The tech IPO economy has few winners and lots of losers

We may look back on Lyft’s initial public offering as the end of a beautiful era, a time of plenty. For well-off city-dwellers, anyway.

We may look back on Lyft’s initial public offering as the end of a beautiful era, a time of plenty. For well-off city-dwellers, anyway.

The business model that landed Lyft on the Nasdaq hinges on attracting users at (literally) any cost—a strategy made possible by staggering sums of venture capital investment. Lyft’s not alone, of course. Backed by VC riches, countless consumer-focused digital platforms have made everything from housecleaning to grocery shopping, laundry delivery to watermelon apportionment, available to their affluent target markets at deliciously deep discounts—sort of like food stamps for urban hipsters. Quartz’s Alison Griswold summed up what’s really going on here, observing that the fat years of VC tech spending “have been less an innovation than a giant wealth transfer, from the VCs and startups they funded to the lucky consumers who got a free lunch along the way.”

Okay, but if venture capitalists want to blow their lucre on, say, feeding Manhattanite millennials free cookies, that’s their problem. Who cares?

Well, everyone—or everyone should, at least. Beyond the VC hipster-subsidy complex, the Lyft IPO is a microcosm of a larger problem besetting the US economy. Silicon Valley-style entrepreneurship is supposed to be the engine of American innovation and future prosperity. Instead, the VC industry and the cash-burning, parasitic startups it favors waste not just money but human capital—the resources the rest of America needs to grow.

Rise of the cash-burners

On the face of it, the VC model makes sense. Staffed by executives with expertise in certain industries, VC funds apply their wisdom toward making bets on firms in that field—handing startups the cash needed to bring innovative technologies and business models to the market. It’s fine that most of these companies will fold. Those losses are offset by the massive capital gains achieved by the few successes.

This financing model has been turbo-charged in the post-financial crisis era of surreally cheap money, widening wealth inequality, and the scarcity of high-yielding investment opportunities. The pools of resulting riches have flooded into Silicon Valley VCs, from wealthy individuals, corporations, and institutional investors like pension funds, university endowments, and insurers. Last year, VCs in the US sank more than $132 billion in startups, according to PitchBook—compared with just under $83 billion in 2017. The subset of VC investments in consumer tech startups has followed a similar trend.

That swell of VC capital has buoyed startup valuations, leading to the “unicorn” phenomenon (i.e. firms like Uber and, before it listed, Lyft that are valued at more than $1 billion). In a parallel gush, the easy money created by central banks has also driven up stock prices, making it much easier for VCs to profit lavishly when they cash out of their portfolio companies after an IPO.

An abundance of funding, along with the low entry barriers afforded by the digital platform business model, set off an explosion in the number of startups. These dynamics have shaped the startup business model. Intense competition among startups and the VCs’ need for a single colossal payout has pushed the industry to favor companies with a winner-take-all strategy.

The losers of winner-takes-all

Take all of what, exactly? Market share. Or, more specifically, users.

One way to do this is simply to create a market that didn’t exist before—by selling customers something they want but couldn’t get before, as with Facebook. This approach, while good for the economy, is also really hard to do.

Or maybe the startup in question can “disrupt” a sector because its technological or managerial innovation lets it provide the product or service in question for cheaper. In that case, hooray! That’s adding genuine value to the economy.

However, most well-known consumer-facing startups—for example, Blue Apron, Postmates, or even Lyft—lack such an edge. Instead, the classic “hockey stick” growth path laid out in their decks is based on “network effects.” That’s jargon for a phenomenon whereby the more people use a product, the more value it provides them—even though the extra cost of adding another user to the platform is virtually zilch. Uber has arguably pulled this off. Its platform has amassed so many customers and drivers now that its network might indeed be pricing services more efficiently than the set fee charged by cabs. (Then again, Uber says it lost almost $1.8 billion last year.)

Of course, to get the effects, you need a network. The key is to sell services for cheaper than the market rate—in other words, taking market share from existing businesses.

