New York is officially affordable (compared to London)

Really London, it’s getting to be a bit much.

Really London, it’s getting to be a bit much.

Real estate prices in the British capital are decoupling radically from income levels in the city, according to analysts from Fitch Ratings. So is this a bubble that’s getting ready to burst?

Not any time soon, Fitch analysts say.

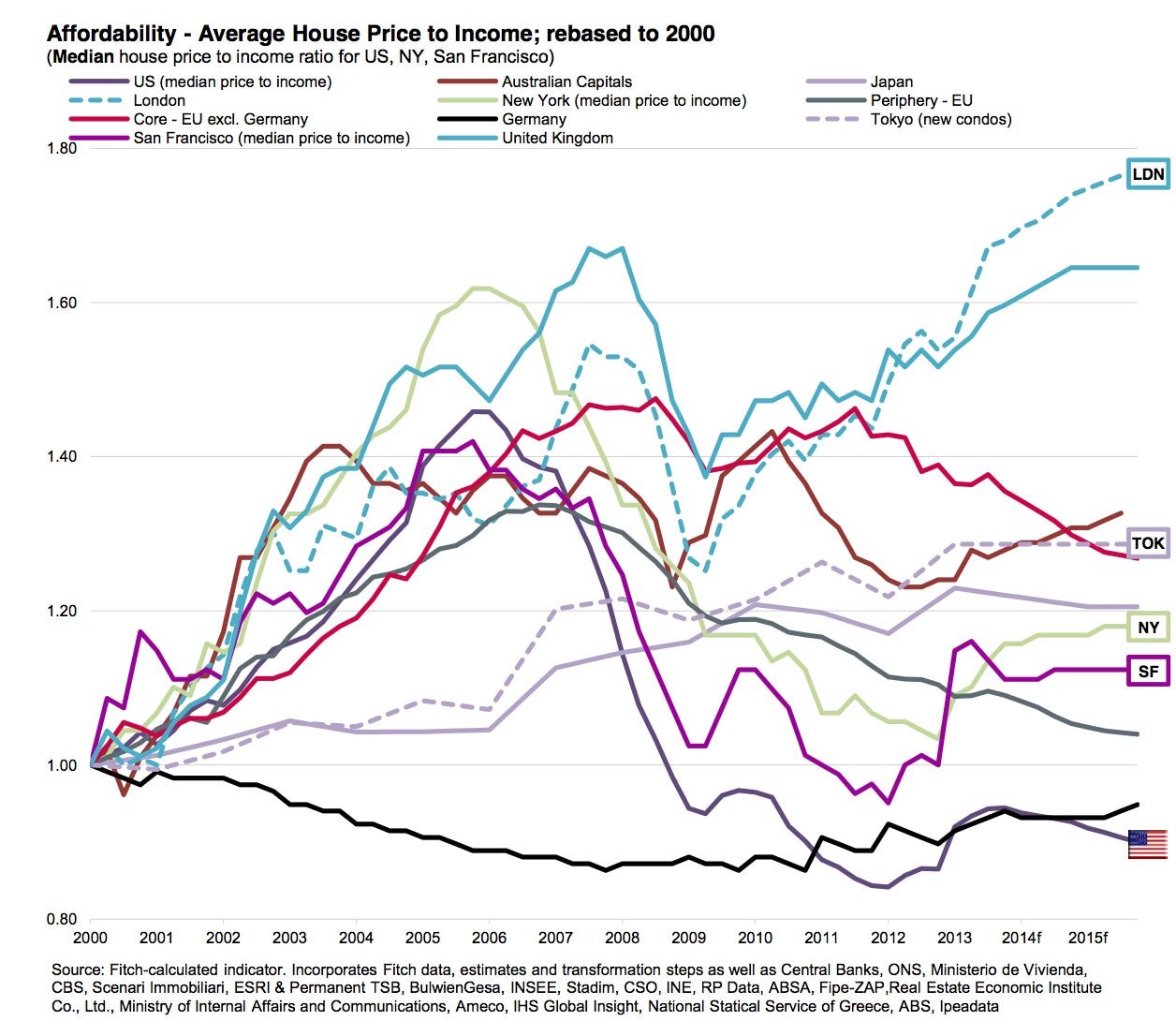

Both London and the UK are above their own averages for the last 16 years (see the “Affordability” chart [above]). Fitch believes the disconnect from incomes in London will further widen over the next two years due to reinvigorated consumer confidence, mortgage availability, high-LTV lending, and continuing demand from foreign cash buyers.

For our money, we’d weight the the foreign cash coming from all over the world as the most important support for London’s real estate market. But it’s worth noting that there has been a bit of an uptick in British mortgage lending lately as well.

At any rate, the surge in London property prices is bad news for London’s working stiffs, at least those who can’t turn to their oligarch parents for a down payment on an apartment. On the other hand it might be good news for global rivals such as New York, which looks downright affordable compared to cities like London. (Better transit system too!)