US stock market drop triggers circuit breaker as European equities plunge

Stock markets went into freefall after government policy makers from Frankfurt to Washington failed to reassure investors that they would be able to contain the economic damage from the spread of coronavirus. The drop in US equities triggered circuit breakers for a second time in a week, while an index of European stocks was on pace for its worst daily drop on record.

Stock markets went into freefall after government policy makers from Frankfurt to Washington failed to reassure investors that they would be able to contain the economic damage from the spread of coronavirus. The drop in US equities triggered circuit breakers for a second time in a week, while an index of European stocks was on pace for its worst daily drop on record.

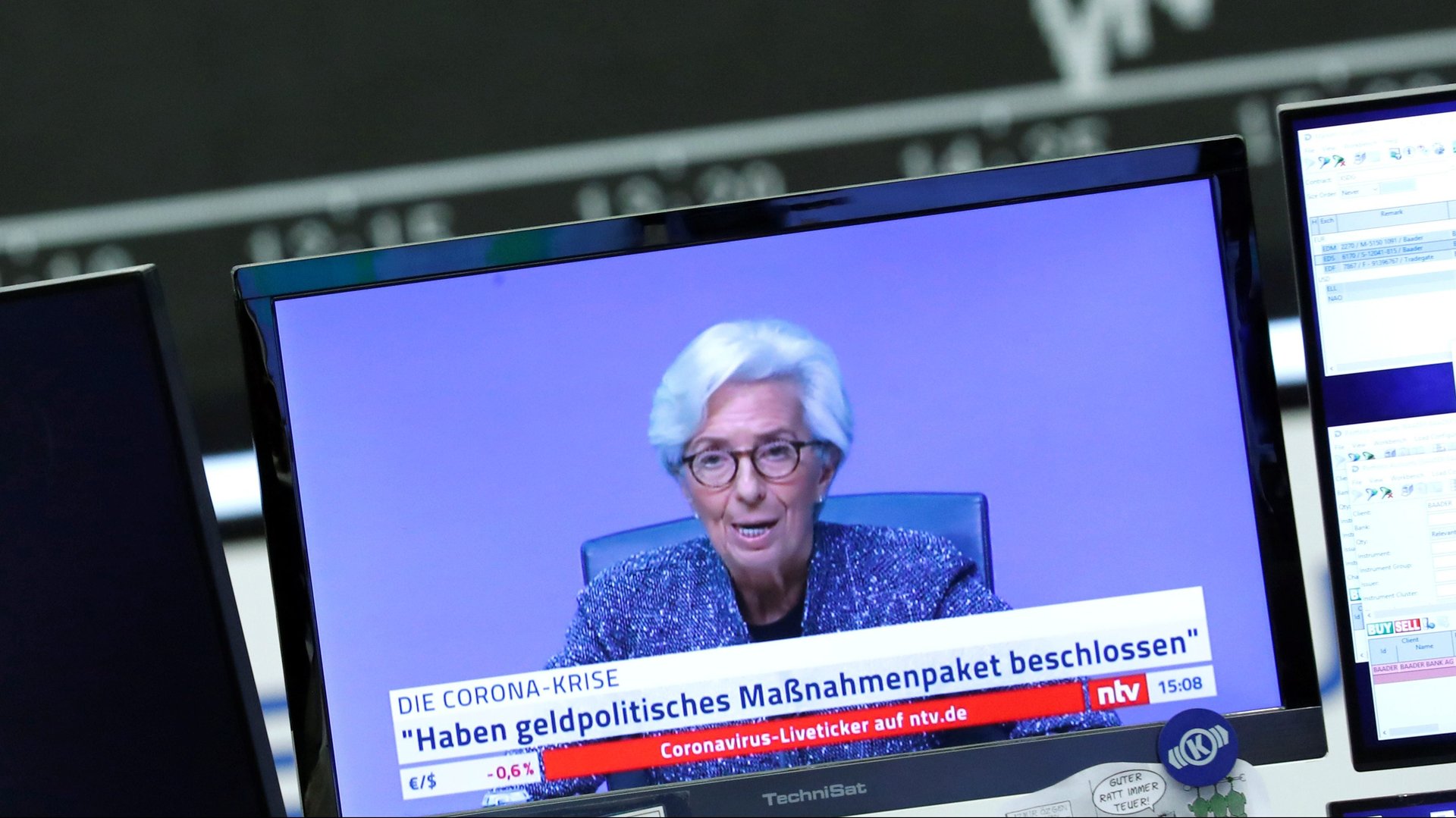

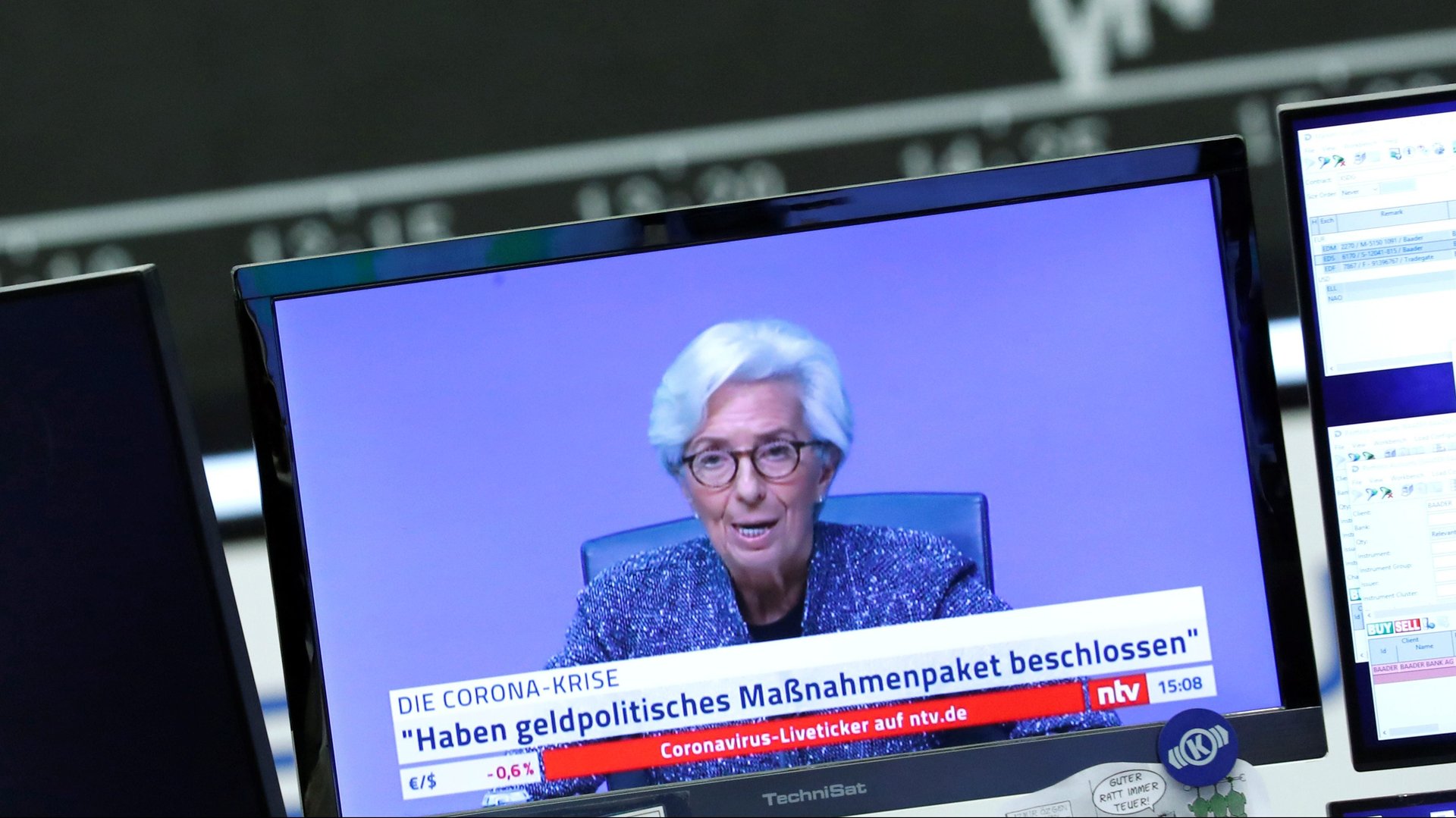

The European Central Bank said it would offer cheap loans to the region’s banks and dial up its quantitative easing program of asset purchases. But the central bank stopped short of changing its key interest rate, which is set at a record low of -0.5%. ECB president Christine Lagarde said governments need to spend money to contain the economic fallout from the new coronavirus, which was declared a pandemic by the World Health Organization this week.

“An ambitious and coordinated fiscal policy response is required to support businesses and workers at risk,” she said in a press conference. “Governments and all other policy institutions are called upon to take timely and targeted actions to address the public health challenge of containing the spread of the coronavirus and mitigate the economic impact.”

The S&P 500 index of US stocks is poised to enter a bear market, which is defined as 20% drop from the peak. Yesterday US president Donald Trump announced a one-month ban on inbound flights from continental Europe—a restriction that is due to begin Friday, March 13, at midnight. Stocks of Norwegian Cruise Line Holdings and Royal Caribbean cratered more than 25%.

Marathon Petroleum stock fell more than 20% as Brent crude oil fell to $35.79 a barrel, bringing the year’s decline to more than 47%. Russia and Saudi Arabia have kicked off a price war, threatening to flood oil markets with crude at the same time that the spread of the new coronavirus jeopardizes global economic growth and demand for energy. The steep drop in oil prices is putting some over-indebted US oil drillers at risk of default.

As governments around the world look to contain the spread of coronavirus while protecting businesses and workers from commercial disruption, traders are betting on major price swings. The Cboe Volatility Index, also know as the “fear gauge,” rose to levels not seen since the 2008 financial crisis.