In this, VC-backed startups have a huge advantage: the ability to accept lower prices because investors kept writing them checks for tens—or hundreds—of millions of dollars at a time, without any expectation of earning a profit. On the contrary, the winner-takes-all stakes means VCs reward companies that spend aggressively to build their user base.

Again, this has been great for the consumers in the target market—mostly well-off urban consumers. But is their business contributing anything to the real economy?

In many cases, no. In the opinion of Martin Kenney and John Zysman—scholars of entrepreneurship at the University of California, Davis and Berkeley, respectively—quite the opposite. “Arguably, these firms are destroying economic value,” they write in a recent essay. “This new dynamic has social consequences, and in particular, a drive toward disruption without social benefit. Indeed, in some cases, they may be destroying social value while also devaluing labor and work in the enterprise.”

Local businesses have to slash prices to compete with cash-glutted startups. Others wind up paying for the profits that are supposed to come from those much-ballyhooed network effects. For example, some restaurants report that food delivery app platforms—notably (the formerly VC-backed, now listed) GrubHub Seamless, followed distantly by Caviar (now owned by former unicorn, Square), Uber Eats, DoorDash, and Amazon—are eroding their profits by charging up to 30% on each order. That eats into income that might fund investment or new hires.

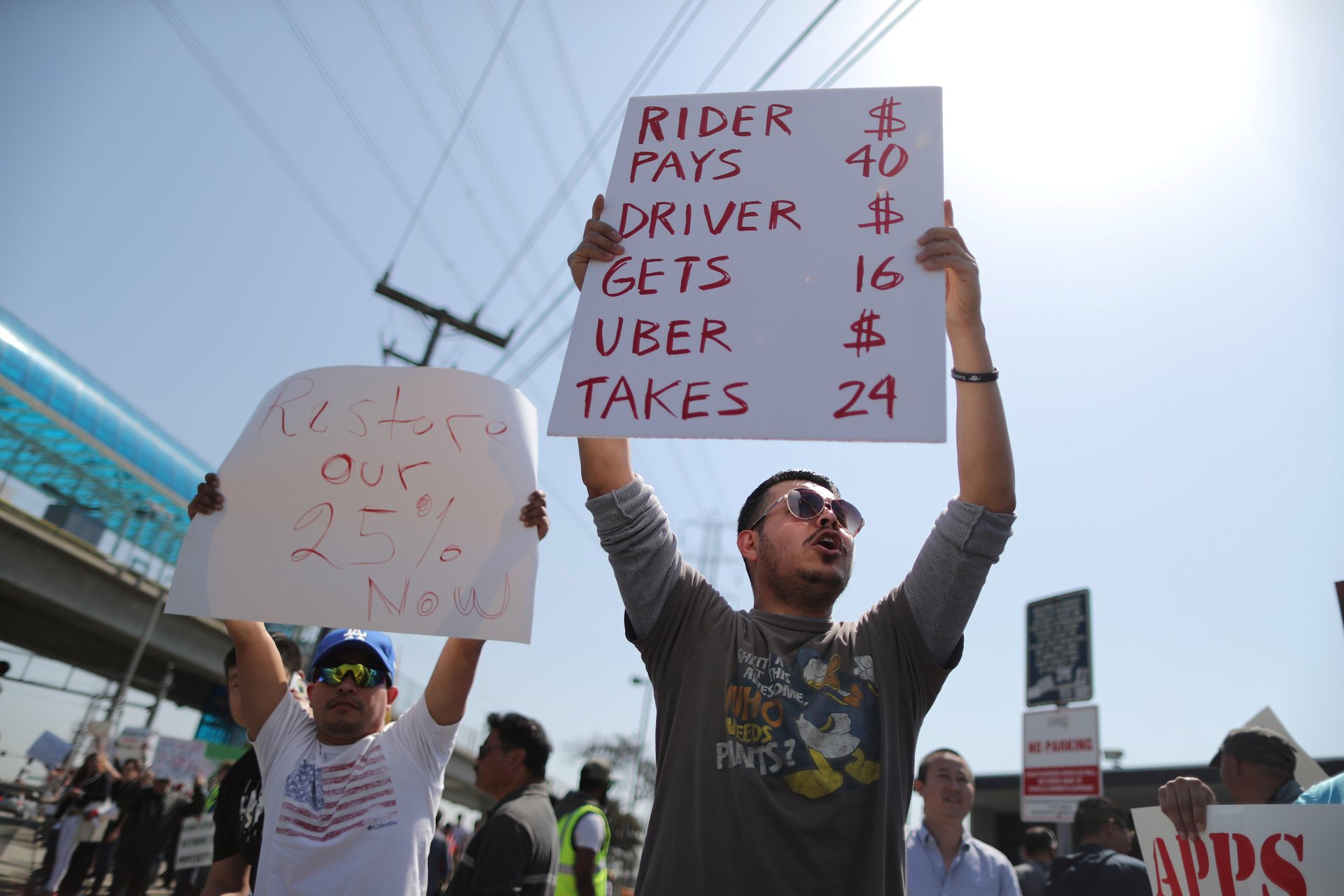

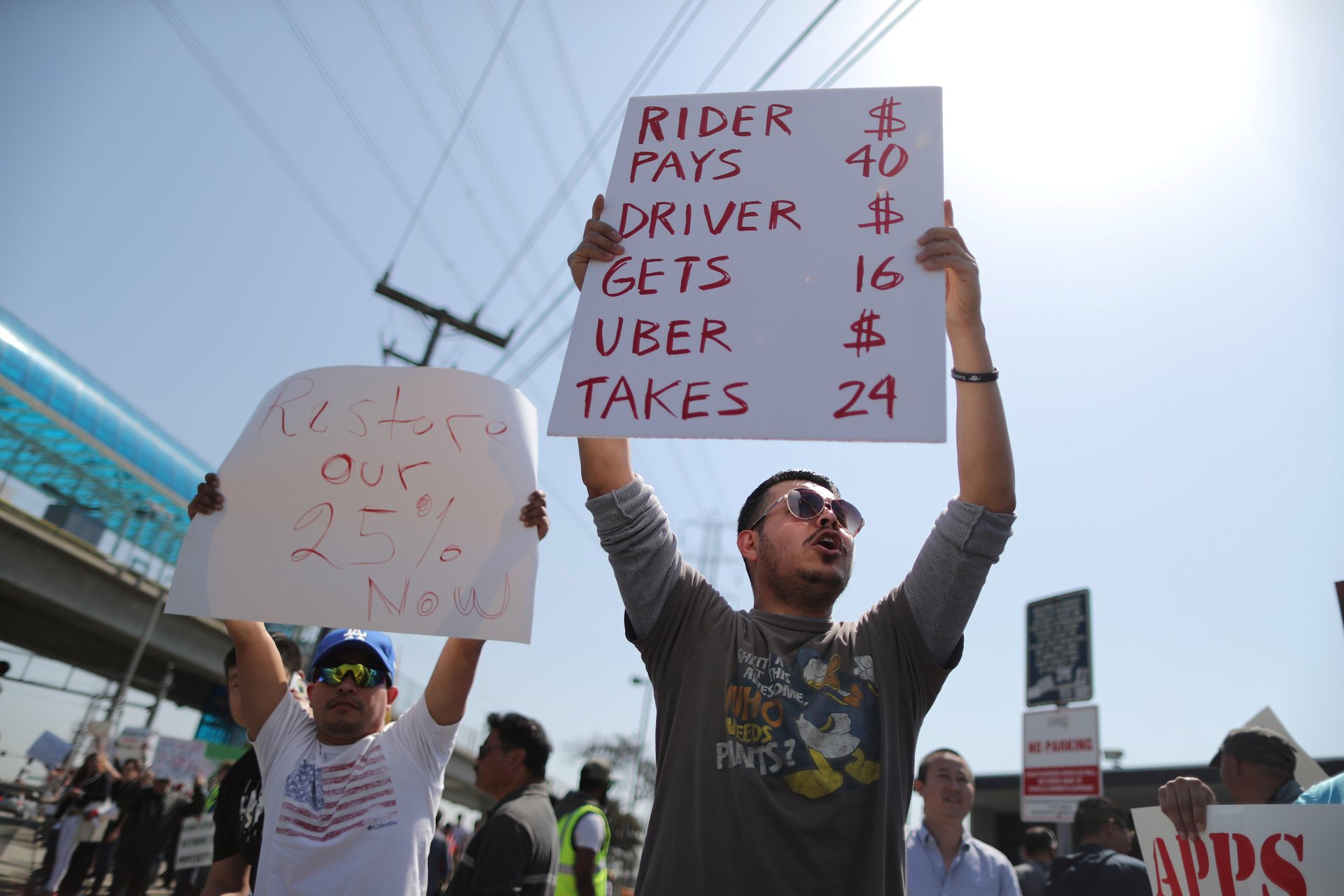

Another source of “cost reductions” is workers’ wages and benefits. Startups like Lyft are notorious for explicitly basing their business on the legal ability to underpay workers by classifying them as workers as “independent contractors.”

