If you were born after 1960, a comfortable retirement will rely on inheritance

For anyone born since 1960, a new report by the Institute for Fiscal Studies (IFS), a think tank, makes for disturbing reading. And although it focuses on the UK, the findings could apply to a range of Western countries, where fears of permanently lower growth and dwindling savings raise concerns for the earning power of younger generations.

For anyone born since 1960, a new report by the Institute for Fiscal Studies (IFS), a think tank, makes for disturbing reading. And although it focuses on the UK, the findings could apply to a range of Western countries, where fears of permanently lower growth and dwindling savings raise concerns for the earning power of younger generations.

By now it’s a commonly held view that economic trends have conspired against twentysomethings, who face a long, hard struggle to amass similar wealth as previous generations. The IFS reckons that those born in the 1960s and 1970s are in a similar boat, they just don’t know it yet:

When compared with those born a decade earlier at the same age, these cohorts have no higher take-home income; have saved no more previous take-home income; are less likely to own a home; are likely to have lower private pension wealth; and will tend to find that their state pensions replace a smaller proportion of prior earnings.

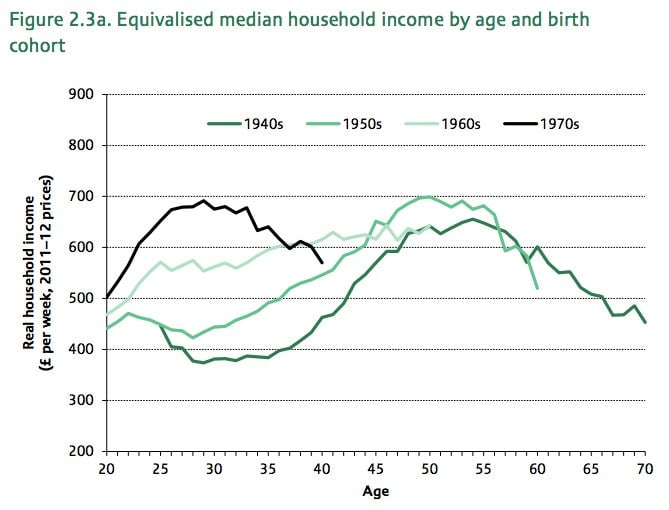

Early in their working lives, people now in their mid-thirties to early fifties tended to have higher inflation-adjusted incomes than earlier generations. But they have also spent more of what they earned, building up less in savings than their older counterparts. A rise in inequality, persistent wage stagnation, and the decline of defined benefit (final salary) pension plans have also chipped away at incomes over the past few decades. As a result, the earnings of every new generation are falling below the previous cohort more quickly than before, as this rather depressing chart shows:

Younger generations are also buying their first house later in life, in part because rising prices make property in Britain’s densely populated southeast increasingly unaffordable. This is another advantage older generations enjoy in terms of generating wealth, thanks to the rising prices that are deterring younger people from buying homes in the first place.

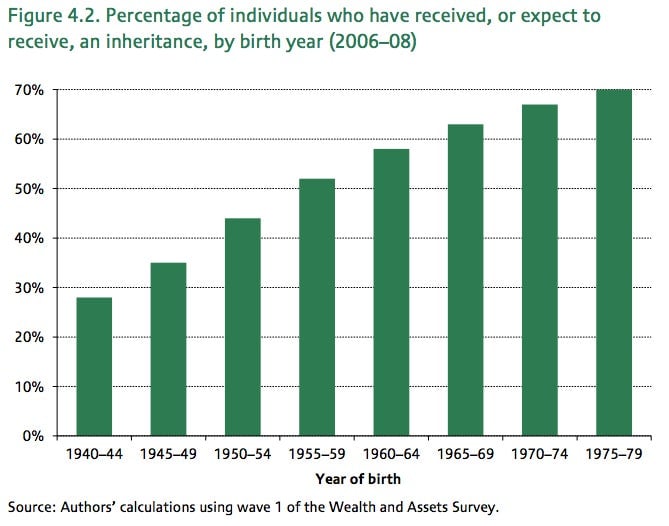

This means that hard-up younger generations will increasingly rely on inheritance from their flush elders to achieve a similar spending power later in life. The parents and grandparents that today’s thirtysomethings hope to tap for financial help are much less likely to have benefited from similar largesse:

A heavier reliance on inheritance will, presumably, make for a more polite atmosphere when extended families get together for the holidays. The macroeconomic implications, in terms of worsening income inequality, are less positive, the IFS notes:

… the prevalence and value of expected future inheritances are distributed unequally, with households that are already relatively wealthy far more likely to benefit. It is important for policymakers to be aware of these signs.