The global water economy in six charts

Water scarcity is becoming a chief concern for businesses around the world, but some industries and economies are more exposed to water risk than others. Here are six charts that explain the water economy, and how industry fits into it.

Water scarcity is becoming a chief concern for businesses around the world, but some industries and economies are more exposed to water risk than others. Here are six charts that explain the water economy, and how industry fits into it.

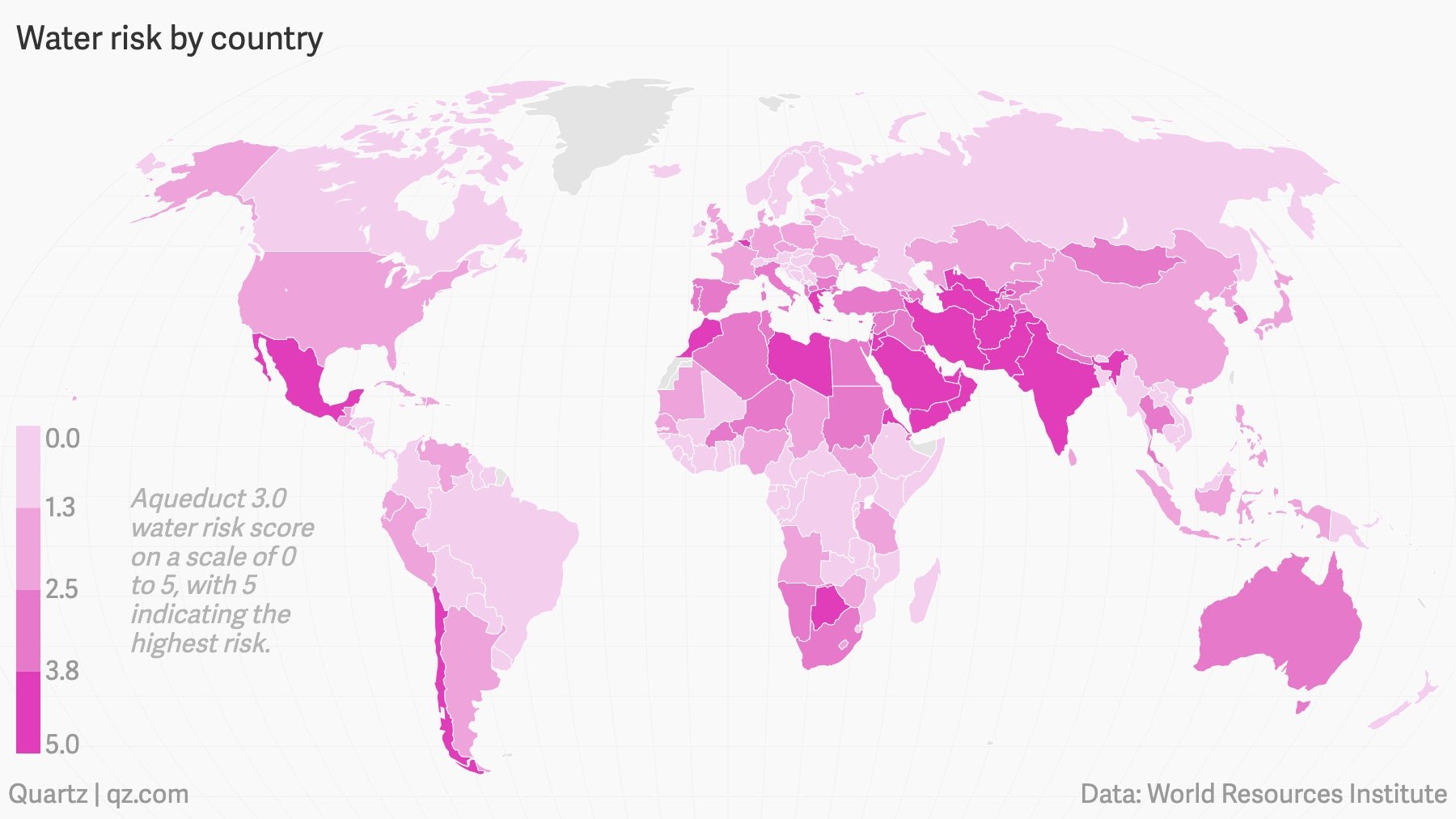

Water stress is highest in South Asia, the Middle East, and parts of Africa

Unlike other resources, there’s currently no significant market for trading water. That’s chiefly because it’s so heavy; it isn’t economical to ship it. That means, for now at least, that water-stressed countries are dependent on their own fragile supplies.

In the most water-stressed countries, industry accounts for a small portion of use

Water usage varies considerably depending on the type of economy. Higher-income countries tend to use far more water for industrial use, whereas in poorer countries agriculture and domestic use dominate.

In some countries, industry accounts for almost all water use

Some industries are particularly dependent on water. Energy, beverages, food production, mining, chemicals, and certain types of manufacturing are among those with the highest water risks, according to Ceres, a nonprofit.

Some forms of water use are more depleting than others. Measures of water withdrawal don’t distinguish between water that is returned to the water table and water that is consumed via evaporation. Power plants consume lots of water for cooling, for instance, but return most of it to the environment. The majority of water used for irrigation, by contrast, evaporates.

The US uses less water per capita than it once did

And produces far more per gallon withdrawn

Economies that are more reliant on water-intensive industries tend to use more water for industry. In the US, industrial water use has declined as the economy shifted from manufacturing to services.

Venture capitalists are investing in water tech

Technology has also contributed to more efficient water use and water startups are working on everything from better detection of leaks in water infrastructure and more efficient irrigation to desalination and water treatment, according to an analysis by CB Insights, a data provider.

Venture capital has a poor record in other areas of sustainability, however. Many well-known VCs took an interest in clean energy investing in the mid-2000s, most famously with Kleiner Perkins’ John Doerr crying on stage during a TED talk on the subject. Today, those investors have largely abandoned cleantech, partly because of the draw of other sectors, partly because of lack of supporting public policies, and partly because energy tends to require lots of capital and longer timelines.

The lesson for water is that investments in new technology have to be paired with public investment, supportive policies, and improvements in public management.