That might count as disruption. A more accurate term, though, would be cannibalism: feeding off the income of those without access to cheap money and the bargaining power it buys.

So if most of these startups are parasitic shams, why do we obsess about them? Why do the Valley’s sharpest minds waste so much money investing in them? And why are they able to raise tens of billions of dollars in public listings?

That brings us to another mechanism of wealth transfer: the initial public offering.

Cashing out

A public listing is the classic last chapter of America’s fairy tale of entrepreneurship. For a hot tech company, it’s a milestone—a bar mitzvah, a coming out party, a ritual marking the company’s transformation from scrappy startup to established company.

Aside from capital, VC investors also provide startups with a precious resource: status. When fancy funds invest, they confer their seal of approval on the startup’s business model. This dynamic is often self-reinforcing as investment from one elite VC attracts others, until an IPO is announced and Wall Street alchemists transmute user base into a valuation. The startup’s aura of viability thickens.

But much of the capital raised in an IPO doesn’t go toward expanding the startup’s business in the traditional sense. Rather, by creating a market for the VC’s shares, it allows the fund to cash out, unloading shares of their startup on investors eager to follow the herd.

This shifting of wealth is completed months later, when the now-public company fails to report a profit. Stock prices snap back to reality—sticking the investors who bought into the IPO hype with the losses.

