Strangely, Korea has a kimchi deficit and it’s getting worse

Strange but true. South Korea runs a kimchi deficit. And it’s getting bigger.

Strange but true. South Korea runs a kimchi deficit. And it’s getting bigger.

South Korean exports of the pungent cabbage dish fell 16.3% in 2013 to $89.2 million. (The weaker yen, which makes Korean kimchi more expensive in Japan was to blame.) And imports, fueled by cheap Chinese kimchi, rose 5.9% to $117.4 million. The result? A culinary cabbage shortfall of $28.1 million.

In fact—with the exception of 2009—Korea has been in the red on kimchi every year since 2006. If you want to, you can see this as bad news, another sign that global trade spats are rising rapidly, exacerbating traditionally difficult relations between neighbors in east Asia.

And you’d have to be blind not to acknowledge that the Abenomics experiment in Japan—and the resulting weak yen—has been tipping the scales when it comes to global trade. (Just today, Toyota forecast a record profit thanks in part to a weak yen, which boosts the profitability of its exports.)

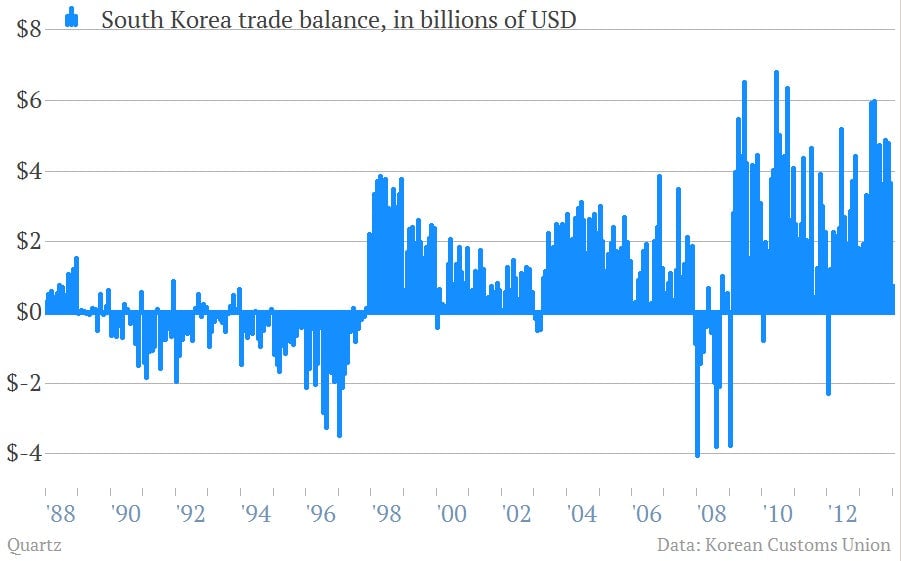

But if South Korea is running a deficit in kimchi, the fact remains that the country continues to enjoy giant trade surpluses. (Even if January’s numbers were a bit weaker than expected.)

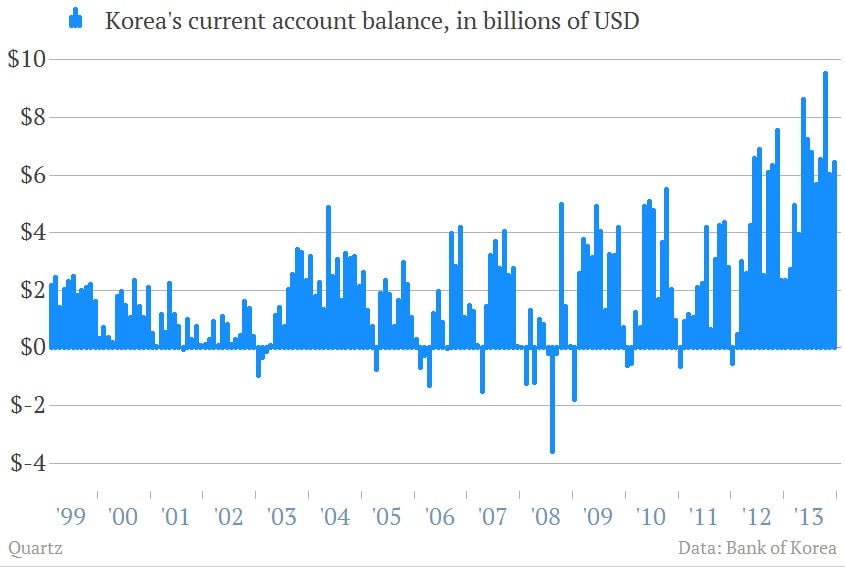

And those trade surpluses—as well as a healthy inflow of foreign capital into investments such as South Korean stocks—have helped drive the country’s current account surplus sharply higher. (The current account is the best big picture measure of how much a country borrows or saves. Surplus = saving. Deficit = borrowing.)

The upshot? Korea’s kimchi deficit might seem like a blow to Korean pride. But the truth is that the country’s exporters are involved in much more profitable pursuits. And those in turn produce plenty of, er, cabbage.