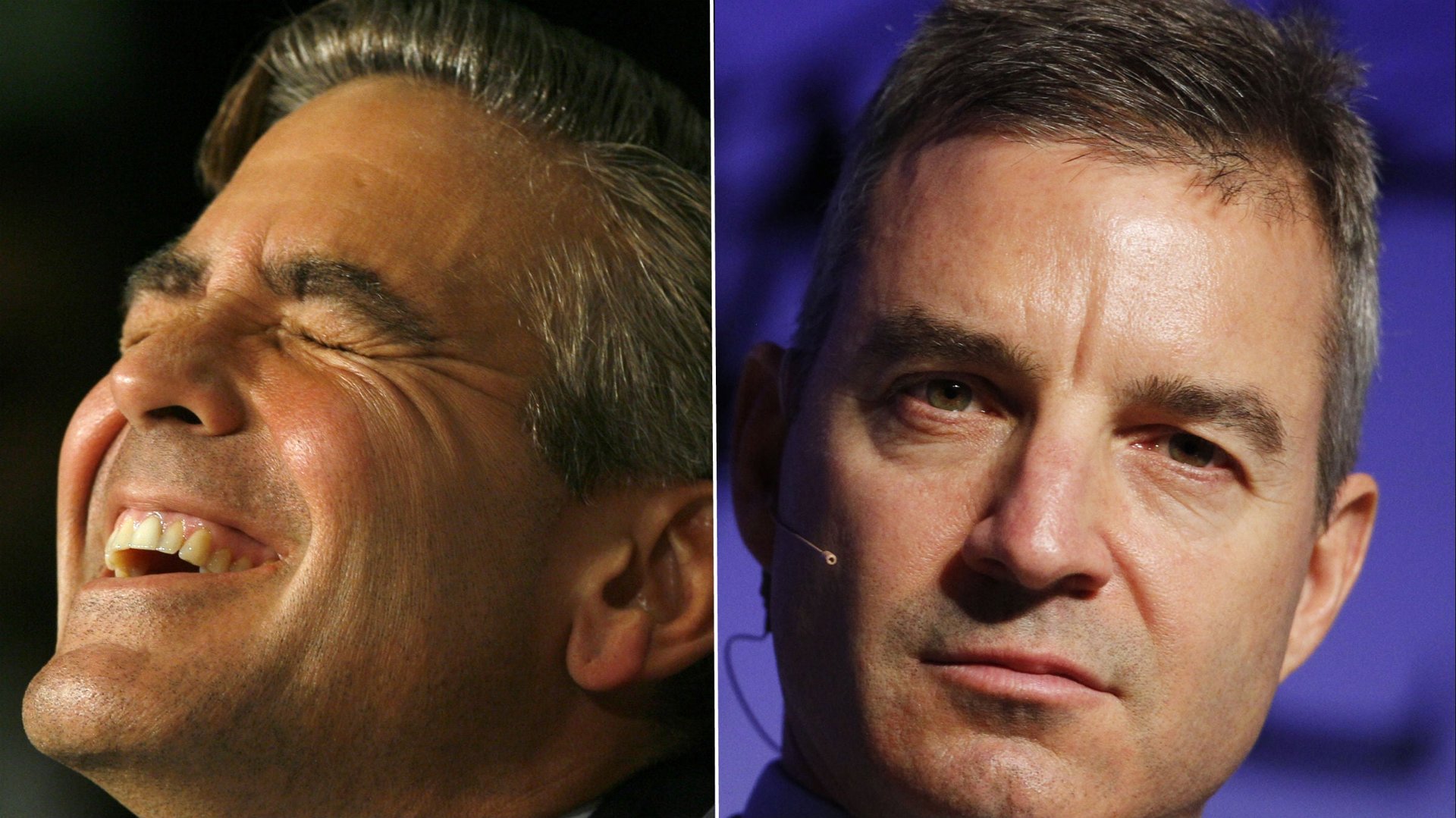

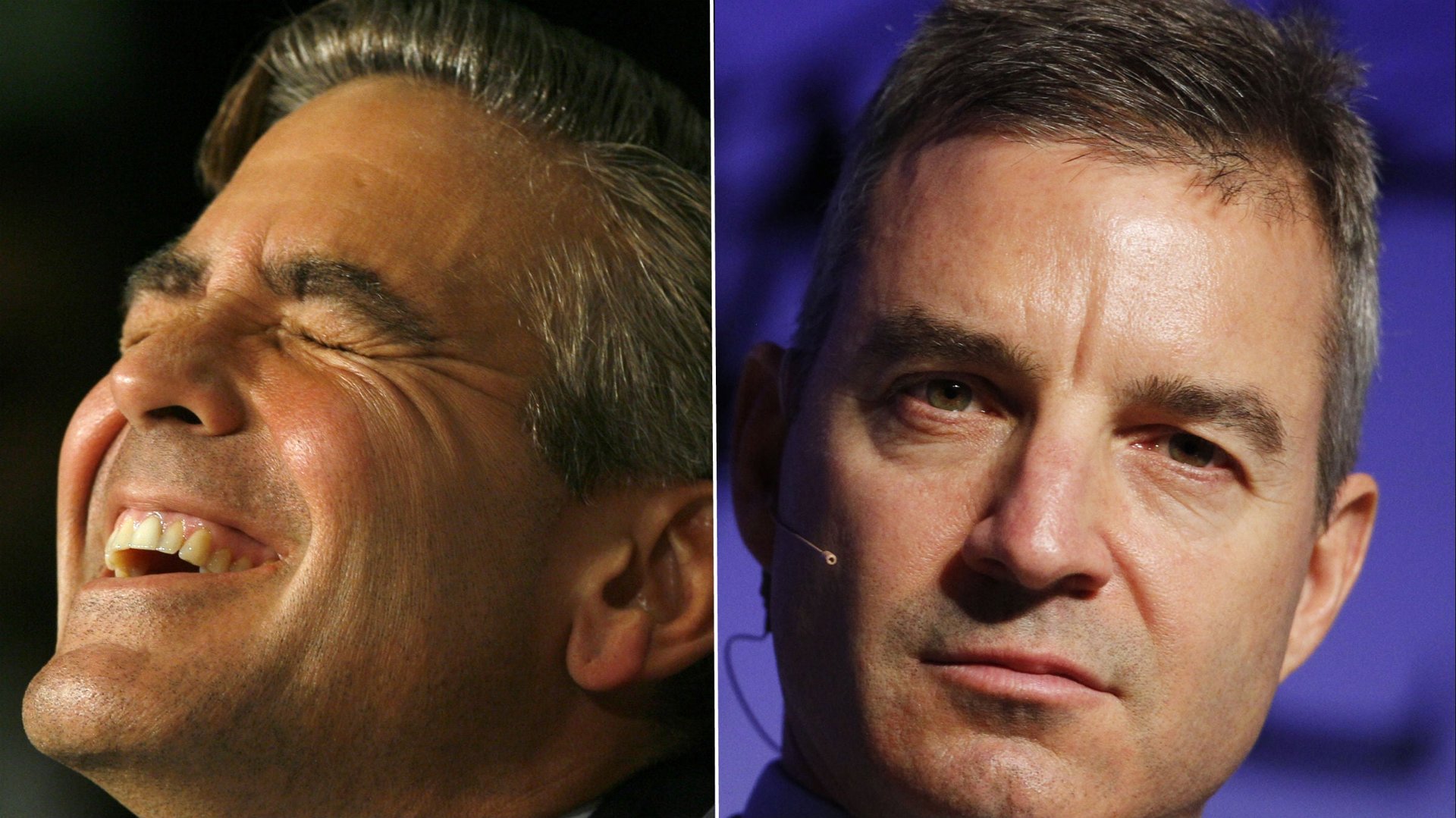

2014 already looks brighter for activist investor Dan Loeb

2013 wasn’t the cushiest year for famed hedge fund manager Dan Loeb. Not only was he the subject of a lengthy and at times vicious Vanity Fair profile, which made explosive allegations about his past (which he denies). He was also subject to scathing criticism from Hollywood star George Clooney about his plan to restructure Japanese entertainment and electronics giant Sony. And negative publicity aside, returns of his Third Point hedge fund, while said to be better than most of its rivals, still lagged the broader market.

2013 wasn’t the cushiest year for famed hedge fund manager Dan Loeb. Not only was he the subject of a lengthy and at times vicious Vanity Fair profile, which made explosive allegations about his past (which he denies). He was also subject to scathing criticism from Hollywood star George Clooney about his plan to restructure Japanese entertainment and electronics giant Sony. And negative publicity aside, returns of his Third Point hedge fund, while said to be better than most of its rivals, still lagged the broader market.

But the tide may already be turning this year for the California-born surfing enthusiast. Today, not one, but two of Loeb’s latest investment targets bowed to his pressure.

Sotheby’s, the 270-year-old auction house, this morning announced it would return $450 million in capital to shareholders, and make other changes to its business, including a potential sale of its valuable London and New York headquarters. In October, Loeb unleashed a scathing critique of what he claimed to be managerial largesse.

Dow Chemical, currently the largest position in Third Point’s portfolio, also announced today that it would raise its dividend and triple its share buyback program, just days after Loeb started agitating for change. (Dow said the decision to return more capital was taken before Loeb’s pressure began. Meanwhile, it’s resisting Loeb’s calls to spin off its specialty chemicals business.) Either way, shares are up about 4% today, a boost to Third Point’s bottom line.

As for Sony, its US listing has fallen 14% since Loeb started agitating for change in May 2013; its Japanese listing has dropped 9% over that period. No word yet whether Clooney has granted Loeb his wish for a meeting. Clearly, Loeb still has his work cut out for him in the year ahead.