A Silicon Valley fintech is looking to supercharge access to financial data for UK startups

Plaid isn’t just a pattern used by Scottish clans that goes back 3,000 or so years. It’s also the name of a technology company that has been building data links between US banks and financial upstarts since 2012. Now the San Francisco-based company is rolling out its services in the UK, Europe’s hub for fintech startups.

Plaid isn’t just a pattern used by Scottish clans that goes back 3,000 or so years. It’s also the name of a technology company that has been building data links between US banks and financial upstarts since 2012. Now the San Francisco-based company is rolling out its services in the UK, Europe’s hub for fintech startups.

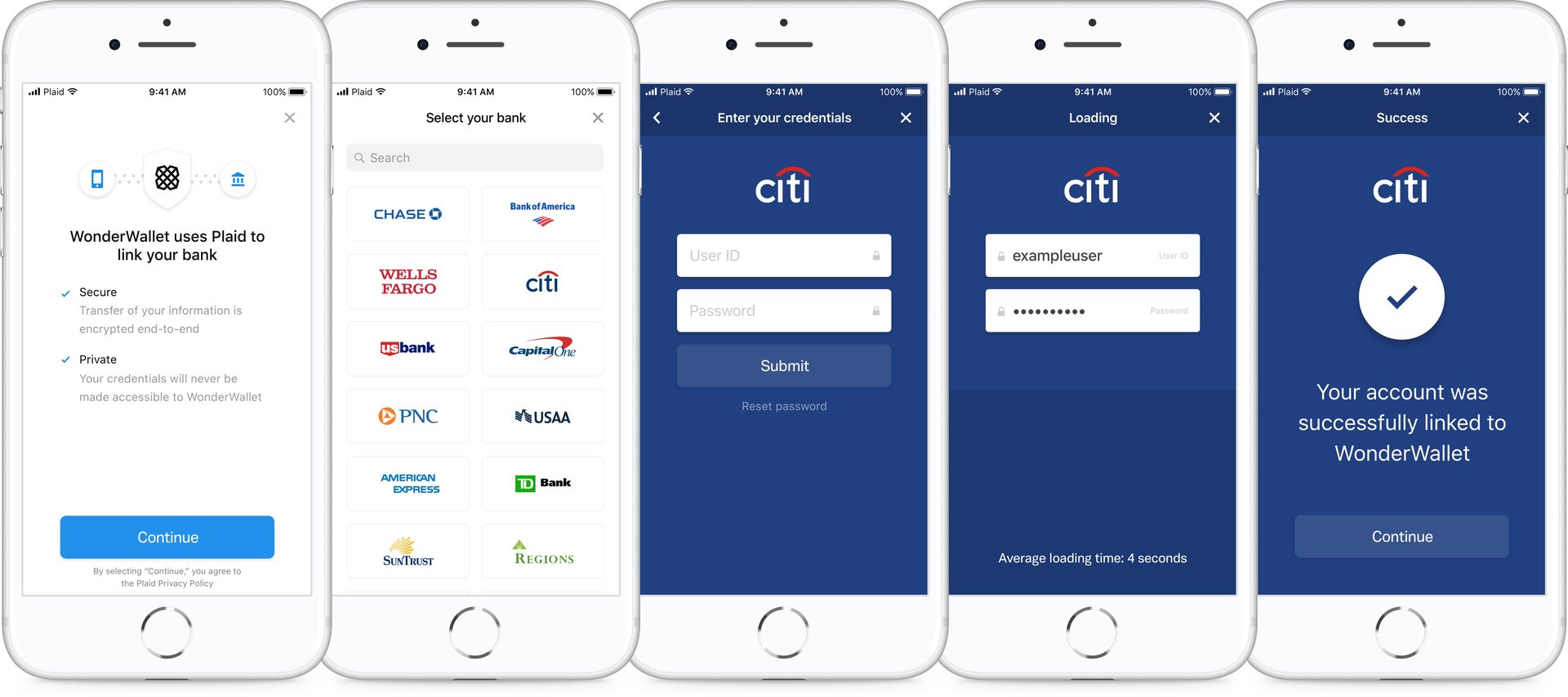

Most consumers don’t realize they’re using Plaid’s technology, which is aimed at software developers. It provides a kind of connective tissue between financial companies, linking firms like PayPal-owned payment service Venmo with consumer bank accounts, and says its software is integrated with more than 15,000 US banks.

Plaid, which is launching in the UK today, is connected to eight of Britain’s largest banks and neobanks—digital-only banks—which it says will give UK fintech businesses instant access to 70% of personal current accounts in the country. Emma, a money-management app, has already plugged into the system, and Plaid says its tech could also help UK firms go international, connecting them with financial firms abroad.

Plaid’s ambition for the UK is another vote of confidence in Britain, a hotbed of financial technology innovation that has nonetheless been buffeted by Brexit. So far, funding for startups in the country has been buoyant despite the uncertainty over its future relationship to the EU, and the UK government estimates that its 1,600 fintech upstarts will more than double by 2030, which could provide a large crop of customers for Plaid. The company has opened an office in the UK and plans to hire more than 25 people locally.

“For fintech in the UK, there’s this incredible boom,” Plaid co-founder Zach Perret said in an interview. “It’s a market we’ve always wanted to be to be in.”

When Plaid launched, American banks were wary about fintech upstarts getting access to their customer data, and using it for things like investing, payment apps, and account aggregation (viewing all their balances from different accounts in one place). JPMorgan CEO Jamie Dimon pushed back (pdf) on this access in 2016, suggesting it put customer data and privacy at risk.

Perret says there has been a “sea change” in the relationship between banks and fintechs since then. He pointed out that JPMorgan has launched Finn, its own neobank, a sign the New York firm is embracing the fintech movement. Plaid has also raised money from top US banks including Goldman Sachs, Citigroup, and American Express, according to PitchBook data, suggesting not only a truce, but also a bet that the company is on to something.

In theory, it should be easier for financial companies to connect to each other in the UK, where open banking regulations were implemented last year. The regulations encourage banks, with the consumer’s consent, to share financial data like spending histories with third-party companies, and is designed to make those connections (by means of application programming interface, or APIs) more straightforward. If successful, one upshot of open banking is that it should streamline data sharing between companies in Britain, meaning there’s less need for services provided by companies like Plaid.

The reality is that open banking has been slower to become widespread than some hoped, amid reports that not every bank has quickly embraced the regulations. Perret said access to data isn’t Plaid’s sole aim, and that it is also focused on analytics and insights. The former Bain consultant said European banks have been cautiously receptive to its business, which “you would hope and expect.”