Take, for example, Blue Apron, the meal-kit company that delivers precisely portioned raw ingredients of meals like “Oregon wine country-inspired pork chops and farro with sour cherry pan sauce” for customers to cook on their own. When it listed in June 2017, its impressive market share won it a valuation of $2.1 billion. (Tellingly, its IPO bankers, Goldman Sachs and Morgan Stanley, originally wanted to price the shares even higher, valuing the company at $3.2 billion.)

The market has since rendered a harsher judgment about Blue Apron’s prospects. Its shares have shed more than 90% of their original worth. It’s a realization that would have been much more obvious had the company’s market-share grab not been subsidized by VC money.

Blue Apron’s descent is a brutal reminder that delusions of financial mania eventually end. The sudden scramble of Lyft, Uber, Pinterest and other startups to list may signal fears that a larger reckoning is drawing near—that the era of cheap VC funding is over. The question, then, is, what will the legacy of this speculative craze be?

After the crash

Innovations outlive the financial frenzies that begot them. Ironically, it’s the destruction of wealth that makes this possible: Once the price of technologies falls back to its market value, the next generation of entrepreneurs can put those assets to newly productive uses. For instance, from the titanically wasteful railway boom of the mid-1800s emerged the infrastructure that powered America’s industrialization. Kenney and Zysman cite a more recent example: the hyperactive buildout of fiber optic networks during the dotcom bubble, which created the bandwidth that gave rise to pioneering social media platforms. After the tide of VC money finally recedes, we’ll finally get a glimpse at the true value of what all those billions of dollars accomplished. Surely it will yield more than how to feed, clothe, and transport droves of urban hipsters.