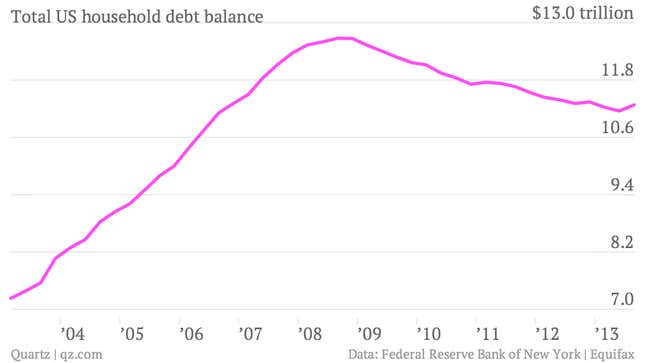

So the great de-leveraging—the mass movement of US consumers to pay down, pay off and default their way out from under unsustainable debt loads—seems to playing itself out.

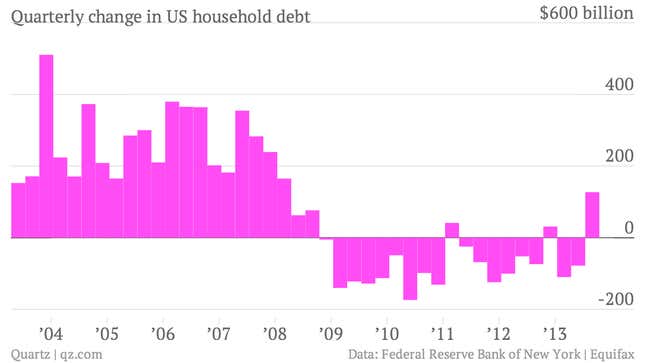

During the third quarter of 2013, total US consumer debt outstanding rose $127 billion, to a total of $11.28 trillion. That’s the largest quarter-on-quarter increase since the first quarter of 2008, when the financial crisis was nothing but a glimmer in the eye of the financial markets. Here’s a look at those quarterly changes, from the data compiled and published by the Federal Reserve Bank of New York.

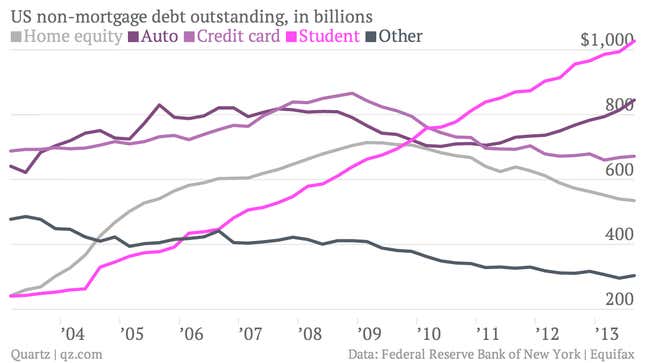

Basically, this just shows that the mortgage market was really starting to get to work during the third quarter. Mortgage debt rose by $56 billion during the quarter. Some of that might have had to do with a rush from people to lock in low mortgage rates, amid signs that the Fed might scale back monetary easing that has pushed rates down. Student debt also continued its long-term march higher, increasing by $33 billion during the quarter. Auto loans—crucial to another part of the American economy—rose by $31 billion. Here’s a look at the non-mortgage debt growth.

Wasn’t it debt that got us into the problems the US economy has faced in recent years? Well, yes. Too much debt—especially home loans made by the banks to people with little reasonable chance of paying them off—was central to causing the crisis.

But at the same time, restarting demand for borrowing remains the key to re-starting economic growth. The hard fact is that capitalism runs on debt. It’s the fuel that makes the whole system work. If you don’t like it, you’re more than welcome to go search for another another hegemonic economic paradigm to live under. Good luck.