Online karaoke isn’t driving growth like it used to for Tencent Music

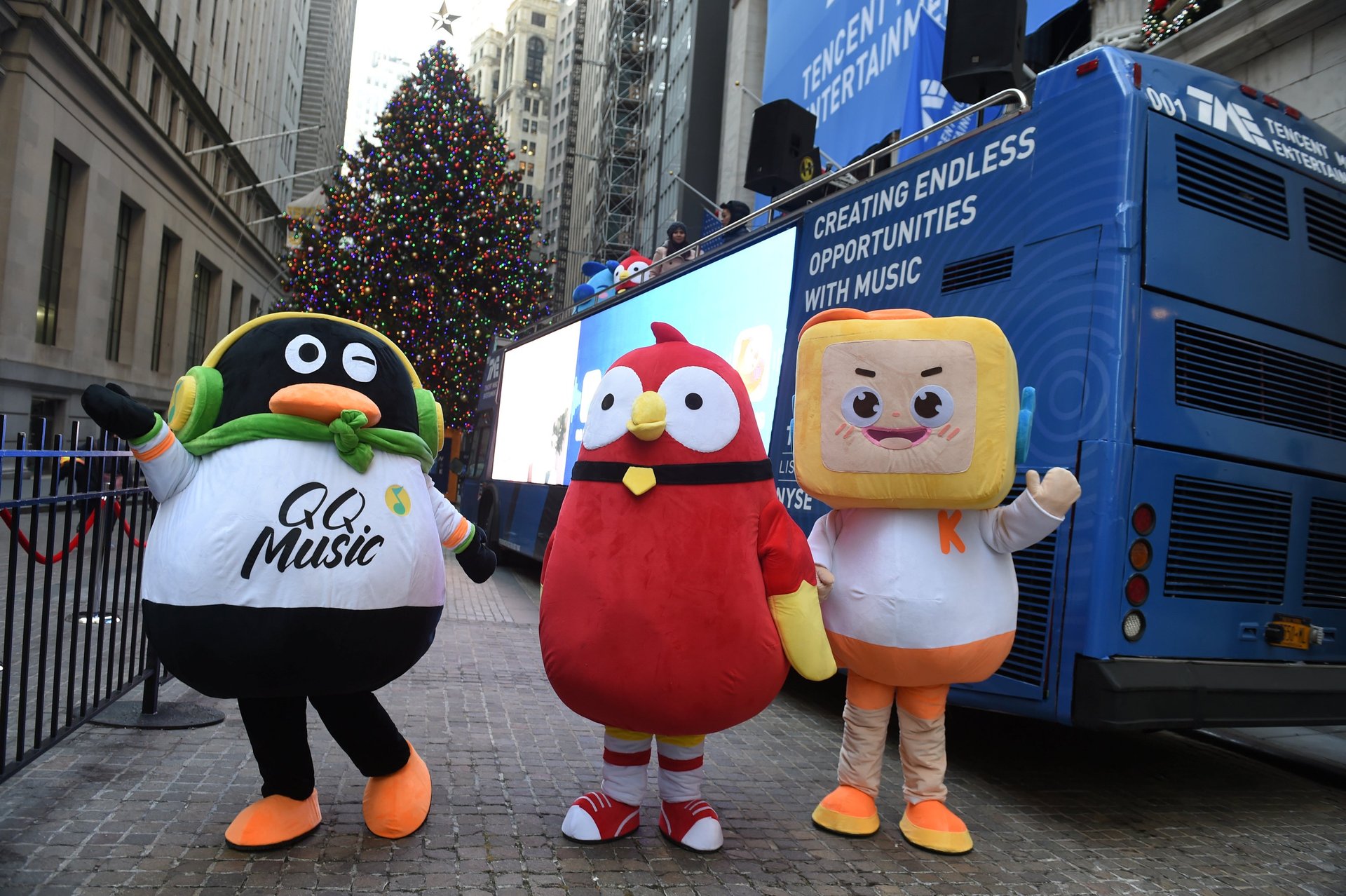

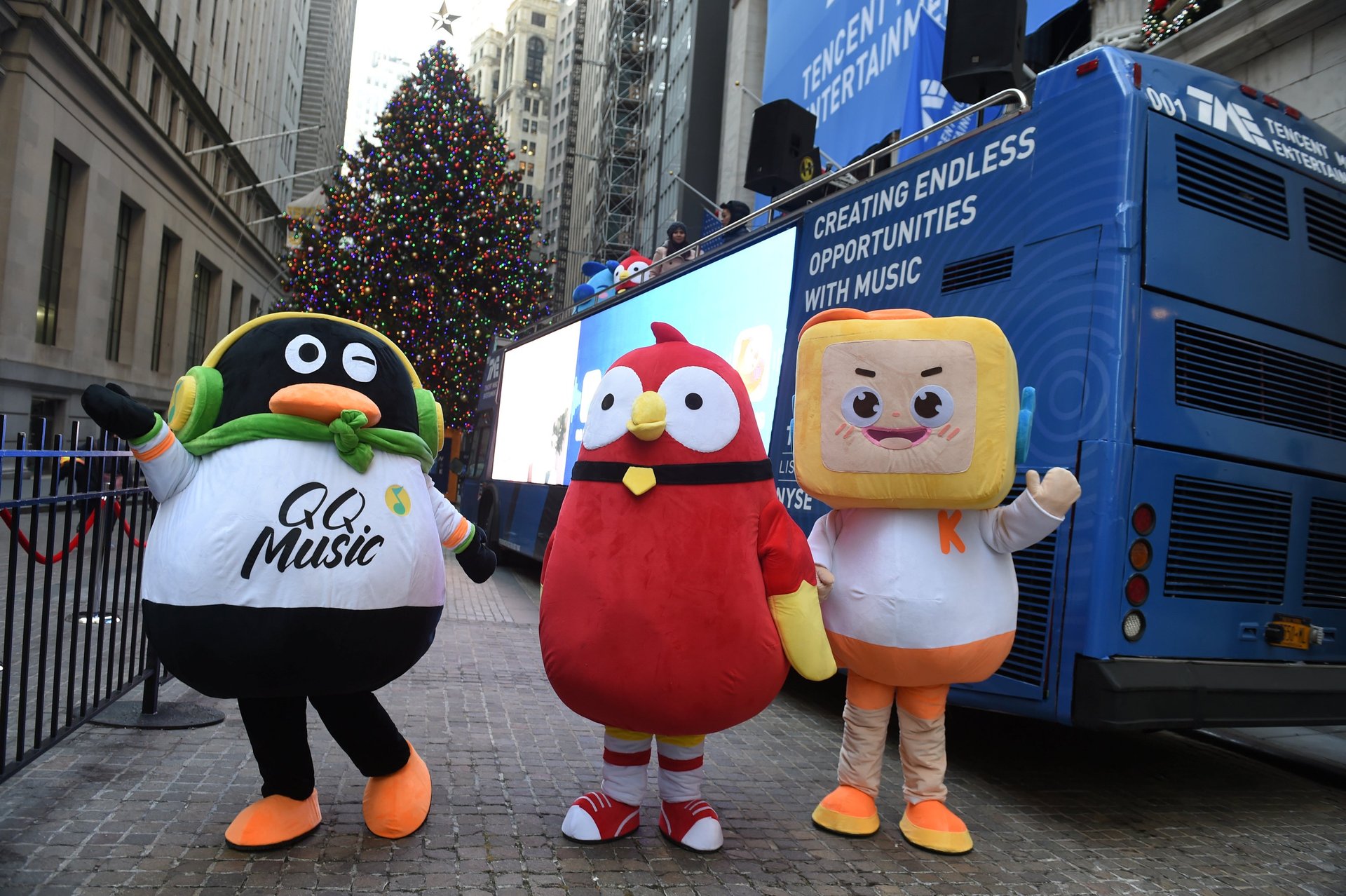

Tencent Music Entertainment Group announced the addition of 2.6 million paid music users in its latest earnings report yesterday. The company, spun off by Chinese internet giant Tencent in December, owns four of China’s biggest music applications, including WeSing, a social karaoke app, and streaming services QQ Music, Kugou Music, and Kuwo Music. Altogether, the company counts around 900 million monthly active users of its services, the vast majority on free, ad-supported tiers.

Tencent Music Entertainment Group announced the addition of 2.6 million paid music users in its latest earnings report yesterday. The company, spun off by Chinese internet giant Tencent in December, owns four of China’s biggest music applications, including WeSing, a social karaoke app, and streaming services QQ Music, Kugou Music, and Kuwo Music. Altogether, the company counts around 900 million monthly active users of its services, the vast majority on free, ad-supported tiers.

Despite growing to 31 million paid music users in the second quarter, a 33% gain versus the prior year, Tencent Music’s New York-listed shares dipped 7% in after-hours trading as quarterly revenue narrowly missed analysts’ expectations. Even after the decline, shares traded at $13.50, above the company’s IPO price of $13 per share.

Although the company’s paid music users have grown steadily, its more profitable social entertainment business—livestreaming on KuGou and Kuwo and online karaoke on WeSing—hasn’t been as robust of late. Over the past year, Tencent Music added just 1.6 million paid users for social entertainment, giving it a total of 11.1 million paid users at the end of the second quarter.

