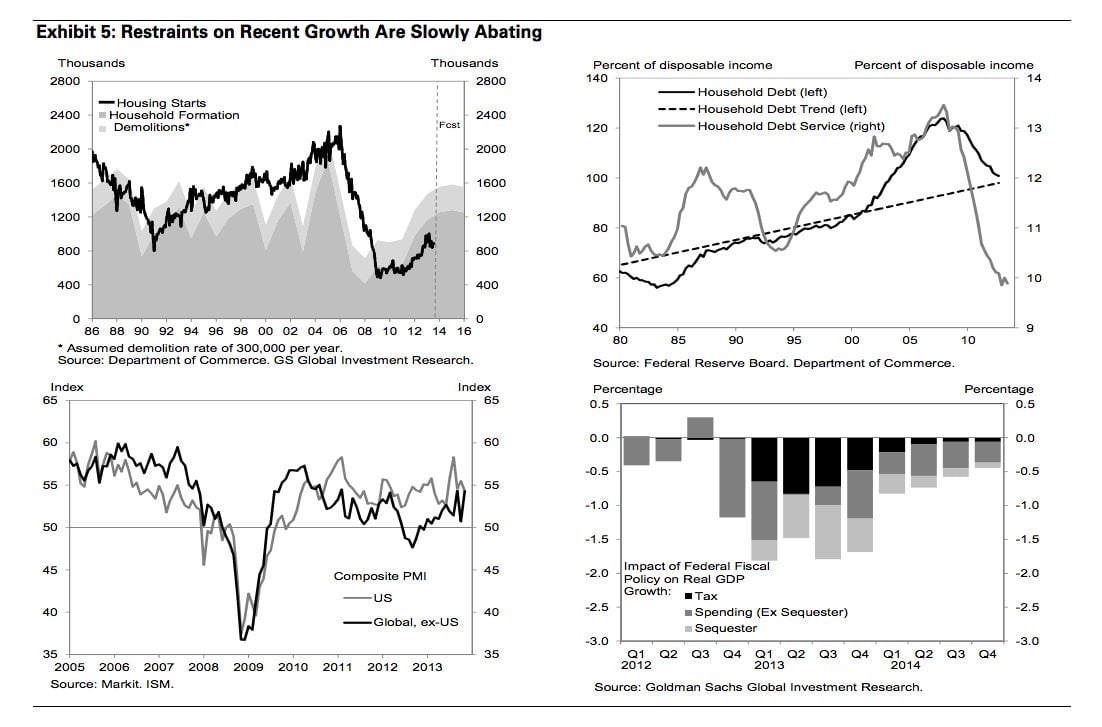

Not everyone is convinced. Goldman Sachs analysts still think the current sluggishness of the US economy has more to do with cyclical problems than deep-seated, demographic-driven economic factors. ”The reasons for the long-lasting weakness resemble those of many other post-crisis episodes. They include excess supply of houses, pressure to deleverage consumer balance sheets, the global nature of the crisis, and the cyclically premature turn to fiscal retrenchment,” Goldman analysts wrote in a research note out earlier this month. Moreover, Goldman analysts see reasons to be hopeful that some of these economic drags are abating.