Small-business owners have no fear of a US recession, according to one online lender

Is the US economy headed for a downturn? Investor confidence has taken a hit, as the trade war between the US and China causes global markets to gyrate. Earlier this summer the Federal Reserve took steps to goose economic growth amid worries that the expansion was cooling.

Is the US economy headed for a downturn? Investor confidence has taken a hit, as the trade war between the US and China causes global markets to gyrate. Earlier this summer the Federal Reserve took steps to goose economic growth amid worries that the expansion was cooling.

But not everyone is losing their nerve. Rob Frohwein, co-founder and CEO of small-business lending platform Kabbage, says his company’s customers are optimistic. The Atlanta-based company originated $670 million in loans during the second quarter, a 45% jump from a year earlier.

“Our customers, they’re seeing a real surge in their business, they’re seeing things go well, and they’re investing in the future,” Frohwein said in a phone interview. All Kabbage loans are for less than $250,000, and the company has originated almost $3 billion in borrowing this year. Most US companies are small—around 98% have fewer than 100 employees—and they are an important engine for employment.

When it comes to understanding the health of the US economy, Kabbage’s user-base lending is far from definitive. But data from online lenders adds to a broad, and conflicting, tableau of information about activity and growth: Some investors worry that the inversion of the yield curve, in which short-term interest rates are higher than medium term rates, is a sign that a recession could emerge. Yet the unemployment rate held near a 50-year low and retail sales jumped last month.

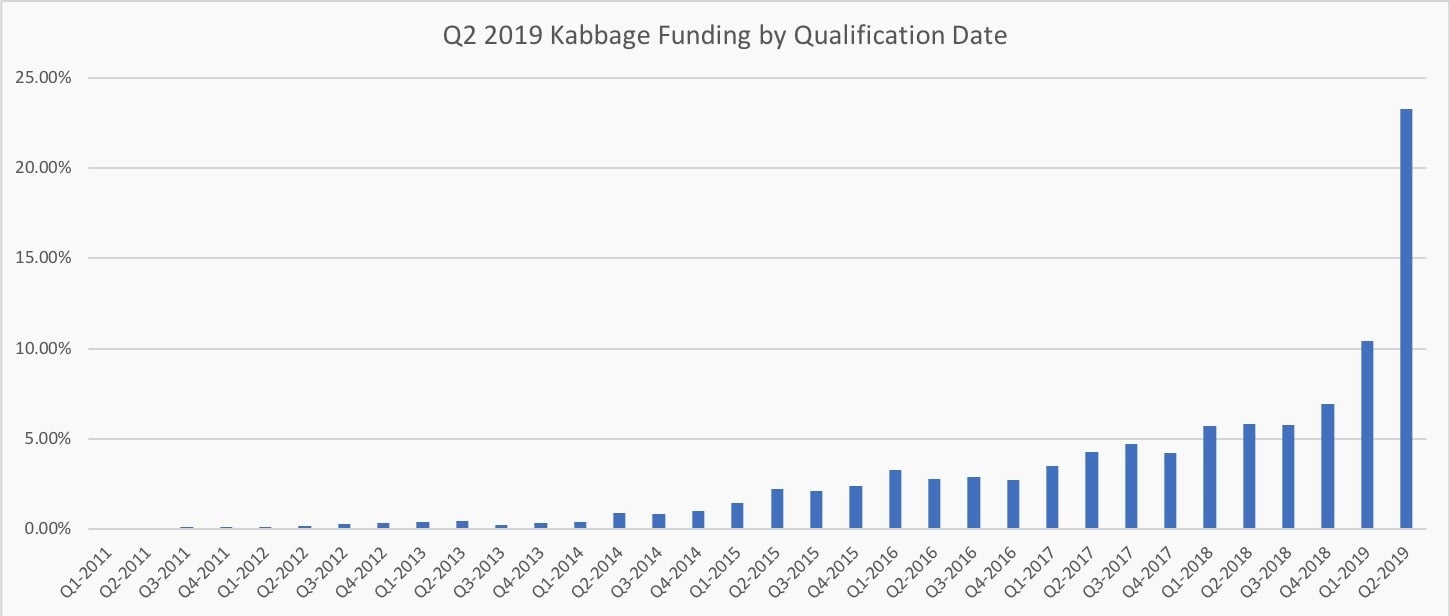

Frohwein says Kabbage’s borrowers reflect small-business America, and represent a cross-section of the country’s industries and geographies. He says 40% of the company’s loan origination in the second quarter came from customers who joined the platform between between 2011 and 2017. At the same time, Frohwein says Kabbage is attracting more new customers than ever.

