The biggest mortgage lender in the US sees something remarkable: Actual homebuyers

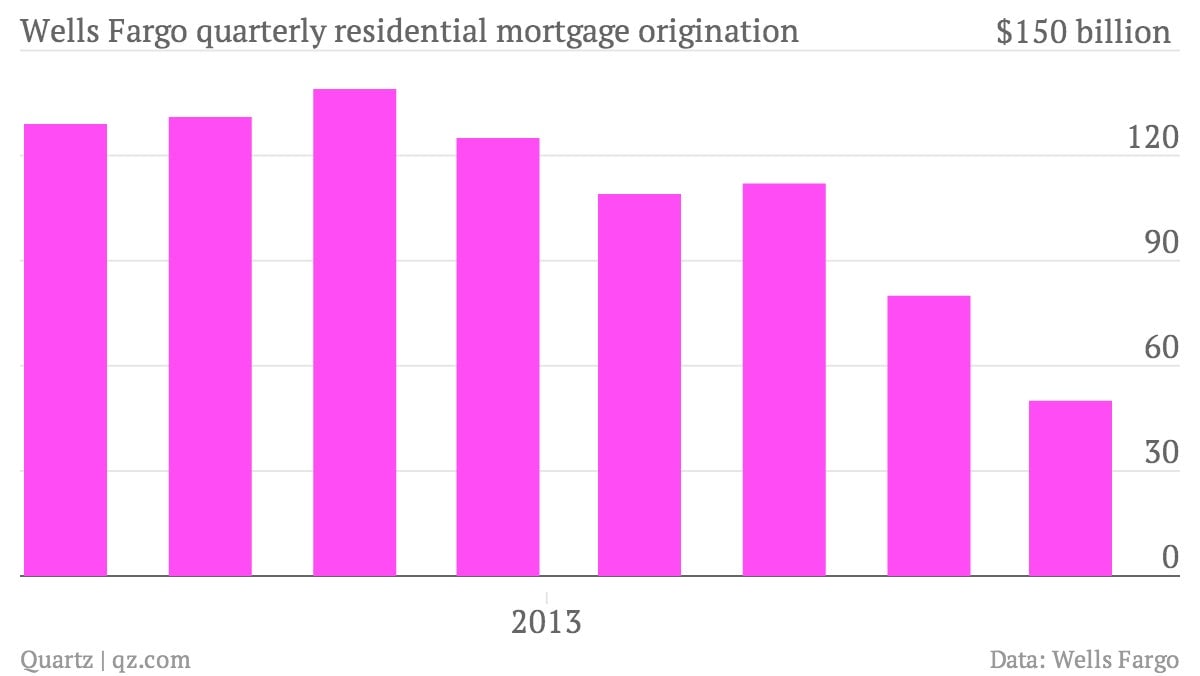

The numbers: Not so hot. Wells Fargo’s residential mortgage originations (i.e., mortgages on new homes and refinancing of existing ones) tumbled 60% compared to the fourth quarter of 2012. But even so, the bank’s net income rose 19% to $2.37 billion.

The numbers: Not so hot. Wells Fargo’s residential mortgage originations (i.e., mortgages on new homes and refinancing of existing ones) tumbled 60% compared to the fourth quarter of 2012. But even so, the bank’s net income rose 19% to $2.37 billion.

The takeaway: As the biggest US mortgage lender, Wells is a barometer of the health of the mortgage market as a whole. A rise in mortgage rates that started in May 2013—when the Federal Reserve first raised the prospect of cutting back on its monthly bond-buying program—choked off a refinancing boom that Wells had ridden for a streak of 15 straight profitable quarters. Since then, mortgage originations have slipped sharply, though the bank has managed to stay in the black.

What’s interesting: Wells doesn’t expect another refinancing boom any time soon. It is, however, expecting something the US mortgage market hasn’t seen nearly enough of in recent years: homebuyers. While Wells’ overall mortgage applications were down 60% in the fourth quarter, compared to the prior year, the decline has been concentrated in refinancing applications. Applications from potential homebuyers looking to purchase houses are up 35%. In fact, 68% of all applications were for purchases, rather than refinancing; in the fourth quarter of 2012 it was only 35%. “I think we’re getting into a more normalized mortgage market where you’re going to see a higher percentage of purchase[s],” Wells Fargo CEO John Stumpf told an assemblage of banking analysts back in December. When the largest mortgage lender in the US says something like that, it’s worth listening.