The pandemic’s impact on digital payments and cash, in five charts

Digital payments were catching on even before the coronavirus pandemic. Now these transactions are getting turbocharged by the crisis, and the disruption could lead to lasting changes in how people spend.

Digital payments were catching on even before the coronavirus pandemic. Now these transactions are getting turbocharged by the crisis, and the disruption could lead to lasting changes in how people spend.

“We are hitting a tipping point across the world where people are seeing just how simple and easy it is to use digital payments to pay for services,” PayPal CEO Daniel Schulman said May 6 in a conference call with analysts. He said the company had its largest single day of transactions ever on May 1, beating out heavy shopping days like Black Friday or Cyber Monday.

As the health crisis intensified and lockdowns came into force, share prices of payment companies like PayPal suffered a smaller decline than the overall US stock market. More recently, they’ve blown the broader equity market away as governments geared up to support their economies, and as stay-at-home restrictions started to be gradually lifted.

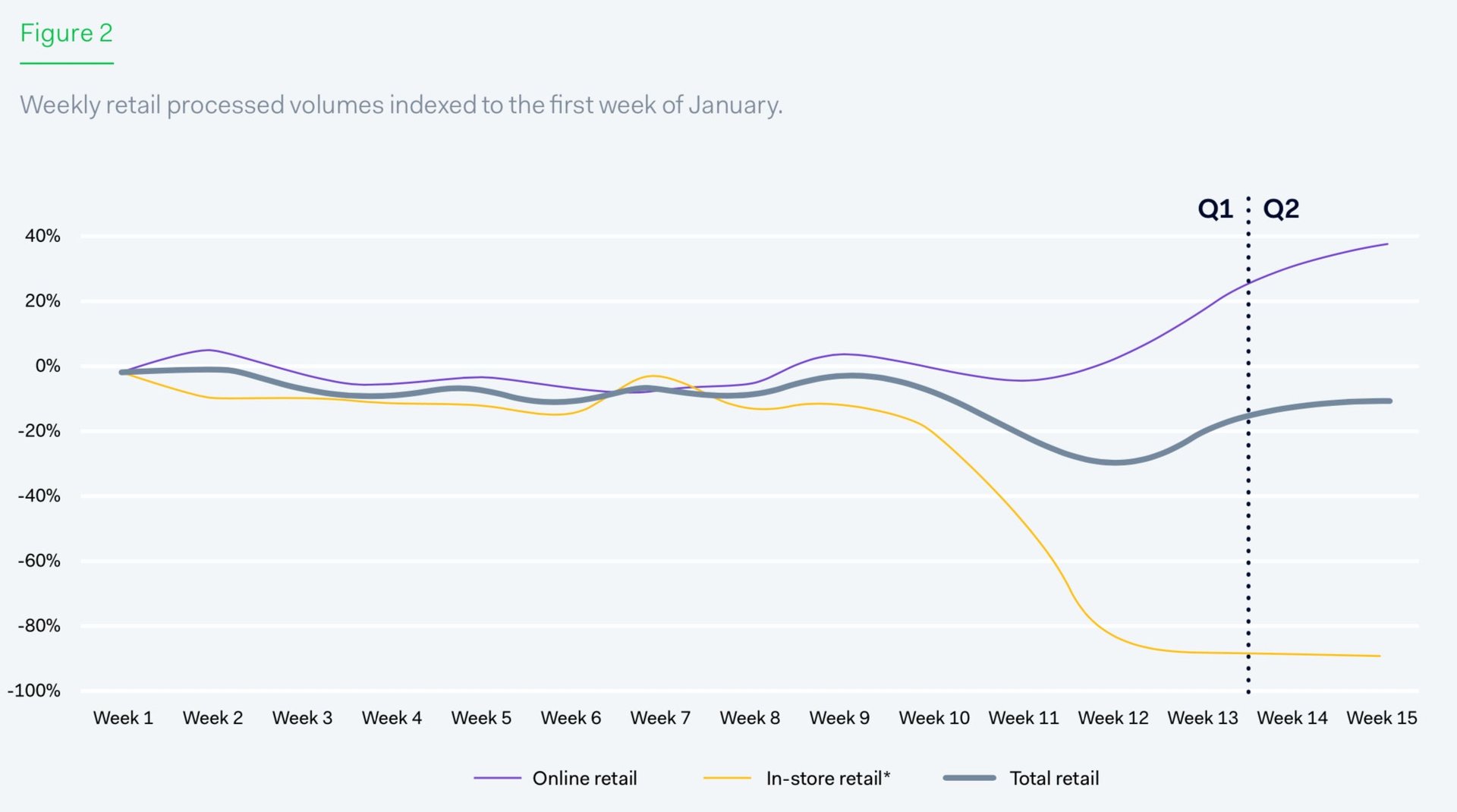

In-store transactions plunged as the crisis set in, but e-commerce payments soared, according to data from Adyen, Mastercard, and Visa. Amsterdam-based Adyen, which processes payments for companies including Netflix and Delivery Hero, said it handled €67 billion ($72 billion) of transactions during the first three months of 2020, 38% more than a year ago.

Growth in e-commerce is welcome news for Mastercard and Visa, the card-network giants. Visa’s CEO said that globally, about 15 cents of every US dollar spent in person uses a Visa card. For e-commerce, that ratio shoots up to about 45 cents for every US dollar spent. “When you think about e-commerce, the reality is that it’s a very, very positive thing for us because cash isn’t a competitor in that space,” Visa chief Alfred Kelly said in a recent earnings call. “E-commerce will explode coming out of this.”

Jack Dorsey, the CEO of payment company Square, said many customers using its payments terminal, from wine stores to restaurants, launched online ordering for delivery and curbside pickup in the wake of the pandemic. “A lot of these sellers wanted to get online and wanted to sell online but just didn’t make the time to do so,” Dorsey said in a call with analysts. “This was kind of a forcing function to show them all the benefits of being online.”

