Spanish banks’ bad debt is worth as much as the entire economy of Singapore—and growing

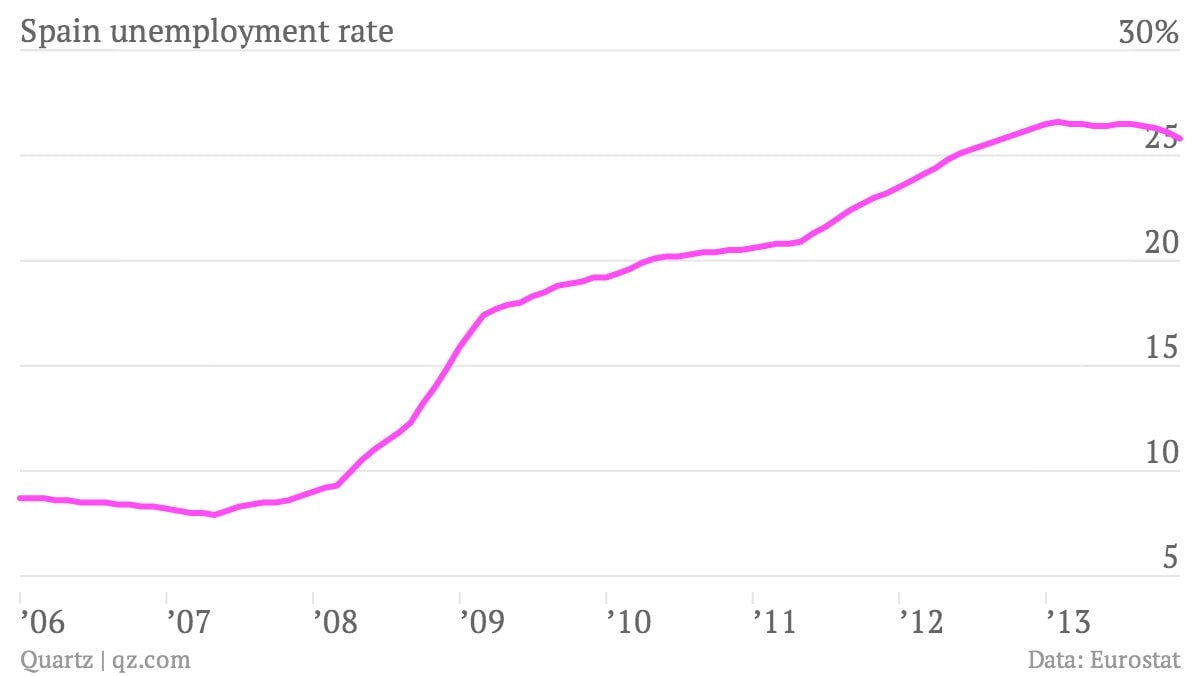

In recent months, the data coming out of Spain have been bad, but not quite as bad as before. The unemployment rate, for example, looks like it’s finally starting to fall. Still, at around 26%, this is hardly a cause for celebration.

In recent months, the data coming out of Spain have been bad, but not quite as bad as before. The unemployment rate, for example, looks like it’s finally starting to fall. Still, at around 26%, this is hardly a cause for celebration.

