How do you predict the next financial crisis?

A pair of business professors have devised an ingenious method for measuring the probability of a financial crisis by examining an entire economy as if it were a failing bank.

A pair of business professors have devised an ingenious method for measuring the probability of a financial crisis by examining an entire economy as if it were a failing bank.

Their analysis relies on SRISK (pdf) an analytical tool designed to evaluate the soundness of financial institutions during a prolonged market downturn. By aggregating SRISK across a country’s economy, Robert Engle, a Nobel Prize winner at NYU, and Tianyue Ruan of National University of Singapore, believe they can estimate the relationship between projected capital shortfalls and the likelihood of a financial crisis. Their work shines a spotlight on the interconnected nature of the economy, reminding investors that potential danger is rarely isolated in a single country. Indeed, the risk of a domestic financial crisis depends, in large part, on the financial position of the rest of the world.

“Our approach is motivated by the observation that excessive credit growth, a main cause of financial crises, is reflected in the undercapitalization of the financial sector,” the professors wrote in their study (pdf), published yesterday (Aug. 27) in Proceedings of the National Academy of Sciences (PNAS). “Market-based indicators of systemic risk enable monitoring how such weakness emerges and progresses in real time.”

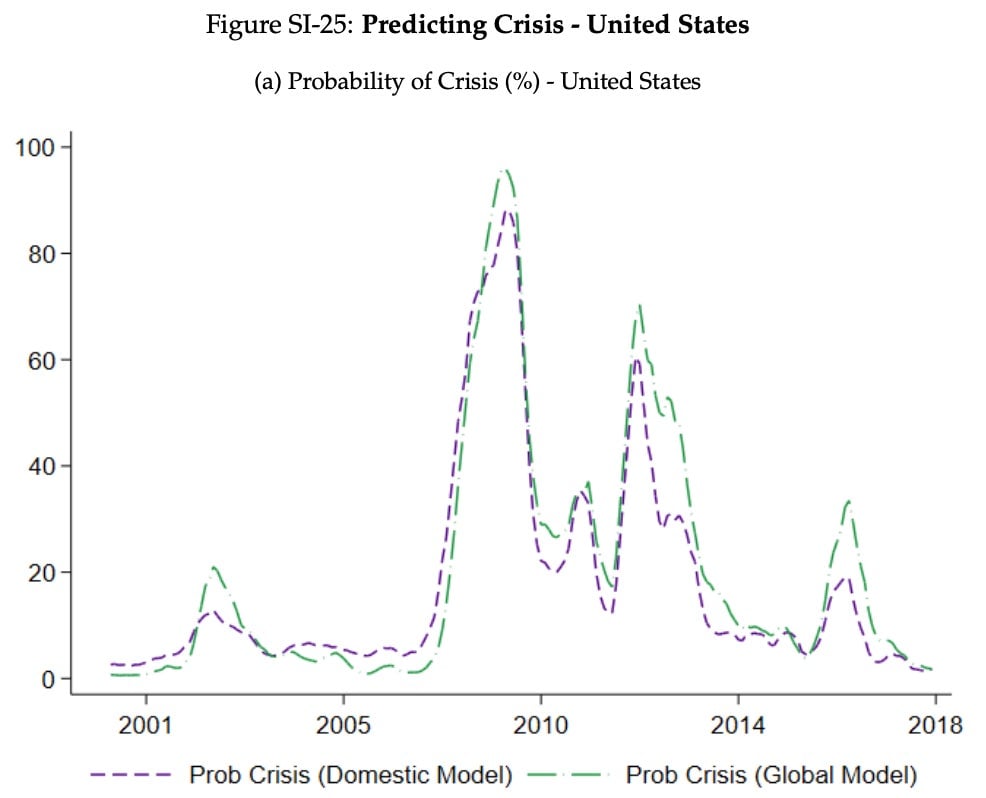

In other words, by examining a combination of stock market data and accounting liabilities (especially at financial services companies), it’s possible to assess the chances of a crisis. The professors also found the probability of a crisis was typically higher in global models than single-country models, illustrating the interdependency of national economies.

Although the probability of a US crisis appears low, that could change in a hurry, as evidenced by past experience. During a CFA Institute conference in November, Engle emphasized the importance of global collaboration to track and regulate risk. While he didn’t sound too agitated about the prospects of another global crisis, Engle cautioned, “I think we’ve some things to worry about. I’ll leave you with that.”

Supplementary information on the professors’ methodology and country-by-country results are available here.