Europe has a bloated, growth-killing zombie of a banking system

This article has been corrected.

This article has been corrected.

Amid the torrent of news about Europe’s piddling growth, catastrophic unemployment levels and worsening fiscal picture in peripheral countries, there’s been less chatter of late about the collapse of bank lending on the continent.

Investors may have moved on from this problem, but Europe’s bloated banking system is yet another hitch to reviving its economy. There are far too many banks for the size of its economy, which leaves too few borrowers to provide relatively safe, profitable loans. Competition for borrowers drives down bank lending quality, worsening banks’ bad debt levels and tempting government rescues.

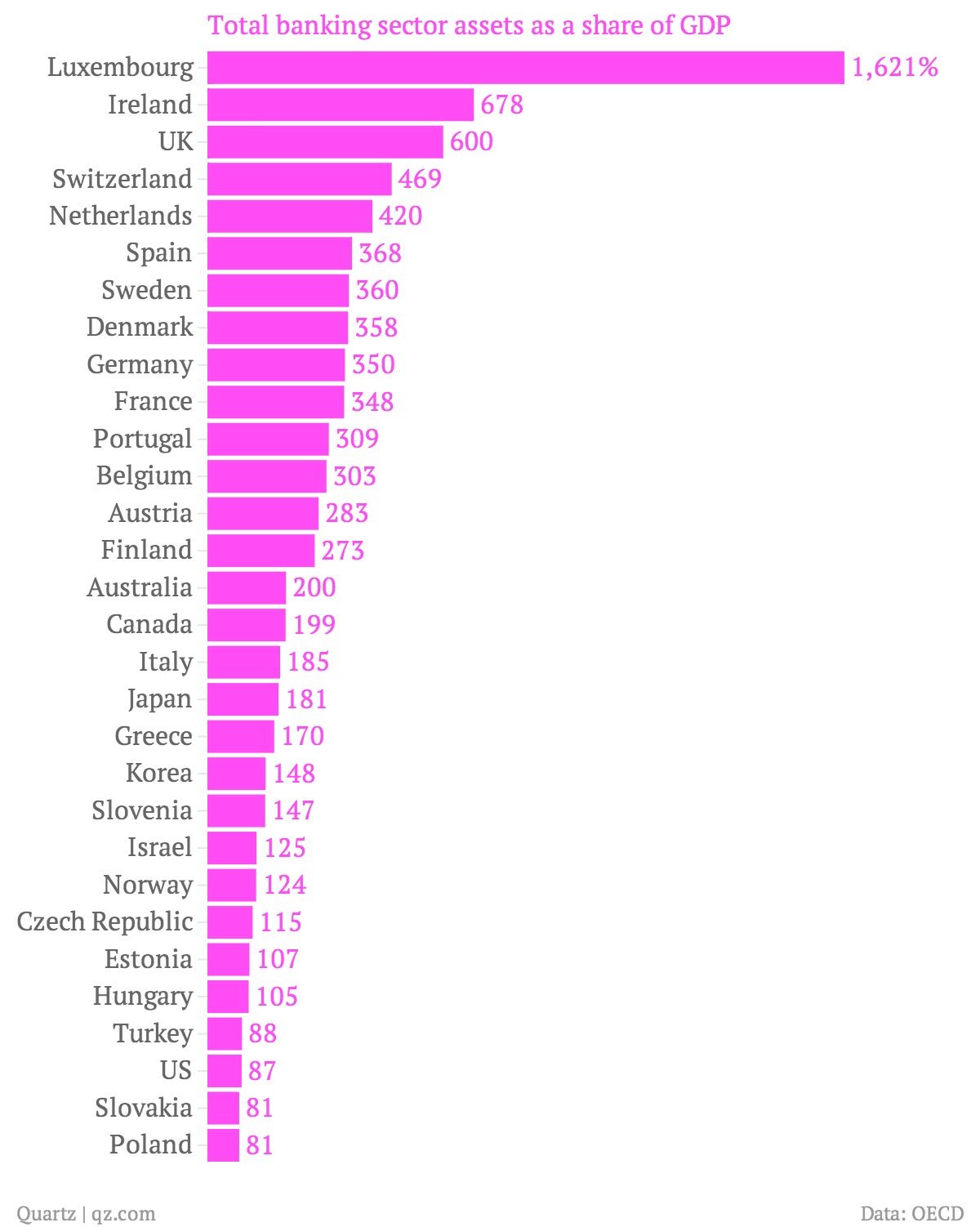

The ECB has promised to buy the government bonds of any troubled nation that asks for help. But the root cause of the crisis remains. Check out this data in a report released on Jan. 20 from the OECD on the size of banks relative to the developed market economies.

The problem will only get worse if banks begin a process of “evergreening” their bad loans, in other words avoiding losses from bad lending by rolling over the debt at very low interest rates.

Such a move would keep a bank afloat while sinking the economy. Such was the case in Japan, where a debt bust led to a zombie banking system, zombie companies and a decades-long fight with deflation. Increasingly, this looks like the path Europe is following.

The European Central Bank is currently in midst of a year-long process of “stress testing” 130 financial institutions. If they’re to have any effect, they need to be quite tough, requiring banks to recognize that some of the government bonds the banks own aren’t safe. (After the swoons of the financial market it recent years, the debt of countries like Spain and Italy can’t credibly be called “risk free.”) They also have to force banks to raise enough capital to allow them to stand on their own feet.

This will be tough politically, but it’s Europe’s best chance for avoiding Japanification.

Correction: In a previous version of this post, the chart incorrectly showed New Zealand with a banking sector approximately of 420% of GDP. That figure is for the Netherlands.