Investors aren’t moved by Uber’s shift into banking

Uber is driving further into financial services. So far, the stock market signals that investors aren’t impressed.

Uber is driving further into financial services. So far, the stock market signals that investors aren’t impressed.

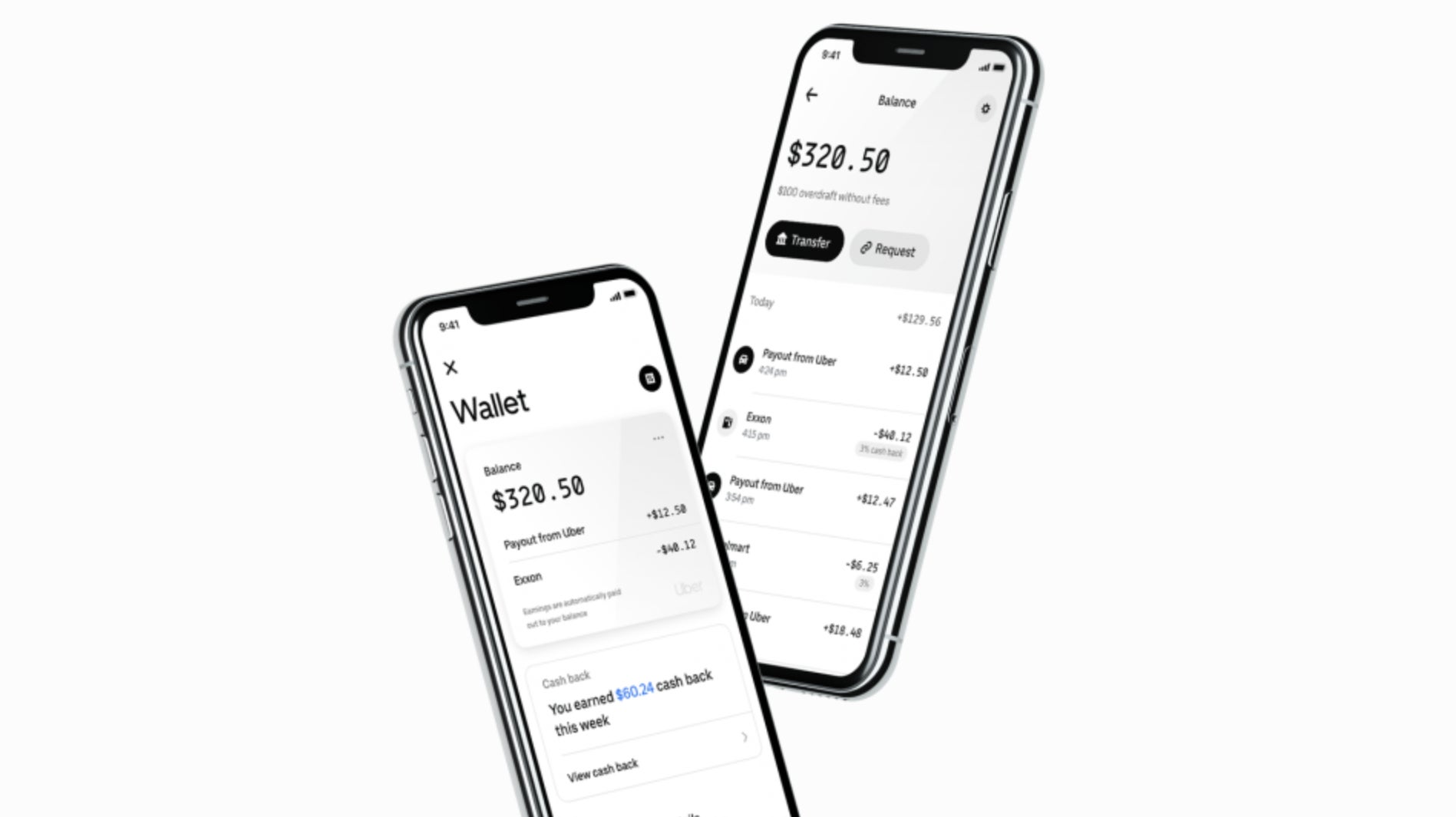

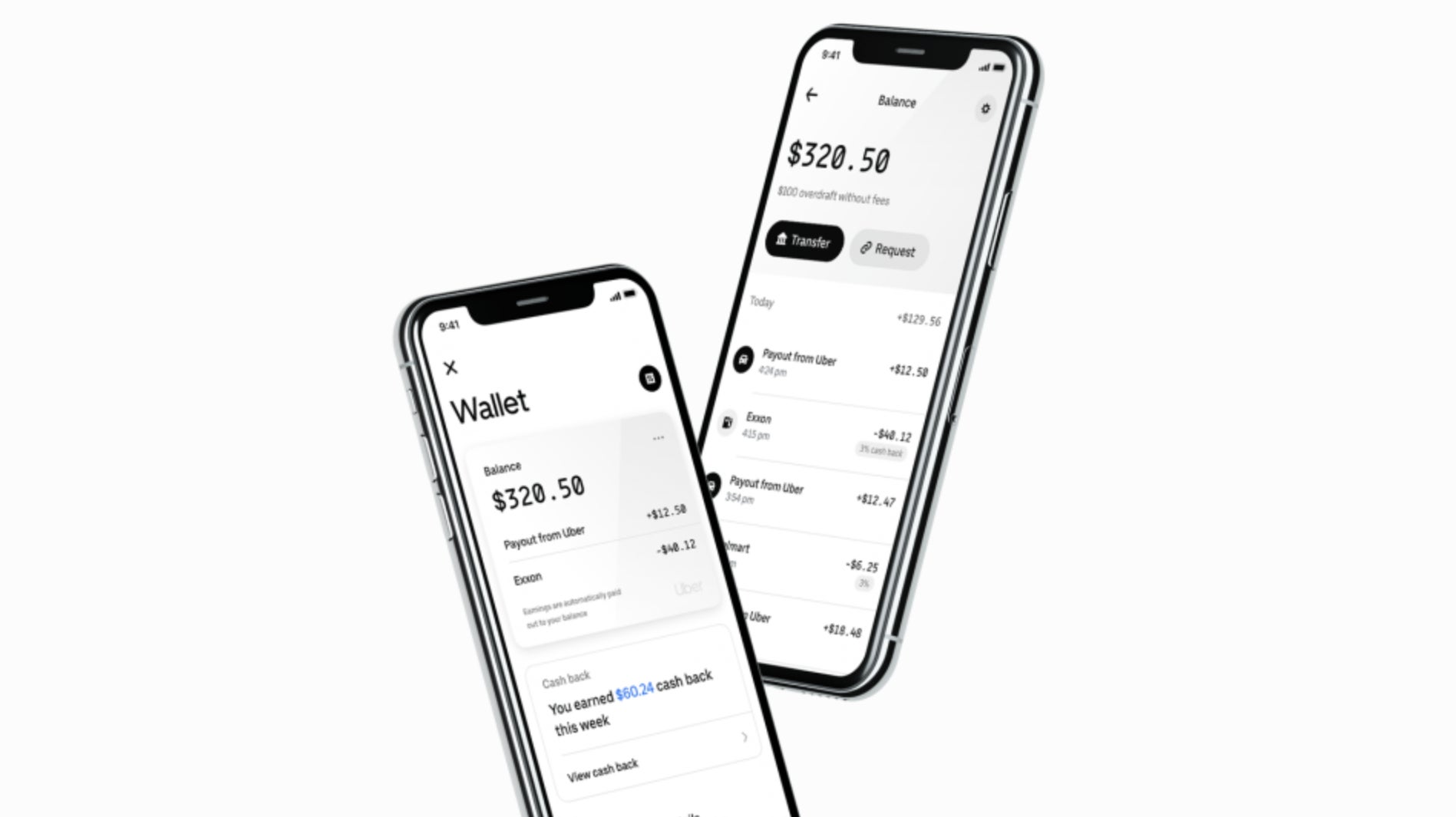

The company is launching a new unit called Uber Money, which includes things like real-time access to earnings for its drivers and couriers, a revamped debit card with cash back on gas purchases (through a partnership with bank Green Dot), and a mobile wallet. The wallet will first be available in its app for drivers and later in the consumer-facing Uber and Uber Eats apps. The company’s credit card also got a refresh.

Uber’s fintech ambitions emerged in June when CNBC reported that the company was bulking up on engineers in New York. But neither that report nor Uber Money’s formal launch this week have done much for the company’s stock price. Shares are down about 20% since the company’s IPO in May.

That’s somewhat surprising given that investors are enamored with payment companies. As consumers shift from cash to cards and digital transactions, Mastercard and Visa have gained 46% and 35% this year, respectively. PayPal, which bought $500 million worth of Uber stock in the company’s IPO as part of a partnership, has gained about 25%. The S&P 500 is up 22% in 2019.

Victor Orlovski, managing partner at Fort Ross Ventures, thinks Uber is well positioned to become a kind of business bank for its gig workers, and says services like financing and remittances could be promising business lines. “It’s not a secret that many drivers, here in the US for example, are immigrants and they have relatives abroad,” said Orlovski, whose firm is an Uber investor. “They can become a great source of remittance payments.”

“Could they capitalize their financial services so the stock will jump five or six times? I don’t think so,” he added. “But it could be a good fit.”

