Covid-19 has put the venture capital boom on hold

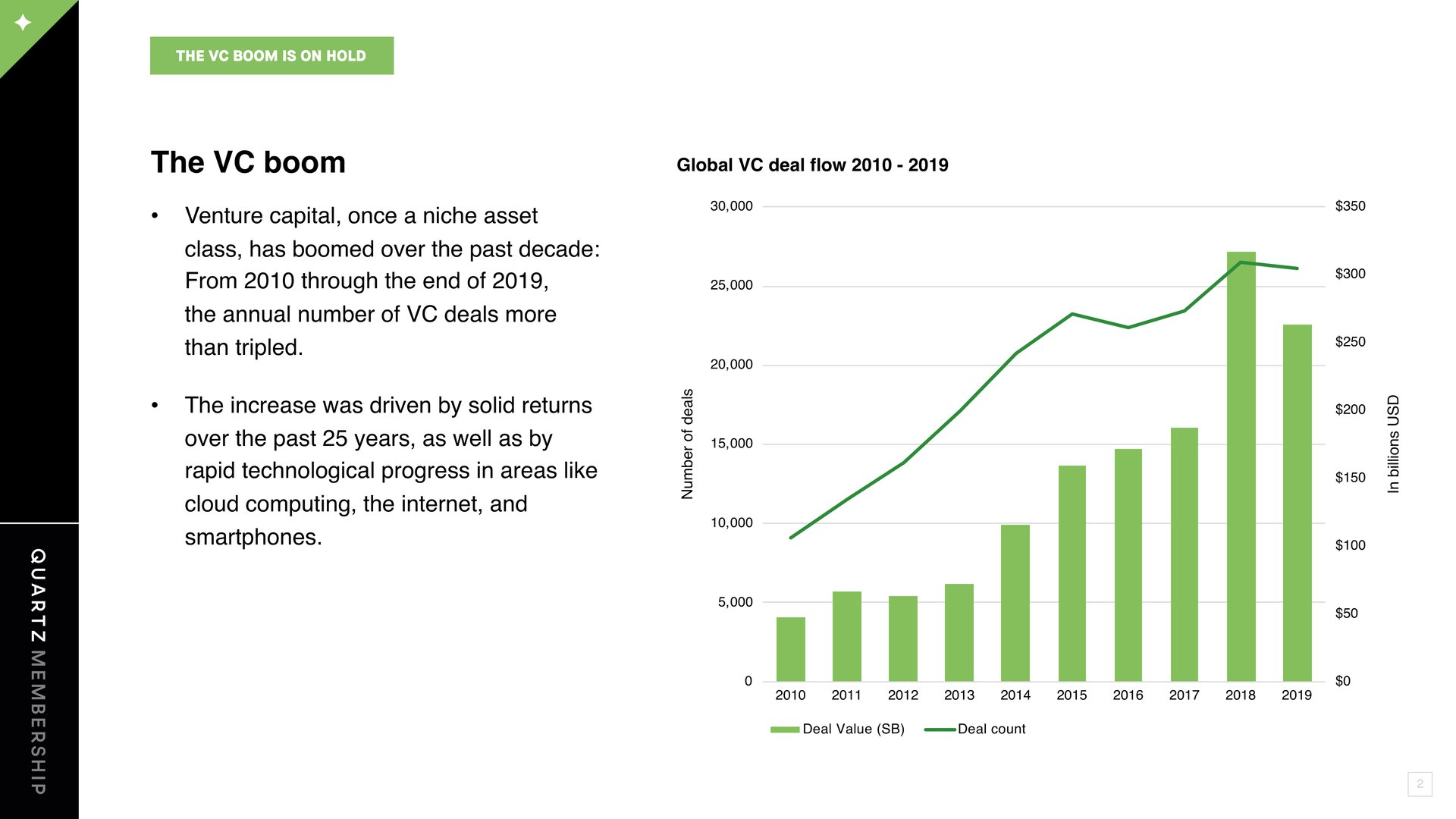

Venture capital, once a niche asset class, has boomed over the past decade: From 2010 through the end of 2019, the annual number of VC deals nearly tripled. The increase was driven by solid returns over the past 25 years, as well as by rapid technological progress in areas like cloud computing and smartphones.

Venture capital, once a niche asset class, has boomed over the past decade: From 2010 through the end of 2019, the annual number of VC deals nearly tripled. The increase was driven by solid returns over the past 25 years, as well as by rapid technological progress in areas like cloud computing and smartphones.

But the boom is on hold, due to Covid-19—and even once the pandemic ends, the landscape of startup financing may be significantly different.

