As much as everyone talks about the need for job and income growth, the US economic engine is fueled on a fine slurry of consumer debt and optimism.

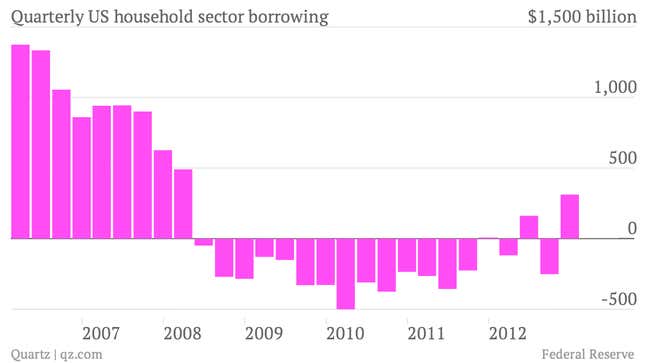

And that’s why this chart below might be the most important of the US economic recovery so far. This is Federal Reserve data on borrowing by US households, released as part of its heavily parsed “Flow of Funds” data. It shows that US households increased their borrowing by $312 billion during the fourth quarter of 2012. (That’s a seasonally adjusted, annualized number.) That’s the biggest bump in borrowing seen since the recession and financial crisis set all levels of US society—except the federal government—scurrying to cut debt, something known by the financial cognoscenti as “deleveraging.”

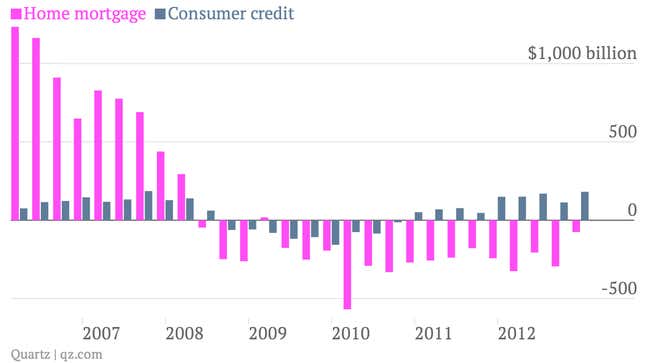

You can see that the big driver of the great deleveraging was shrinking mortgage debt. But it’s consumer debt, stuff like student and automotive loans, that’s been leading the charge higher in borrowing lately. Consumers were still shedding mortgage debt in the fourth quarter—both through defaults and paying off their homes—but the rate of shrinkage has really slowed down, suggesting that they could soon start ramping up borrowing again.

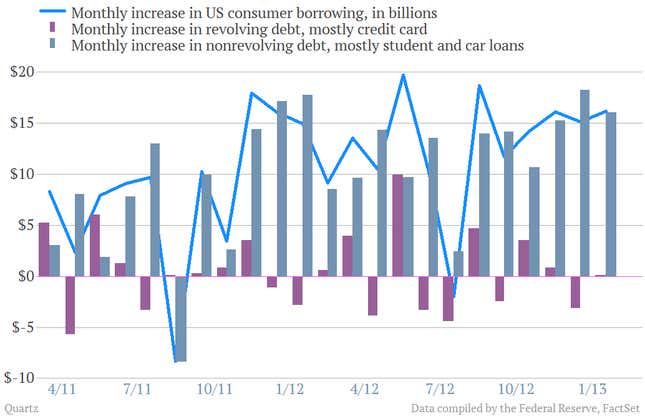

The recent rise in consumer borrowing has been driven by an increase in borrowing for college and cars. Here’s a look at consumer debt from a separate Federal Reserve report, the central bank’s monthly look at consumer credit for January. It shows that those trends seemed to stay intact through the start of the year.

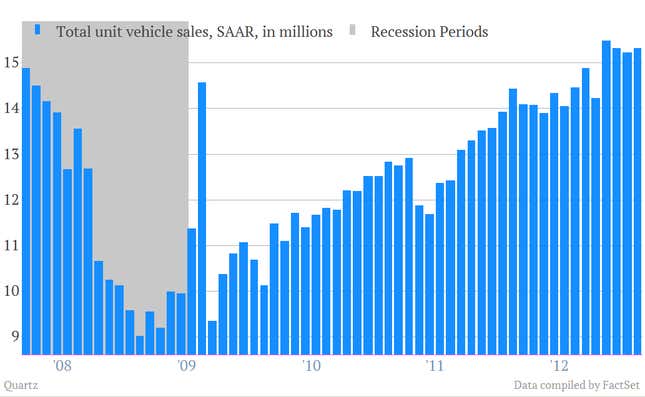

And while the increase in student loans is a question mark for the economy, access to car loans has really helped the US automotive sector post solid sales. US vehicle sales have been clocking above the 15-million annualized rate for the last four months.

Given that consumer activity accounts for roughly 70% of the US economy, the fact that US consumers are showing signs of taking on debt again is an important step. We’ve been pointing out for months that demand for credit is the key to moving the US economy forward.

But wait, wait, wait, you say. Isn’t excessive debt the way that the US economy got itself into trouble in the first place?

Why yes, yes it is. What, did you expect that to change? Fat chance.

On the other hand, because they shed so much debt during the depths of the US recession—a lot of which happened through defaults—US consumers seem to be in a better position borrow, at least for now.