Europe has little hope for growth as long as its banking system looks like this

We’ve said it before, and we’ll say it again. And, well, again. In the capitalist system, lending and debt are crucial to economic growth. And while these tools can be—and often are—abused, that doesn’t make them any less necessary.

We’ve said it before, and we’ll say it again. And, well, again. In the capitalist system, lending and debt are crucial to economic growth. And while these tools can be—and often are—abused, that doesn’t make them any less necessary.

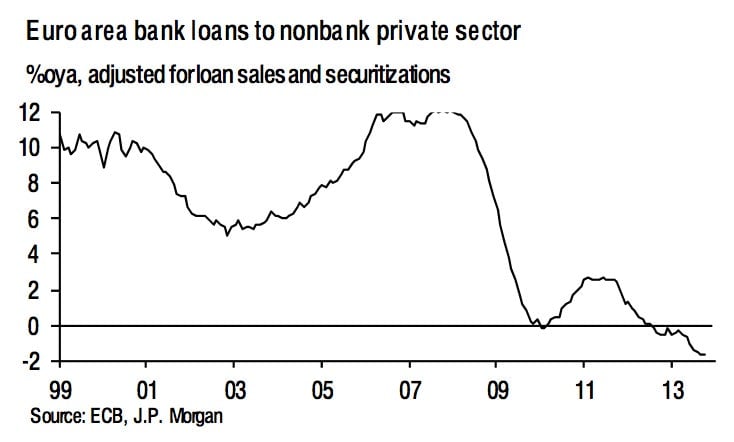

Which is why this chart, from the good folks over at JP Morgan, makes us less than ebullient about the prospects for European growth any time soon. The chart shows the percent change in bank loans over a year ago.

JP Morgan analysts note that bank lending to the private nonbank sector of the euro zone shrank by €15 billion (about $20 billion) in October.

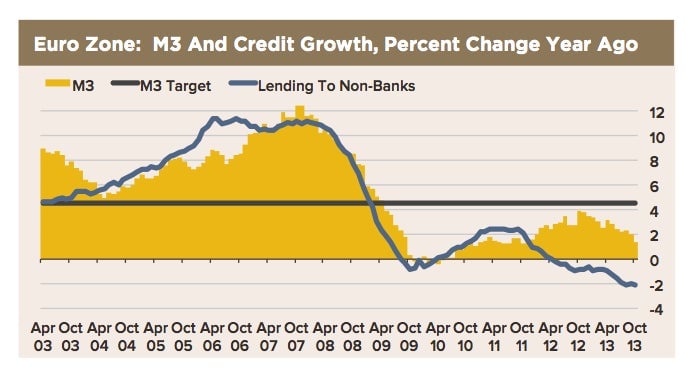

In effect, that means some €15 billion of money was vaporized during the month. (Banks don’t just lend out money, they actually create and destroy it via the fractional reserve system.) The chart below shows lending as against M3, a broad measure of the euro money supply. The ECB estimates that M3 should be growing by about 4.5% a year (pdf, p.12) if inflation is to be at 2.0%. As you can see, M3 has in fact been growing a lot more slowly.

The slow growth of the money supply is one of the reasons inflation in the euro zone is slowing fast. The euro zone consumer price index rose just 0.9% in November, compared to the prior year, below the European Central bank’s target (the pink line below) of around 2%.

And the European Central Bank is shifting its stance toward creating more money to fight the risk of deflation. Why is deflation bad? Ask Japan, which lost more than a decade of growth to the pernicious effects of deflation.