This good news might actually be bad news: Americans are borrowing big again

The great American de-leveraging is over.

The great American de-leveraging is over.

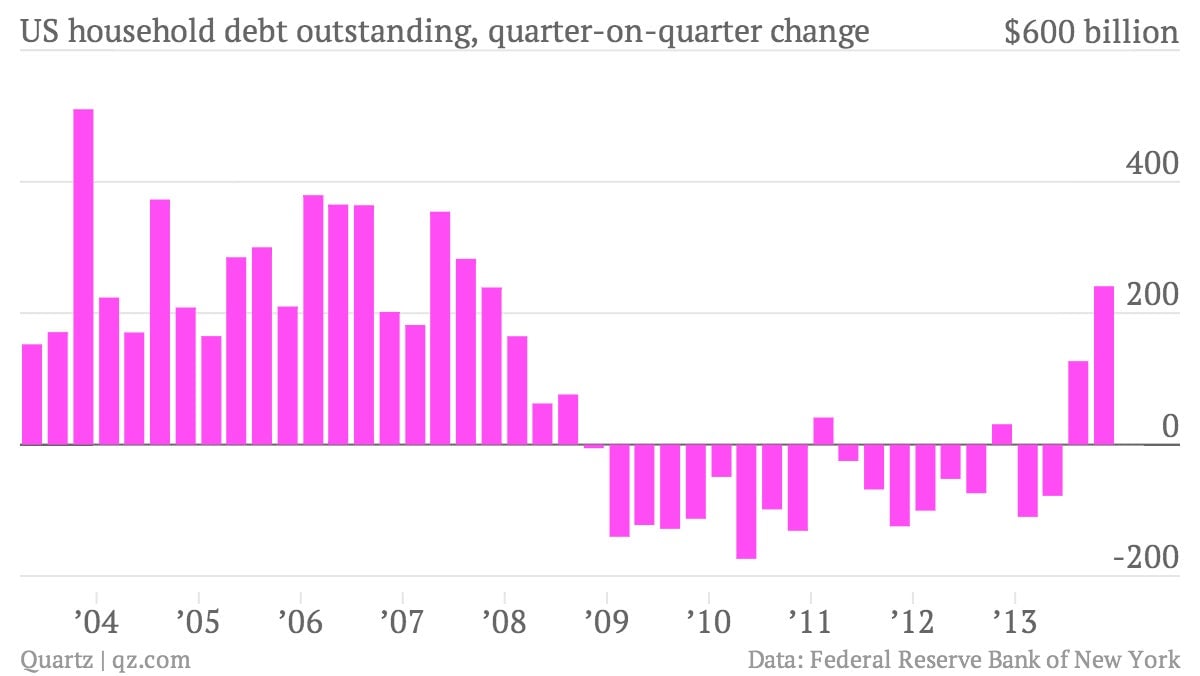

American household borrowing jumped by $241 billion in the fourth quarter of 2013, compared to the prior three months. That’s the largest jump since the third quarter of 2007, when the financial crisis was barely a twinkle in Ben Bernanke’s eye.

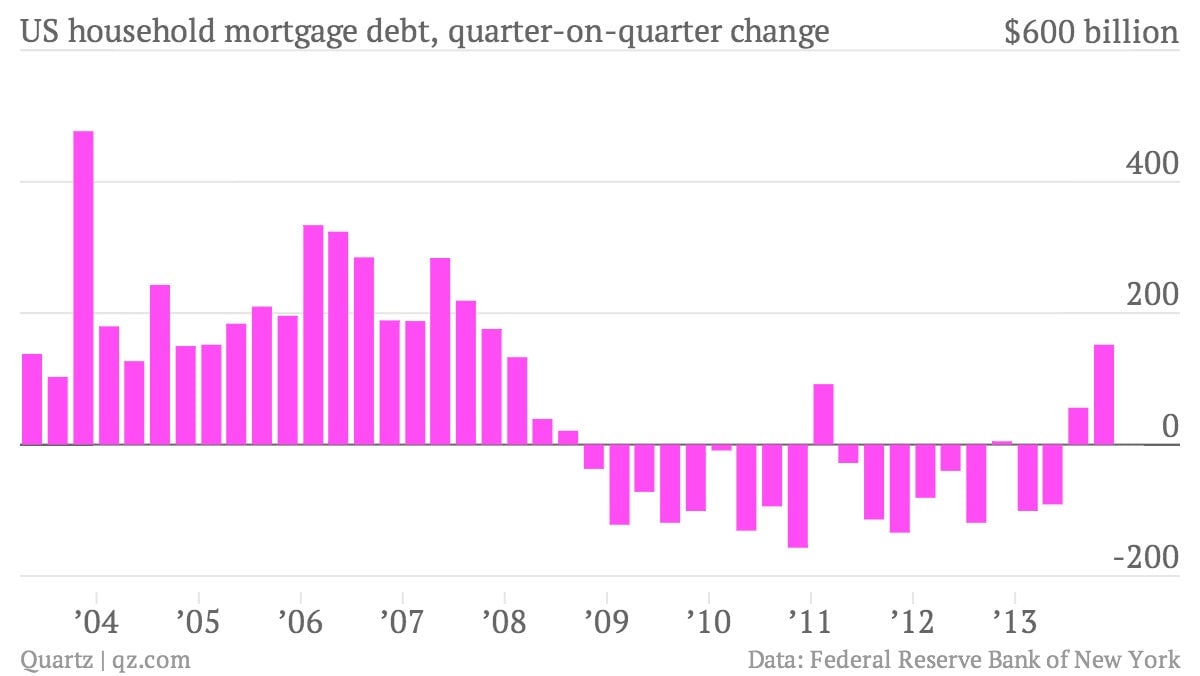

Total household indebtedness rose to $11.52 trillion during the fourth quarter, a 2.1% increase over the third quarter. The big driver of this uptick in borrowing comes from mortgage debt, which rose by $152 billion, the most since the financial crisis hit.

So is this good news or bad news? Well, for those who worry that too much borrowing got the US into its mess in 2008 and could do so again, this will likely be a disappointment. For others who’ve been biding their time and hoping things just get back to normal at some point, this is a very good news in indeed. After all, access to credit is important to getting the consumer economy roaring. The only other way for that to happen would be a meaningful rise in wage growth, which could take a very long time indeed.