Remittance drop

Some cross-border transactions, meanwhile, are expected to decline substantially. Remittances—money that typically flows from high-income countries to middle- and lower-income nations—are expected to drop by 20% in 2020, according to the World Bank. The decline is mainly because of a drop in wages and employment for migrant workers.

Money transfer companies like Western Union and MoneyGram were battered in the stock market as lockdowns cut consumers off from in-person money transfer agents. “Lockdowns in places around the world in fact shuttered Western Union’s highest margin products, agent-based cash-to-cash transactions,” wrote Daniel Webber, founder and CEO FXC Intelligence. While the digital services at Western Union and MoneyGram are growing, they haven’t been able to offset the headwinds from Covid-19.

But digital remittances have gotten a major boost. “Covid-19 has also accelerated a shift in consumer behavior and led to increased use of digital channels,” Western Union CEO Hikmet Ersek said in an earnings call.

News reports in March claimed the World Health Organization was urging people to use contactless payments instead of cash to avoid infection from the new coronavirus. That isn’t quite accurate. Rather, the WHO says people should wash their hands after touching money, the same as with other surfaces that could be harboring the coronavirus.

Nonetheless, contactless payments, seen as a safer alternative to notes and coins, grew 40% around the world in the first quarter, according to Mastercard president Michael Miebach. ”More than half of new tappers are saying they will continue to use contactless once this pandemic is over,” Miebach said in a call with analysts.

That could be disruptive for cash usage. ATM transactions crashed in the UK, a country that was already predisposed to card payments, as the government’s lockdown came into force. Cash machine use will surely bounce back somewhat as restrictions are eased. But as consumers become more comfortable with cards and contactless payments, as well as online commerce and delivery services, paper money may never make a full comeback.

With reporting assistance from Youyou Zhou in New York.