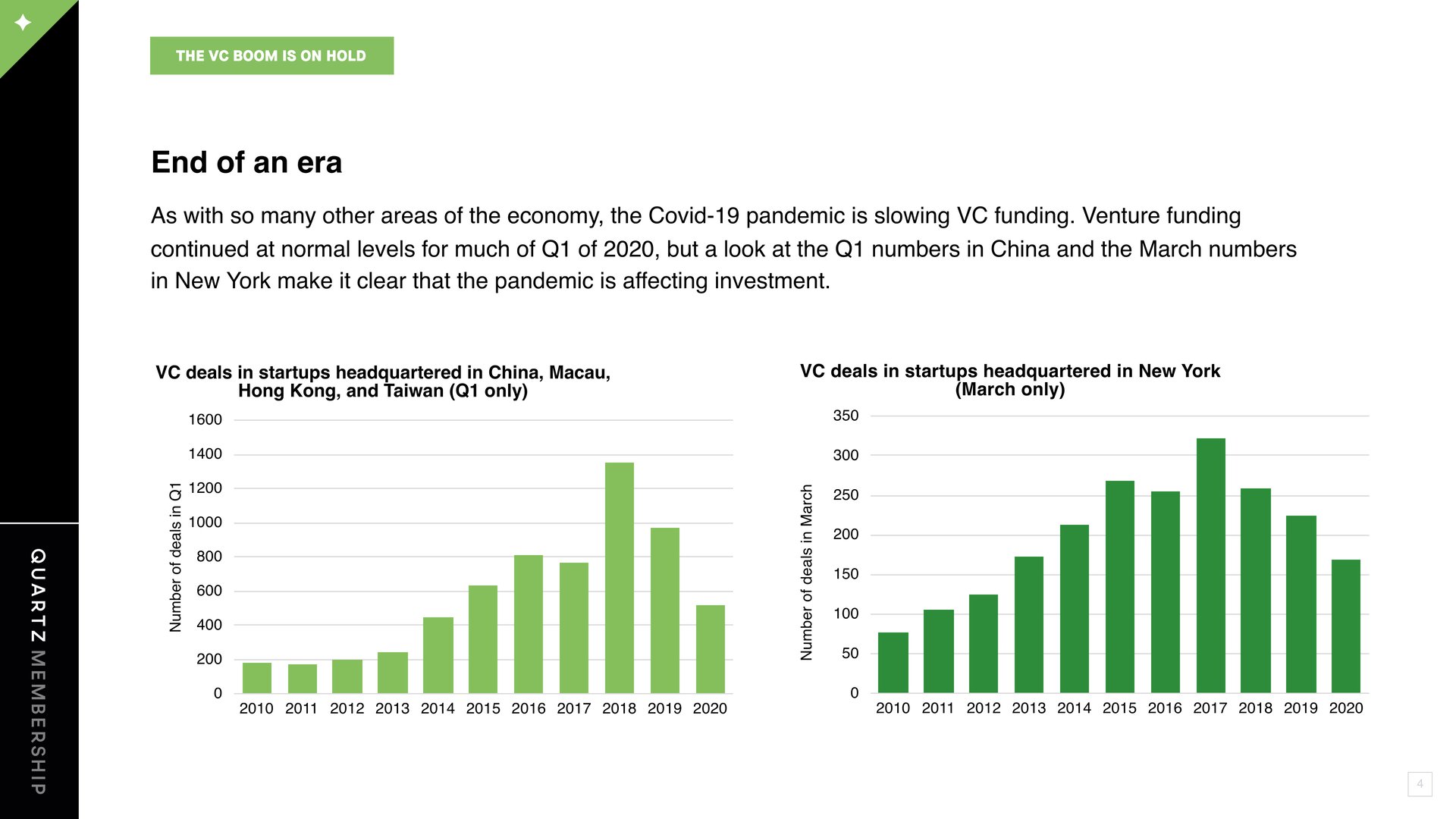

Venture funding continued at normal levels for much of Q1 of 2020. But a close look at the Q1 numbers in China and the March numbers in New York make it clear that the pandemic is affecting investment.