“We are seeing strong performance growth in borrowing and being paid back,” he said.

Frohwein says the firm hasn’t changed its lending criteria, and attributed the growth to repeat business and more customer familiarity with the brand. The company is a platform and doesn’t make the loans, which are issued by Celtic Bank, a Utah-chartered industrial bank. Kabbage collects financial data by connecting to customers’ business accounts.

Small business financing deserts

As important as small businesses are to the economy, financing for little enterprises didn’t rebound after the financial crisis like it did for bigger companies. Federal Reserve data in 2015 signaled that the smaller the company, the more likely it was to face a financing shortfall.

Online lenders say their automated systems are an answer. One of them is Square Capital, part of Jack Dorsey’s payment company Square, which said (pdf) it facilitated $390 million of borrowing during the second quarter, a 22% increase. Last week Stripe, a Silicon Valley payment company valued at more than $20 billion, said it is also getting into the lending business.

Small business owners traditionally went to their local bank branch for loans. But those branches are gradually closing, especially in rural areas, as people go online for the banking. As banking deserts spread, digital lenders say they can be an answer. The lending process is quick and borrowers have their money almost immediately. Some research suggests algorithms may be less biased against borrowers than a human credit officer.

At a conference in May, PayPal CEO Daniel Schulman said a quarter of its loans have gone to US counties where 10 or more bank branches have closed. “Typically, those neighborhoods have median incomes below the national average. It’s disproportionately minority-owned businesses, women-owned businesses,” he said. “And when we lend to those businesses, on average, their sales go up 22% versus control group that was up 1% to 2%.”

Small businesses are increasingly seeking out online lenders, according to a Federal Reserve survey (pdf). It showed that digital lenders received 32% of business loan applications last year, compared with 19% in 2016. Banks accounted for about half of lending requests during that period, though their share declined a few percentage points during that span.

The survey indicates that online lenders were preferred because they were faster, more likely to provide approval, and didn’t require collateral. While borrowers indicated some dissatisfaction with the wait times at banks, they were also dissatisfied with the high interest rates some digital lenders charge.

Kabbage’s website says the company’s loans charge monthly fees that range from 1.5% to 10%. A business owner told that Wall Street Journal (paywall) earlier this year that he got a short-term loan from the company at a 25% interest rate. Kabbage says its loans are easy to understand, and it offers a tool to help borrowers compare options. It helps them review the annual percentage rate of a loan as well as the total cost of capital.

Out-banking the banks

Online lenders have had some bumps along the way. LendingClub was founded in 2006 and is expected to post a loss this year, though it says it may be less in the red than previously anticipated. Its stock price has fallen more than 80% since going public in December 2014.

Established banks are still stiff competition. They have low cost funding from deposits, already have a deep customer base, and have sizable technology budgets. Digital lenders LendingClub and OnDeck were spending around $2,500 to $3,500 per loan to acquire new customers in 2015, according to data in Fintech, Small Business, & the American Dream by Karen Mills, a senior fellow at Harvard Business School. By comparison, a regional lender in New England in 2017 was spending an average of $500 for small business loans under $100,000. Kabbage says it is profitable in terms of adjusted earnings before interest, taxes, depreciation, and amortization.

The digital lenders have shown that borrowing can be handled much more quickly online when companies use the right technology. A key question is how smart their lending decisions will look when the economy eventually does go into reverse. But for now, Kabbage’s customers suggest that a downturn may not happen as soon as some had feared.