Whose fault is the emerging market sell-off?

With emerging markets facing weakening currencies and skittish investors around the world, the Solons of finance have a question: Who, exactly, is to blame? There are two popular answers.

With emerging markets facing weakening currencies and skittish investors around the world, the Solons of finance have a question: Who, exactly, is to blame? There are two popular answers.

1. It’s the United States’ fault

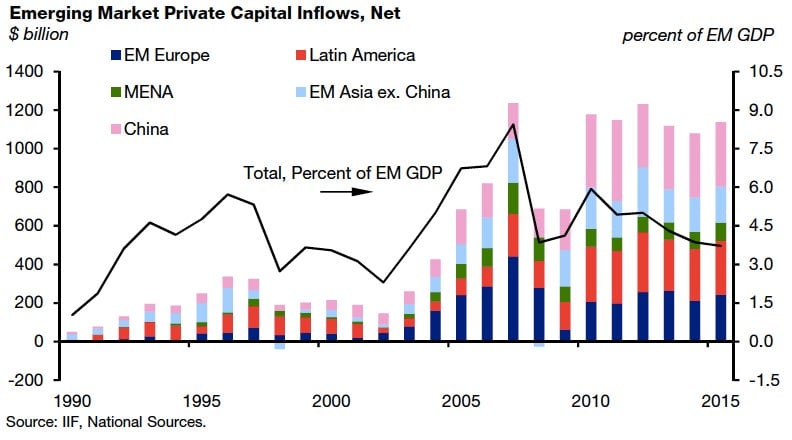

The US role is well-told: The Federal Reserve’s attempt to keep interest rates low helped send investor money flooding to the fast-growing emerging markets, where yield was cheap. At the time, some emerging markets—notably Brazil and its finance minister, Guido Mantega—cried foul: While the US central bank might be aiming to boost the US economy, the resulting flood of hot money led emerging-market currencies to appreciate. That cramped their plans for export-led growth by making their goods more expensive abroad.

Now that the Fed has confirmed its decision to slow the pace of bond purchases in two consecutive meetings, investors have a clear sign that rates outside emerging markets are going to rise. So shouldn’t critics of the US bond-buying, like Mantega, be celebrating its demise?

At least some are: Colombia’s central banker has said the recent devaluation of the Colombian peso is a good thing—it will help the agricultural sector find new export markets. But other countries had been taking advantage of the incoming hot money flows to paper over other ills, from expensive domestic credit, to slowing growth, to an over-reliance on commodities, to a lack of internal demand. When the money flowed out, those ills became apparent. Those ills are the basis of one popular taxonomy of emerging market woes, which separates out those countries that the ebbing tide has shown to be wearing skimpy bathing suits from those that have turned to be wearing nothing at all.

2. Its emerging markets’ own fault

That’s a case made by economists Dani Rodrik and Arvid Subramanian, who say the emerging markets should have known better. We’ve seen the hot money problem before, and there are ways around it—strengthening foreign reserves, hiking interest rates, imposing capital controls. And, indeed, some countries have taken those routes, which is one reason why, at least for them, this time really could be different. China, for example, has massive reserves and fairly strict capital controls, so hot money isn’t so much a problem there. (It’s own financial system, however, may be a different story.)

Other countries, like India and Turkey, come in for criticism from Rodrik and Subramanian: They repeatedly embraced financial globalization, even as it hurt them, by opening new portions of their economies to foreign investment or relaxing other restrictions on foreign flows. Emerging markets, then, aren’t victims of the US, but of their own hubris.

Whose idea was it, anyway?

Rodrik and Subramanian are right to a certain extent. But it’s important to remember who was telling these countries to embrace financial globalization: Developed economies, multinational corporations and multinational investors. As recently as last September, the International Monetary Fund’s prescription for Turkey included plans to “attract more foreign direct investment—a stable source of external funding.” While that kind of long-term direct investment isn’t as subject to the whims of global investors as money that goes into bonds and currencies, it’s still part of the liberalization tool-kit. Even though the Fund and other influential economists have been reconsidering the wisdom of capital controls, their advice to Turkey was to rebalance its economy by cutting domestic spending, not restraining outflows.

So if it’s unfair to blame the United States’ domestic stimulus efforts, and their withdrawal, for the problems in emerging markets, it’s important to remember who pioneered the structures that allow these problems to spread.