The “pivot” to fintech has been a popular strategy among Asian tech and ride-hailing companies. India’s Ola made fintech a priority in 2015 after spinning out its payment service, Ola Money, into a standalone app. Indonesia’s Go-Jek started its Go-Pay service in 2016.

“There is some precedence for success,” Bernstein analyst Harshita Rawat said of big tech platforms in Asia offering financial services. Companies like Uber know a lot about their workers, and can leverage that information to offer tailored loans and other services.

Right now, Uber Money appears mainly focused on the ride-hailing company’s drivers. But Peter Hazlehurst, who will head the unit, told CNBC that the company could offer accounts and other services to consumers as well. Uber has more than 4 million drivers and couriers around the globe, and 99 million monthly active consumers on its platform.

But when it comes to the bottom line, payments and fintech can take years to gain momentum. PayPal bought Venmo in 2012 and is still running the business for growth rather than profit, even thought it’s on pace to process $1 trillion in payment volume in the coming year. Uber is burning through cash quickly in its main business, and financial services seem unlikely to offset that anytime soon.

In the near term, Uber Money could keep its drivers on the road and away from competitors. The company offers no-cost $100 overdrafts, according to CNBC, which could help drivers gas up their cars so they can work more.

Fintech could also make Uber’s own business more efficient. The company spent $749 million on card processing fees in 2017, according to Bernstein, and its partnership with PayPal could help recoup some of that cash. Outside the US and Europe, cash payments are still popular in many markets, and providing riders and gig workers with banking services could shift transactions away from notes and coins to digital.

But Uber still needs to develop a distinguishing feature for its financial app, Orlovski said. “It isn’t yet clear what exactly Uber is going to do,” he said. “Fintech is broad, and they should have a killer feature.”