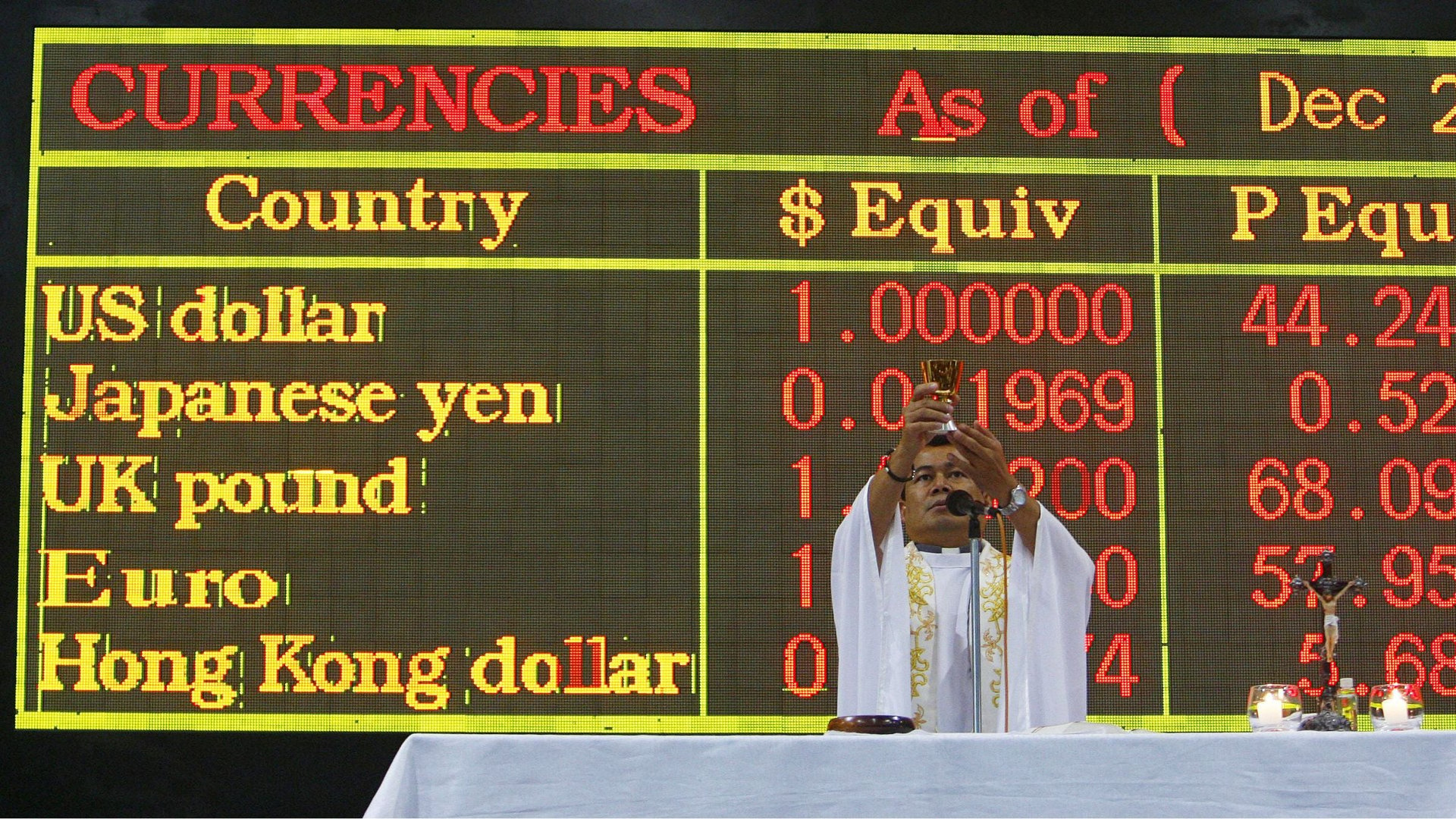

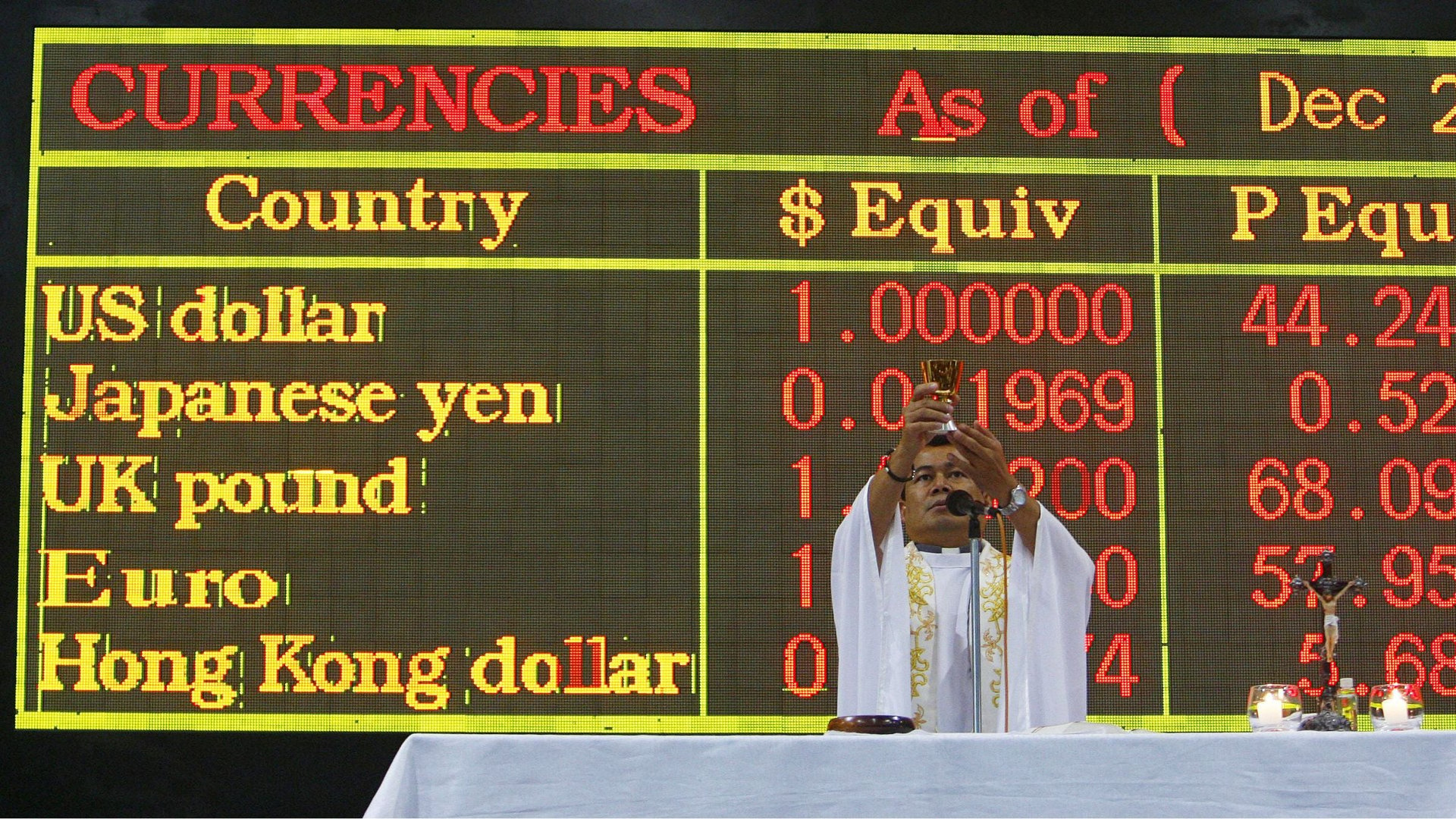

The world’s biggest banks are tightening their hold on the currency market they’re accused of rigging

It’ll take more than a unfolding currency-trading scandal to shake the dominance of the world’s biggest currency dealers. The top five currency-trading banks have actually increased their share of the market during this slow-motion train wreck, according to new research from Greenwich Associates. Those firms—Deutsche Bank, UBS, Citigroup, Barclays and JP Morgan Chase—now hold a commanding 52.9% share, up from the 47.9% they held back in 2011.

It’ll take more than a unfolding currency-trading scandal to shake the dominance of the world’s biggest currency dealers. The top five currency-trading banks have actually increased their share of the market during this slow-motion train wreck, according to new research from Greenwich Associates. Those firms—Deutsche Bank, UBS, Citigroup, Barclays and JP Morgan Chase—now hold a commanding 52.9% share, up from the 47.9% they held back in 2011.

Germany’s Deutsche Bank boasts the largest share of trading at 12.4%. UBS is effectively tied, according to Greenwich, with 12.1% of the market.

Many of the these same market-leading banks are facing accusations (paywall) that their traders (who make money for their firms by betting on currencies’ shifting values) colluded to rig currency prices. More than 20 traders have left or been placed on leave by their employers, including some from each of the top five banks.

Here’s a look at the top five banks in 2014, according to Greenwich Associates data:

The oligopoly in the currency-trading universe suggests that some of the very financial institutions implicated in the scandal are still in an ideal position to dictate pricing to the rest of the world. Earlier this week it emerged that Bank of England officials knew of concerns about currency price-rigging as far back as 2006. But it was only last year that regulators began formally investigating.

At this point, it’s unclear how the exchange-rate market will be regulated, going forward. A number of regulators have continued to put pressure on currency dealers, including New York’s top financial regulator; Ben Lawsky, head of the state’s department of financial services, has demanded information from a dozen banks about their trading practices.

Meanwhile, the currency scandal’s net is widening, with a Bank of England official suspended amid questions about suspected knowledge of currency manipulation years ago.