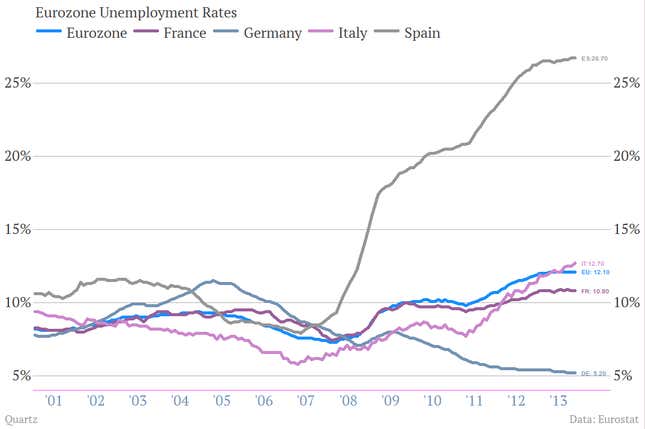

Another day, another update on the disastrous state of some important European economies. This time it’s the official unemployment rate from the European Union’s statistical body, which shows Spain’s unemployment rate at an ungodly 26.7%.

What’s interesting is that financial markets don’t seem bothered at all by the ongoing pain in the euro zone’s fourth-largest economy. In fact, the bond market thinks Spanish government bonds are the safest that they’ve been in years.

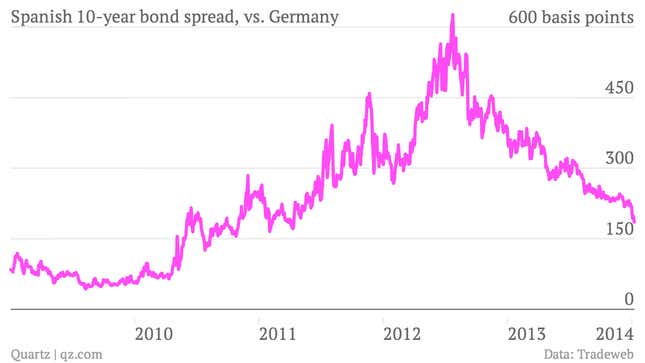

You can tell that from looking at interest-rate spreads. Spreads are the difference between the market rate one entity—like a corporation or, in this case, a national government—pays to borrow money compared to the rate paid by another, usually super-safe entity. (In Europe, the reference entity is usually Germany.)

Here’s how they’ve looked over the last few years.

You can see that they moved sharply higher starting in 2010, as the European debt crisis started to flare up in Greece. Concerns about Spain continued to grow. By 2012, the market was asking Spain to pay 600 basis points—that’s a full six percentage points—more in interest than Germany to borrow for 10 years.

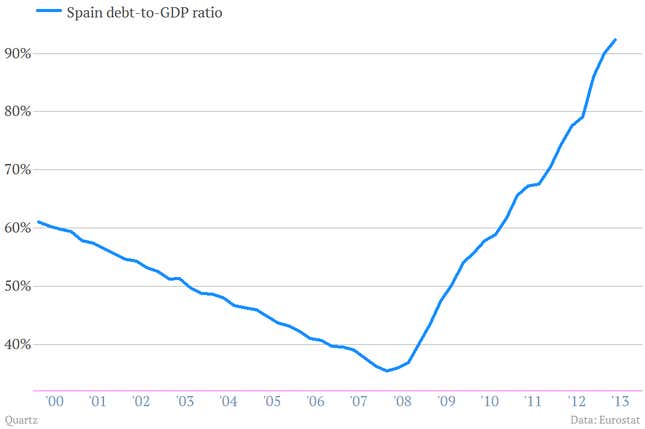

Then what happened? Did Spain suddenly cut its debt load sharply and get its financial house in order? Not at all. In fact, Spain’s financial house was never that disorderly in the first place. (It was a real estate bust—and the potential costs the government would face if it had to bail out its banking system—that was the source of the central risk surrounding Spain.) And since the economic crisis struck, Spain’s debt burden—captured by the country’s debt-to-GDP ratio—has only gotten worse in recent years.

So why are bond market investors less and less worried about lending to Spain? It’s very simple actually. On July 26, 2012, European Central Bank President Mario Draghi said he would do “whatever it takes” to ensure that the euro zone would survive, adding wryly “and believe me, it will be enough.” Draghi backed up his tough words by unveiling a new policy in September 2012 laying out a plan for the European Central Bank—under strict conditions—to step into the market to buy government bonds of troubled European countries.

The markets believed it. And despite the fact that the ECB hasn’t actually bought any government bonds under that program, the European sovereign debt crisis appears largely over. Draghi’s turn at the top of the ECB has been a big success, if you think the role of a central banker is mainly to be a firefighter tamping out financial panics.

Unfortunately, while the financial market crisis might be over, the economic crisis continues unabated. And the ECB—and more importantly, the political forces with the fiscal muscle to try to reinvigorate European growth—seem unwilling to do anything about it.

Correction: Spain is the euro zone’s fourth-largest economy. A previous version of this post was was unclear.