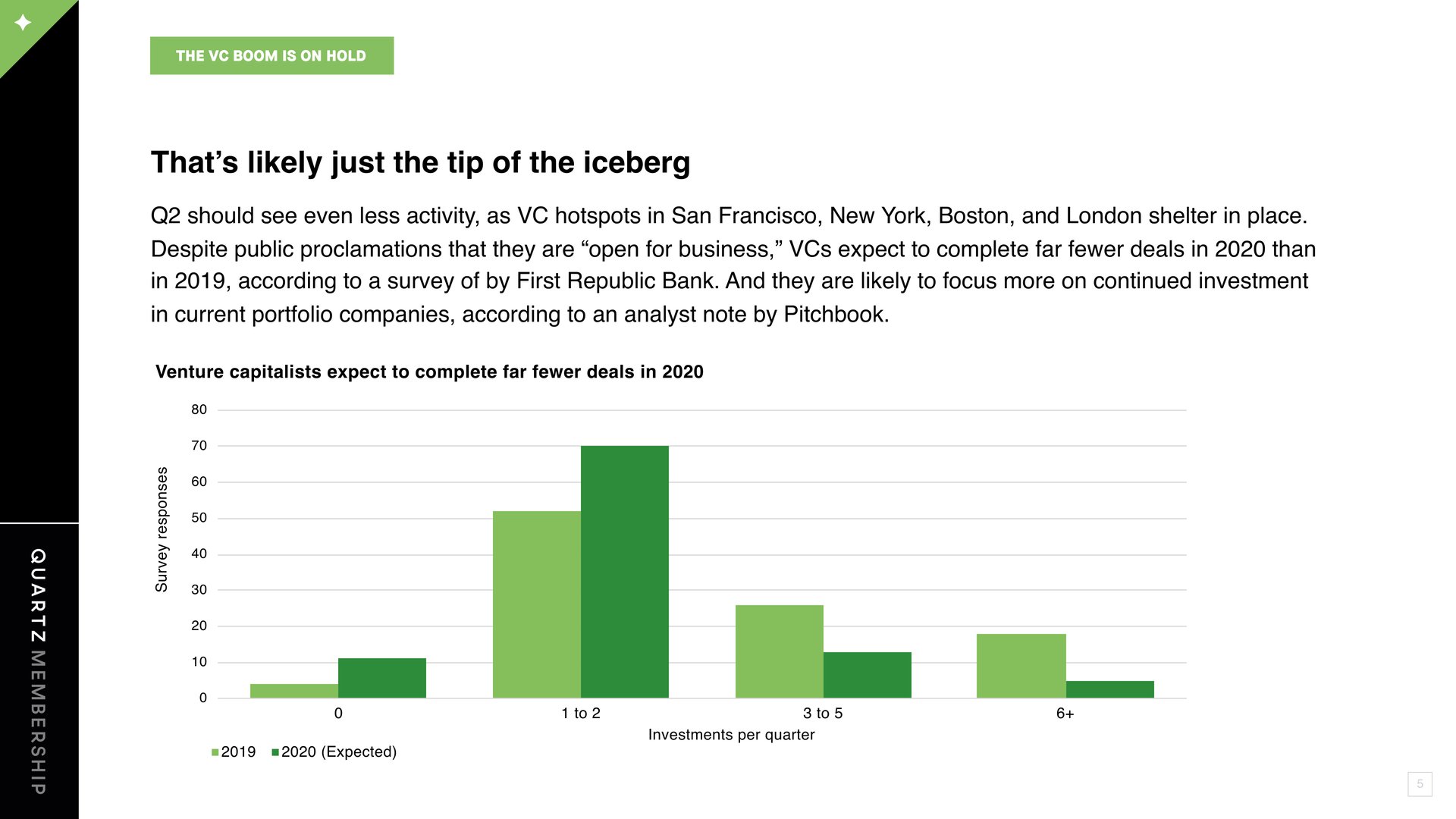

Q2 should see even less activity, as VC hotspots in San Francisco, New York, Boston, and London shelter in place. Despite public proclamations that they are “open for business,” VCs expect to complete far fewer deals in 2020 than in 2019, according to a survey by First Republic Bank. They are likely to focus more on continued investment in current portfolio companies, according to a PitchBook analyst note.

Traditional VCs have lots of capital on hand and are likely to invest it, at least once the pandemic ends, which is good news for startups. But there is a chance that “non-traditional” VCs, like corporations and hedge funds, will abandon the asset class—in some cases to avoid risk and in others because the coming recession presents other opportunities.

Finally, there’s the question of what will be left to fund. Fewer startups are being founded because of the pandemic, and the ones already started are at risk of going out of business. When the pandemic ends, there may be fewer promising ventures available for VCs to back.

To see all of the slides, you can view the PDF version or download the PowerPoint file, which includes our sources and notes. This is one of an ongoing series of member-exclusive presentations, which you can read, reformat, and use as you wish.

Please share any feedback about what would make these presentations more useful—or topics you’d like to see us cover—by emailing us at [email protected]. These presentations are an exclusive benefit for Quartz members. We’d love it if you’d encourage any friends or colleagues who express interest to become a member so they can access them too.