Here’s the chart that explains why Ron Paul is wrong and QE3 really has helped the US economy

Newly-installed Federal Reserve chair Janet Yellen is sitting down before US Congress today to offer her first semiannual update on monetary policy. (She’ll reprise the performance tomorrow for the Senate.)

Newly-installed Federal Reserve chair Janet Yellen is sitting down before US Congress today to offer her first semiannual update on monetary policy. (She’ll reprise the performance tomorrow for the Senate.)

The prepared opening comments are out, in which she reiterates that she “strongly” supports the Fed’s approach current approach to monetary policy, which she helped develop while serving as vice-chair of the central bank.

Opponents of the Federal Reserve, such as former US congressman Ron Paul of Texas and his son Rand, a US senator from Kentucky, have long argued that unconventional monetary policy—including the bond-buying program known as quantitative easing (QE)—that the Fed embarked on during and after the financial crisis has had little impact on the real economy.

Of course, such efforts haven’t been a panacea, as elevated levels of unemployment and still-sluggish growth suggest.

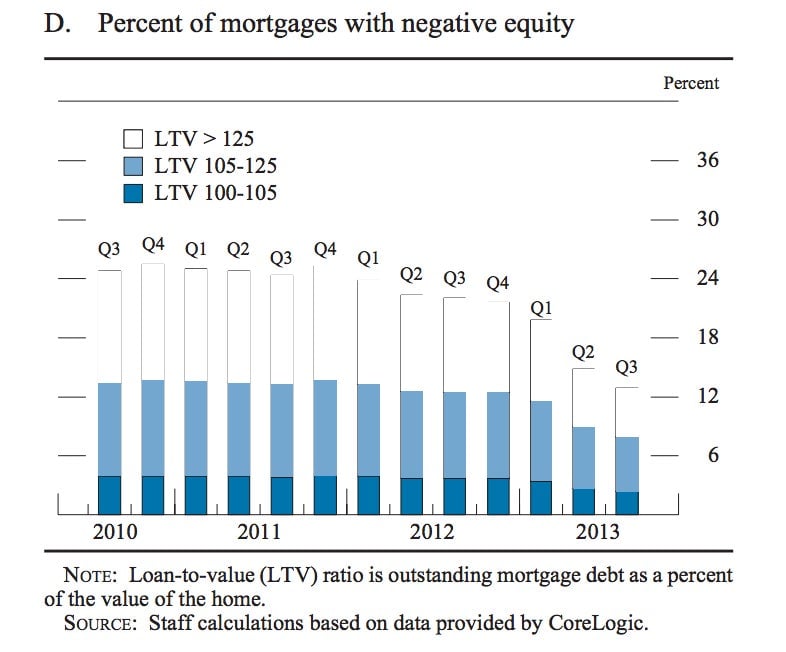

But they have affected the economy in important ways. For example, the third round of QE focused on the housing market by purchasing packages of government-guaranteed mortgages—Mortgage-backed Securities, or MBS—where roughly 90% of all US home loans end up. The QE3 program also corresponded to a sharp improvement in housing prices in the US. You can see the results of that strong rebound in home prices in this chart, yanked from the official monetary policy report accompanying Yellen’s testimony. It shows the shrinking percentage of US mortgages which are “underwater”:

As I wrote way back in 2012, pulling people out of their underwater mortgages was a key goal of QE3 because it makes eligible for refinancing, and refinancing allows them to take advantage of the still historically-low interest rates the Federal Reserve is providing. The Fed says as much in today’s report:

These improvements could help with the transmission of monetary policy. Banks are more willing to refinance mortgages when homeowners have positive equity, so improving home equity may allow more homeowners to take advantage of the current low interest rates.

Being able to refinance at lower rates frees up monthly cash to be spent elsewhere in the economy. Before the monetary policy pipeline got gummed up by the financial crisis, this effect was one of the main ways that the central bank could move the economy via monetary policy. But with rates already near zero, the bank has turned has been forced to use other tools, such as QE, to try to influence the economy.

Now, yes, there have been other elements of at play in decline of underwater mortgages. For example, good old fashioned foreclosures have also played a role in vaporizing some of this debt, along with the Treasury Department’s programs aimed at boosting mortgage refinancing. But the fact that such improvements came just as the Fed doubled-down on bond-buying in an effort aimed at the housing market has to be seen as important win for the central bank.