Emerging market stocks are so ugly they might just be beautiful

Time to buy?

Time to buy?

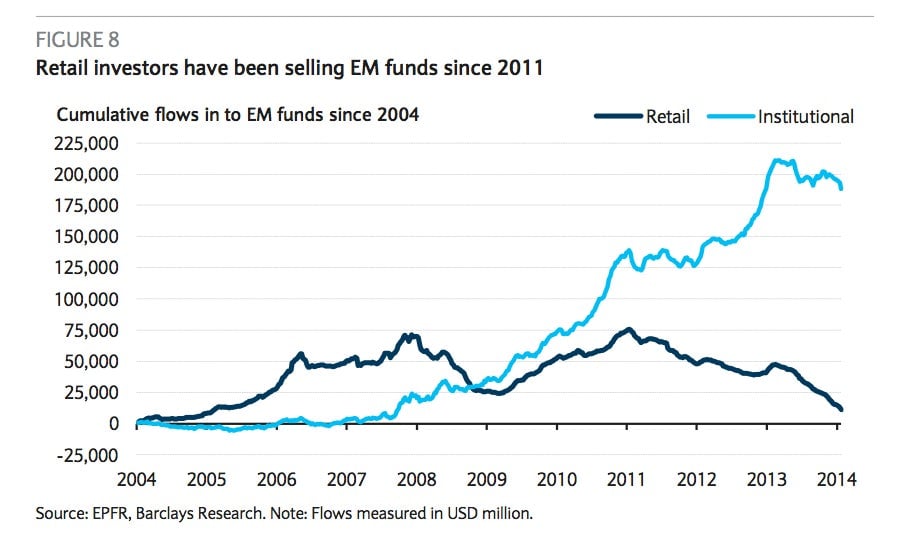

Emerging-market stocks have been battered and bruised in the opening weeks of 2014. The MSCI Emerging Markets index has fallen roughly 5%, as retail investors have dumped the asset class.

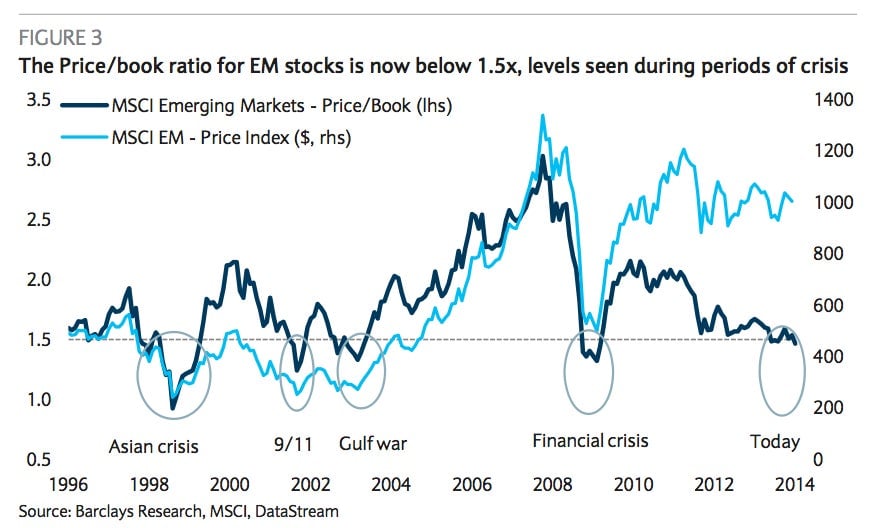

Inevitably, some market watchers—such as the Barclays analysts who made this chart—are starting to argue that EM stocks look cheap.

Longtime EM enthusiast Mark Mobius agrees. Larry Fink, the head of asset management giant BlackRock, which makes money by selling things like iShares MSCI Emerging Market index ETF, also recently wondered whether now might be a good time to get back into emerging market stocks. “These emerging markets have growing and stronger balance sheets and a faster GDP [growth rate],” Fink said.

Maybe. But growth in many of the leading emerging markets—Brazil, India, China—has been looking less robust over the last year. And balance sheets are looking a bit ragged too, especially in countries like Turkey where corporations took full advantage of cheap dollar-denominated loans over the last few years. The recent sharp devaluation of the Turkish lira makes those dollar-based loans tougher to repay. Several emerging market central banks have sharply raised interest rates in order to prop up their currencies. That won’t help growth either.

Even if the valuation case for buying EM stocks was clear cut, valuation is a notoriously poor way to predict market moves over anything other than the very long term. Just because stocks go on sale, doesn’t mean anyone immediately will rush in to buy them.

So what’s the takeaway? It’s clear that the headlong rush of investors into any and all things EM over the last few years is over. And that’s likely a good thing. After all entire notion of “emerging markets” as a single bloc was never that helpful a concept. Indonesian stocks are up 5% in 2014 and the Philippines up a tidy 4%. Turkey is down 5%, India’s Sensex is off by 3.5%, and China’s Shanghai Composite is roughly flat. With performances that are all over the map, picking the exact right time to jump back into “emerging markets” is probably a fool’s errand.