The “peak travel” theory of US auto usage is hitting a few bumps in the road

A popular new narrative has it that a pillar of the American rite-of-passage—the urge to drive—is passé. According to the theory of “peak travel,” teens of legal driving age are no longer rushing to obtain licenses. Unlike prior generations, they’re not hurrying to buy an automobile. And when they finally do make the big purchase, they are driving much less.

A popular new narrative has it that a pillar of the American rite-of-passage—the urge to drive—is passé. According to the theory of “peak travel,” teens of legal driving age are no longer rushing to obtain licenses. Unlike prior generations, they’re not hurrying to buy an automobile. And when they finally do make the big purchase, they are driving much less.

But new data points are confounding some of peak travel’s precepts: Even if Americans do motor later and less, the significance may be smaller than initially thought. Among other things, peak travel may not mean a permanent and continuing decline in US carbon emissions and oil demand.

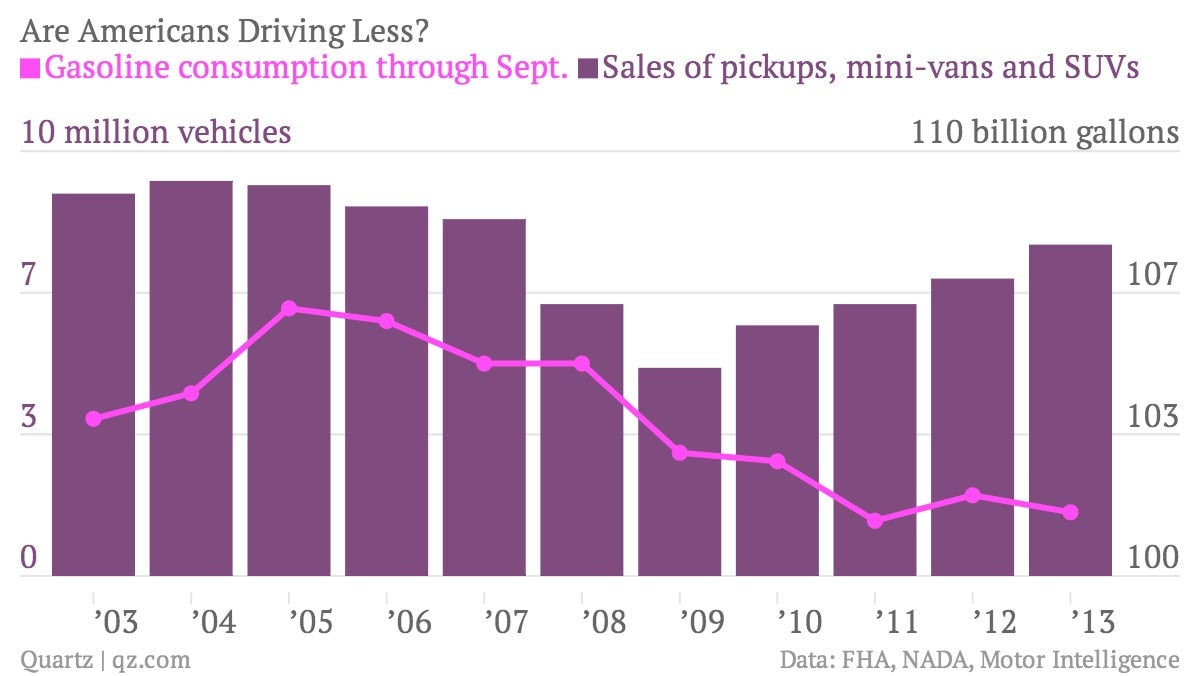

The trends involved are new, and the data constantly shifting. The US, for example, is experiencing two unexpected upticks in the purchase of new pickups and SUVs and, to a lesser degree, gasoline consumption:

How can we reconcile these trends with peak travel? Are older motorists in SUVS skewing the entire US oil consumption curve? Or maybe American youths have abandoned their iPhones for Ford-150s? Unfortunately it’s difficult to piece together a coherent story based on existing data.

Until we know more, peak travel is the best demand theory we have

The main reason it’s hard to say anything definitive at the moment is that key relevant data on youth driving habits is current only through 2011, while the data undermining peak travel—oil consumption and vehicle purchase statistics—are more up-to-date. That is, we know that Americans are burning a lot more fuel than they were in 2011, but cannot say why, nor whether they will continue doing so.

But the demographic and economic shakeup identified by peak travel scholars is probably the most compelling narrative out there to explain fuel demand trends. It is broad, encompassing not just America but much of the developed world. In addition to the demographics noted above, they say that Americans and Europeans are more rapidly urbanizing, vehicles are becoming more efficient, and consumer tastes are slowly turning to hybrid and electric cars.

The University of Michigan’s Transportation Research Institute, a locus of peak travel study, has pinpointed 2004 as a peak in US driving per household, person and vehicle, plus in the total amount of fuel consumed by passenger vehicles. The institute reports a 5% decline in absolute miles driven in the US from 2006 through 2011, and that the consumption of fuel dropped by 11% from 2004-2011.

Peak travel data has also been studied at Citi, which in a March 2012 report highlighted a 2-million-barrel-a-day drop in US crude oil demand since 2005, a 16-year low. The plunge, Citi said, was “in part due to the recession but also due to a structural change due to demographic changes, policies on fuel efficiencies and the mass-commercialization of technologies.”

Reinforcing these conclusions, data from the US Energy Information Administration (EIA) showed a decline in gasoline consumption starting in 2007, before the financial crash. From 106.3 billion gallons in 2006, the volume dropped to 101.3 billion gallons by 2011. The EIA said the drop in oil and gasoline consumption had the corresponding impact of pushing down US carbon emissions to mid-1990s levels.

But new oil demand stats are challenging the theory

Such shifts are so consequential, argue the peak travel crowd, that they require a fundamental recontemplation of public policy. Tax, budget and economic policy-makers need to stop putting cars front and center, and also think less about suburbs and new roads. Instead, legislation should fix existing roads and bridges, support urban walkability, and build public transportation.

Sadly for the peak travelistas, in recent weeks, reports from two major research institutions—the EIA and the International Energy Agency (IEA)—have suggested that the oil and gasoline demand started bouncing back right after those 2011 numbers.

Gasoline consumption began to edge back up in 2012, according to the EIA. In the first nine months of 2012, Americans consumed 101.9 billion gallons of gasoline, up from 101.3 by that point the previous year. In 2013, the volume was also higher than in 2011—at 101.5 billion gallons.

Oil demand went up, too, in a trend across the developed world: in a Jan. 21 report, the IEA said that after three years of contraction, oil demand in developed countries reversed itself and turned upward in 2013, led by the US with 2.1% growth.

The shift seems likely to continue, at least for awhile. Just a month ago, the IEA forecast that US oil demand would contract this year by 0.1%, but now the agency says the figure will grow by 0.4%, to around 19 million barrels a day. US gasoline consumption rose in three of the four months ending Jan. 20, and Americans consumed 644,000 more barrels of gasoline than in the same period a year ago.

In addition, US carbon emissions rose last year by 2%, reversing yet another trend, according to the EIA.

In terms of what happens next, US fuel consumption could return to the levels of 2004 peak and perhaps higher given the rising US population and improving economy, both of which will swell the total annual distance driven by motorists, according to a November study by Michigan (pdf, page 14). On the other hand, peak-travel demographics could counter-balance that escalation—oil consumption and CO2 emissions would not necessarily spike if youths persist stubbornly in not driving, vehicle efficiency doubles as planned, and electric vehicles penetrate the fleet.