Between the first and second quarter of this year, the company added just 300,000 paid users to its social entertainment business. More importantly, monthly average revenue per paying user for social entertainment came out to 130.20 yuan ($18.42), a small improvement over the 127.50 yuan reported in the first quarter. In the past, quarterly gains in revenue per user were much stronger. (Streaming music was worth only 8.60 yuan per paid user per month in the second quarter.)

Looking ahead, Tony Yip, Tencent’s chief strategy officer, said the company was forging partnerships with “leading manufacturers of cars, smart speakers, and smart watches,” building the company’s services into more devices. Tencent Music recently introduced WeSing Lite, a simplified version of its karaoke app, meant to “attract users in China’s lower tier cities” who have phones with less capacity and slower processing speeds, Yip explained on the company’s earnings call.

The company is also pushing to expand WeSing in Southeast Asia. WeSing’s rollout has been especially successful in the Philippines, where it has been the most downloaded music-related app on Google Play for the past three months.

Tencent Music’s challenge is to convince more users to move into its paid tiers—it controlled approximately 75% of China’s streaming music market at the time of its IPO. Its parent company is reportedly in talks to take a 10% stake in Universal Music Group (paywall). UMG, owned by French media giant Vivendi, has a star-studded roster of musicians including Billie Eilish, Taylor Swift, and Kendrick Lamar in its stable. A deal could give Tencent Music greater say over licensing agreements in Asia and listeners more reasons to stick with its services.