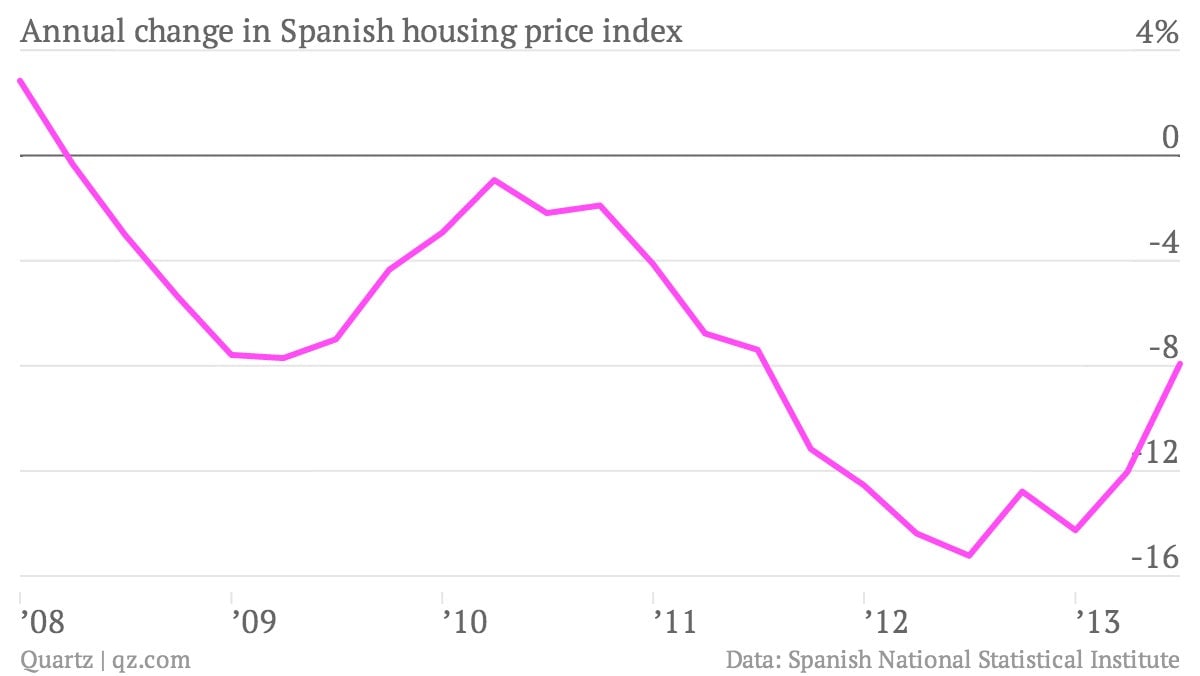

Many of Spain’s woes relate to a dizzying real-estate boom and bust. The average house in the country has lost around 40% of its value since a peak in 2007. Prices have been falling for more than five years, although the pace of decline has mercifully slowed in recent quarters.

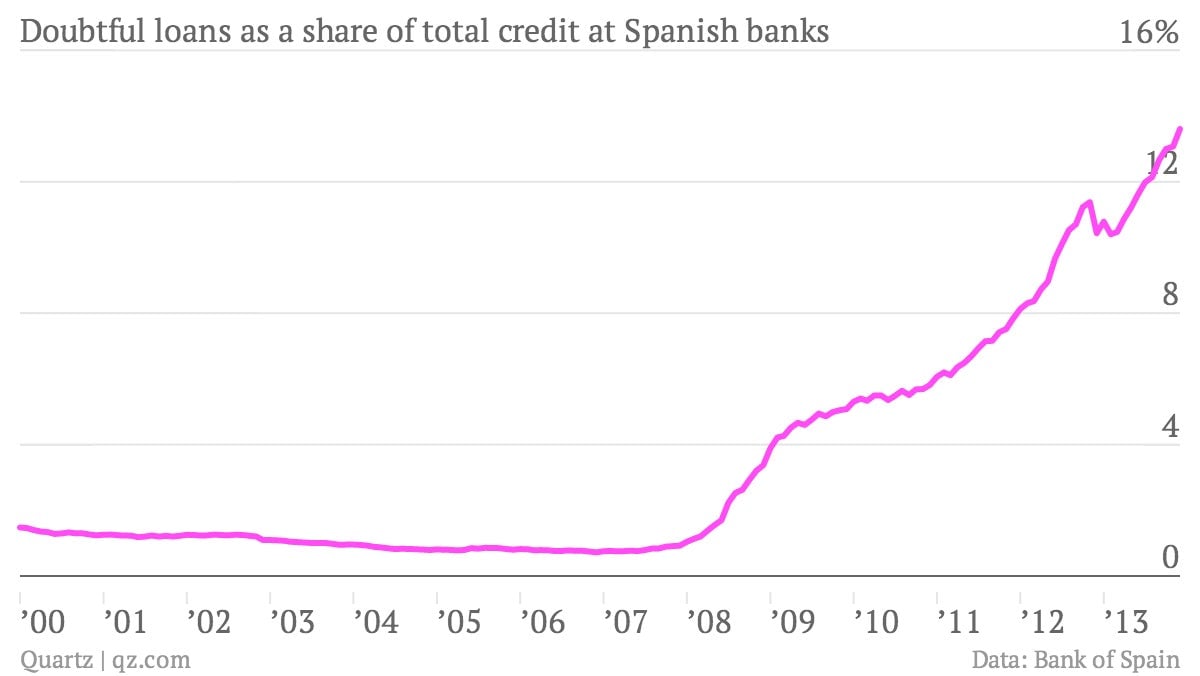

The combination of high unemployment and plunging property prices is bad news for Spanish banks. How bad? Non-performing loans have set a new record, according to data released today. Doubtful loans in December were worth a whopping €197 billion ($270 billion), roughly the same as the annual GDP of Singapore.

Just under 14% of all Spanish bank loans are now behind on payments, and this ratio is likely to get worse before it gets better. Even after the recent declines, by most measures Spanish property remains overvalued by around 10% versus long-term averages (link in Spanish). With the labor market improving very slowly, borrowers will continue to struggle to service their loans. The economy is out of recession, but growth remains anemic.

Unsurprisingly, banks have been reining in lending, with credit falling at a 10% annual pace in the latest data. Less lending means less of a chance for loans to go bad, but this also limits the Spanish economy’s ability to grow. Investors may be keen on Spanish assets, anticipating an economic recovery, but for the foreseeable future the size of the country’s bad debt pile will be one indicator unlikely to move in the right direction.