Nestle’s sales: Is this coffee cup half empty or half full?

Nestle’s sales beat or missed expectations this quarter depending on what you measure and who you read.

Nestle’s sales beat or missed expectations this quarter depending on what you measure and who you read.

Bloomberg reported disappointing nine-month numbers with slowing organic sales (growth generated from internal resources rather than through acquisition or currency effects) as demand fell in emerging markets. Revenue increased 6.1%, missing the 6.3% growth expected by 12 analysts Bloomberg surveyed.

Andrew Wood, an analyst at Sanford C. Bernstein said:

We expected a slowdown in growth, but we did not expect things to slow so much.

MarketWatch took a more positive view, reporting that Nestle’s nine-month total sales (those including everything) were better than expected, increasing 11% to CHF 67.6 billion ($73.2 billion). The explanation: “Strong growth in emerging markets offset a slowdown in Europe, where consumer confidence has been hit by the continuing debt crisis.”

Quoting chief executive Paul Bulcke from his statement:

We grew in the intensely competitive developed markets in spite of a general economic malaise and low levels of consumer confidence.

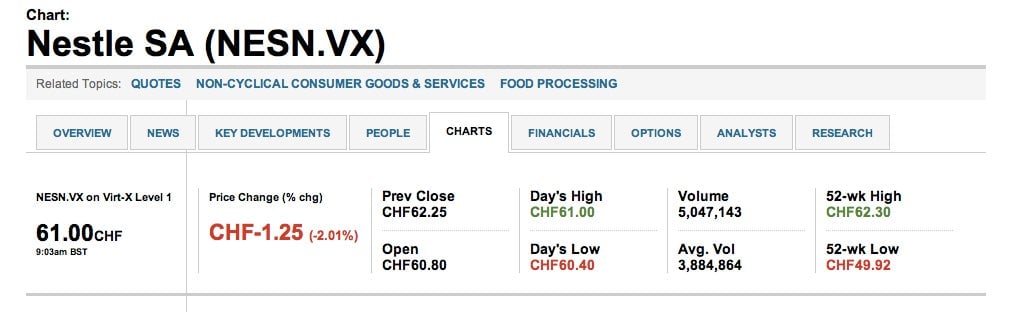

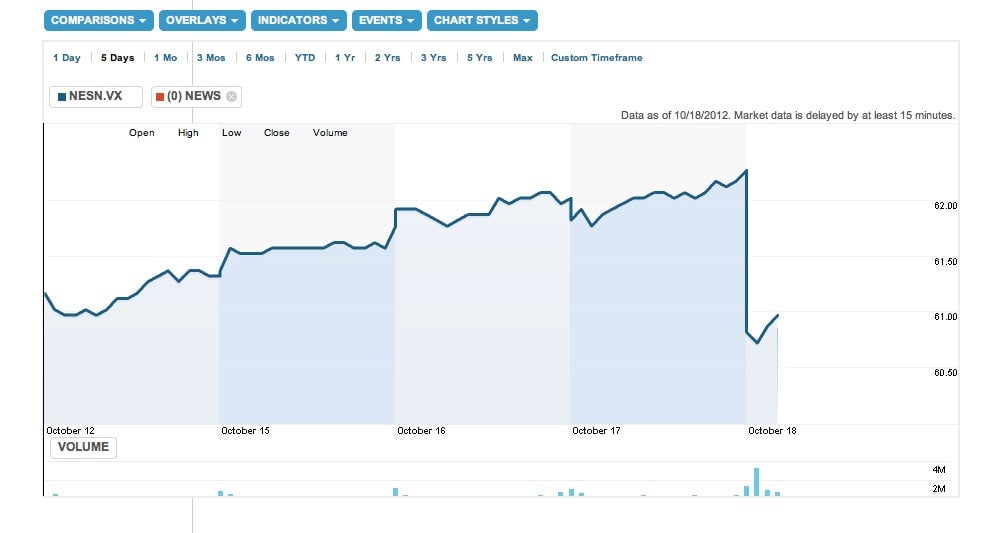

Let’s see how the market read the numbers: